Spotlight On November 2024's Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, small-cap stocks have captured investor attention with the Russell 2000 Index leading gains, despite remaining slightly below its record high from November 2021. This surge reflects optimism around potential growth and deregulation under a new administration, creating a fertile ground for identifying undervalued opportunities in this segment. In such an environment, a good stock is often characterized by strong fundamentals and strategic insider buying that aligns with broader market sentiments of growth and reduced regulatory pressures.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 23.4x | 0.8x | 30.30% | ★★★★★☆ |

| PSC | 7.9x | 0.4x | 42.03% | ★★★★☆☆ |

| Avia Avian | 17.2x | 3.9x | 6.02% | ★★★★☆☆ |

| German American Bancorp | 16.5x | 5.5x | 39.36% | ★★★☆☆☆ |

| NCL Industries | 13.9x | 0.5x | -65.80% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 20.8x | 0.7x | 29.43% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 13.9x | 1.6x | -38.67% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.3x | -203.45% | ★★★☆☆☆ |

| Bajel Projects | 241.7x | 1.9x | 31.76% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Tourism Holdings (NZSE:THL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tourism Holdings is a company engaged in tourism and vehicle rental operations across New Zealand, Australia, the USA, Canada, and the UK/Ireland, with a market capitalization of NZ$1.02 billion.

Operations: Tourism Holdings generates revenue primarily from its Australian Rentals, Sales & Manufacturing segment, followed by the Action Manufacturing Group and USA Rentals & Sales. The company's cost of goods sold (COGS) has increased over time, impacting gross profit margins which have seen a decline from 74.52% in June 2015 to 59.40% in June 2024. Operating expenses also play a significant role in financial performance, with general and administrative expenses being a major component.

PE: 10.8x

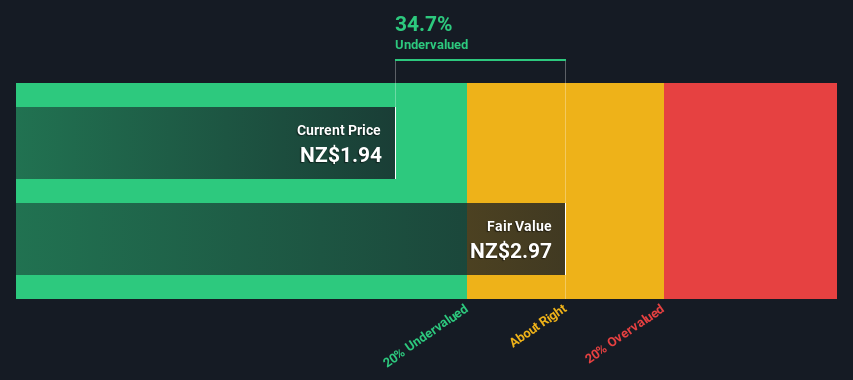

Tourism Holdings, a company in the travel sector, recently reported revenue of NZ$921.7 million for FY24, up from NZ$663.8 million the previous year. Despite this growth, net income decreased to NZ$39.4 million from NZ$49.9 million due to slimmer profit margins at 4.3%, down from 7.5%. Insider confidence is evident with recent share purchases by insiders over the past year, suggesting potential undervaluation in this small-cap stock's current market position amidst its forecasted earnings growth of 20% annually.

- Delve into the full analysis valuation report here for a deeper understanding of Tourism Holdings.

Review our historical performance report to gain insights into Tourism Holdings''s past performance.

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Wave Group operates in the corporate, sports and leisure, and gifts and home furnishings sectors with a market cap of SEK 6.81 billion.

Operations: The company generates revenue primarily from three segments: Corporate, Sports & Leisure, and Gifts & Home Furnishings. Over recent periods, the gross profit margin has shown an upward trend, reaching 50.28% by September 2024. Operating expenses have been a significant cost factor, with general and administrative expenses consistently forming a substantial part of these costs.

PE: 14.9x

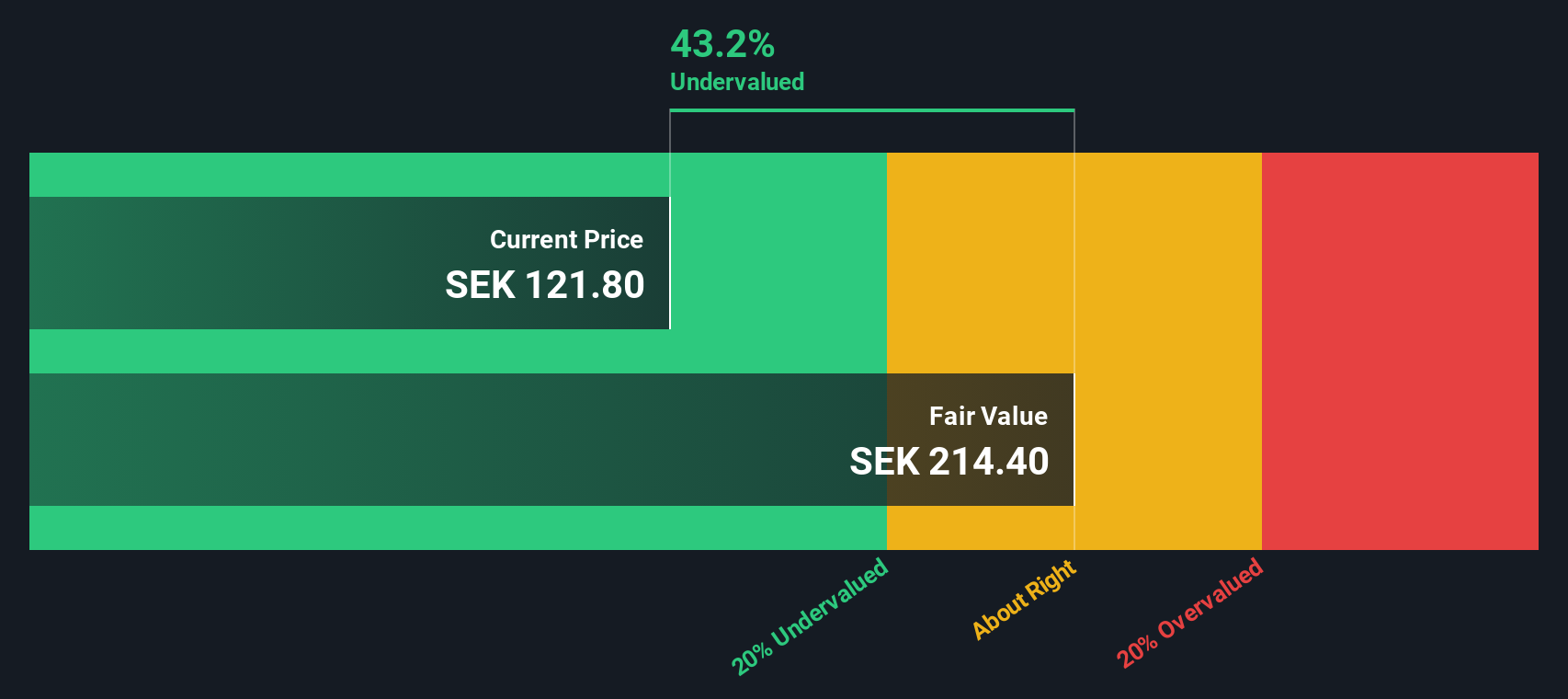

New Wave Group, a smaller company in its industry, recently reported a dip in net income for the third quarter of 2024 to SEK 204.2 million from SEK 270.9 million the previous year, with sales slightly down to SEK 2,308.3 million. Despite this, insider confidence is evident as they increased their holdings over the past months. The appointment of Anna Gullmarstrand as CFO might bring fresh strategic insights. Forecasts suggest potential earnings growth of 19% annually, indicating possible future value opportunities despite current challenges with higher-risk external borrowing sources.

- Click here and access our complete valuation analysis report to understand the dynamics of New Wave Group.

Evaluate New Wave Group's historical performance by accessing our past performance report.

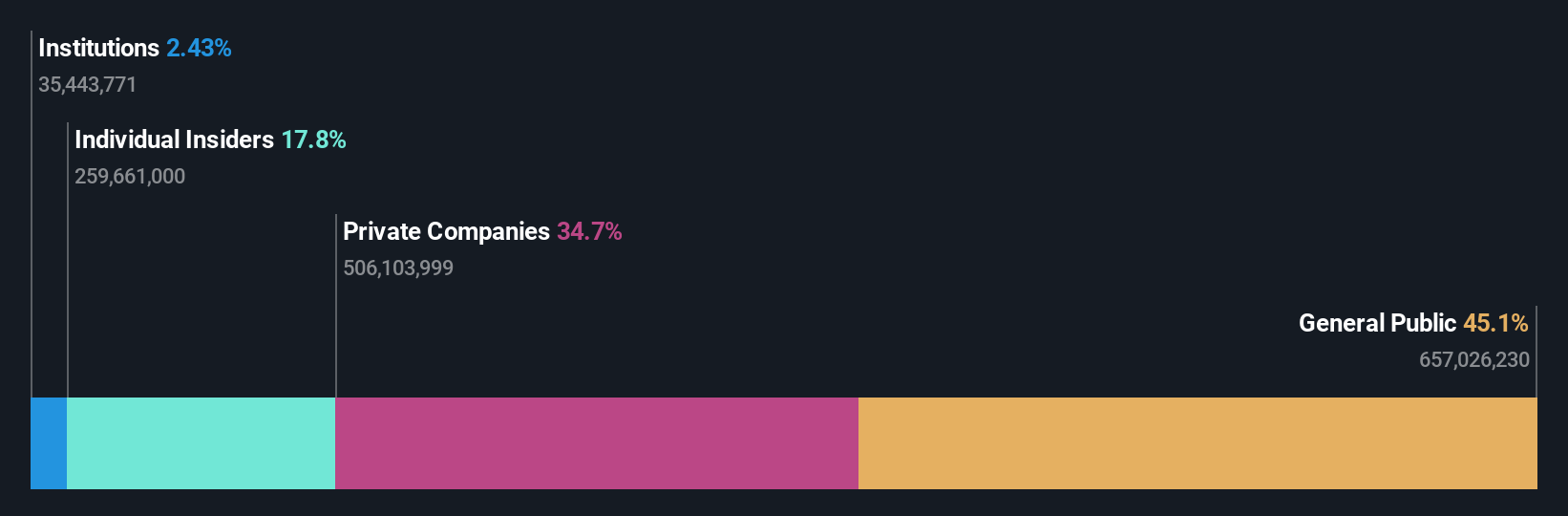

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China XLX Fertiliser is engaged in the production and sale of various chemical products, including urea, compound fertilizers, methanol, and melamine, with a market capitalization of CN¥8.13 billion.

Operations: The company's primary revenue streams include Urea, Compound Fertiliser, and Methanol. Over the analyzed period, the gross profit margin has fluctuated, reaching a high of 24.46% in mid-2019 before declining to 15.58% by mid-2023. Operating expenses have shown an upward trend, impacting net income margins which varied from a peak of 7.63% at the end of 2021 to lower levels in subsequent years.

PE: 4.2x

China XLX Fertiliser, a company in the fertiliser industry, displays insider confidence with Executive Director Qingjin Zhang purchasing 160,000 shares for CNY 672K recently. Despite its high debt levels due to reliance on external borrowing, the company is positioned for potential growth with an expected earnings increase of 11.59% annually. Recent board changes include Mr. Wong Wing Wang as data protection officer while maintaining his CFO role. Upcoming financial results will be announced on October 30, 2024.

- Navigate through the intricacies of China XLX Fertiliser with our comprehensive valuation report here.

Gain insights into China XLX Fertiliser's past trends and performance with our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 167 Undervalued Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Wave Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NEWA B

New Wave Group

Designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors in Sweden, the United States, Central Europe, rest of Nordiac countries, Southern Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.