- Sweden

- /

- Consumer Durables

- /

- OM:NOBI

Further Upside For Nobia AB (publ) (STO:NOBI) Shares Could Introduce Price Risks After 26% Bounce

Despite an already strong run, Nobia AB (publ) (STO:NOBI) shares have been powering on, with a gain of 26% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

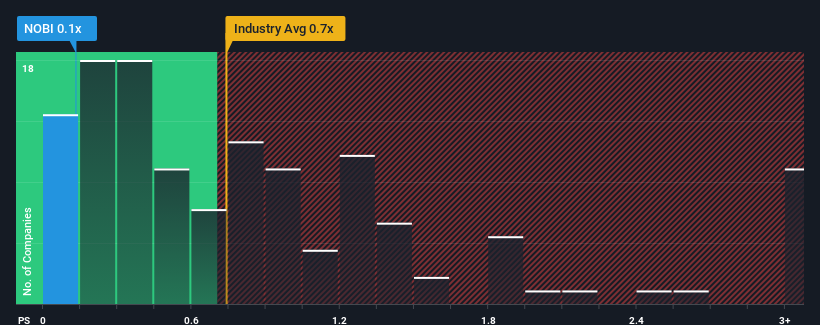

Although its price has surged higher, when close to half the companies operating in Sweden's Consumer Durables industry have price-to-sales ratios (or "P/S") above 0.7x, you may still consider Nobia as an enticing stock to check out with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Nobia

What Does Nobia's P/S Mean For Shareholders?

Nobia could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nobia will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nobia's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 7.6% during the coming year according to the three analysts following the company. Meanwhile, the industry is forecast to moderate by 9.5%, which suggests the company won't escape the wider industry forces.

With this in consideration, we find it intriguing but understandable that Nobia's P/S falls short of its industry peers. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Nobia's P/S

Nobia's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Nobia's analyst forecasts revealed despite having an equally shaky outlook against the industry, its P/S much lower than we would have predicted. Even though the company's revenue outlook is on par, we assume potential risks are what might be placing downward pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to resist further pain to its business from the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Nobia that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nobia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NOBI

Nobia

Engages in the development, manufacture, and sale of kitchen solutions in Sweden, Denmark, Norway, Finland, the United Kingdom, Germany, the Netherlands, Austria, Iceland, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives