As European markets reach record levels, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly observing dividend stocks for their potential to provide steady income amid fluctuating economic conditions. In this environment, a good dividend stock is often characterized by its ability to maintain stable payouts and demonstrate resilience against market volatility, making it an attractive option for those seeking reliable returns in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.31% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.91% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.00% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.95% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.64% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.43% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 3.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.67% | ★★★★★☆ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

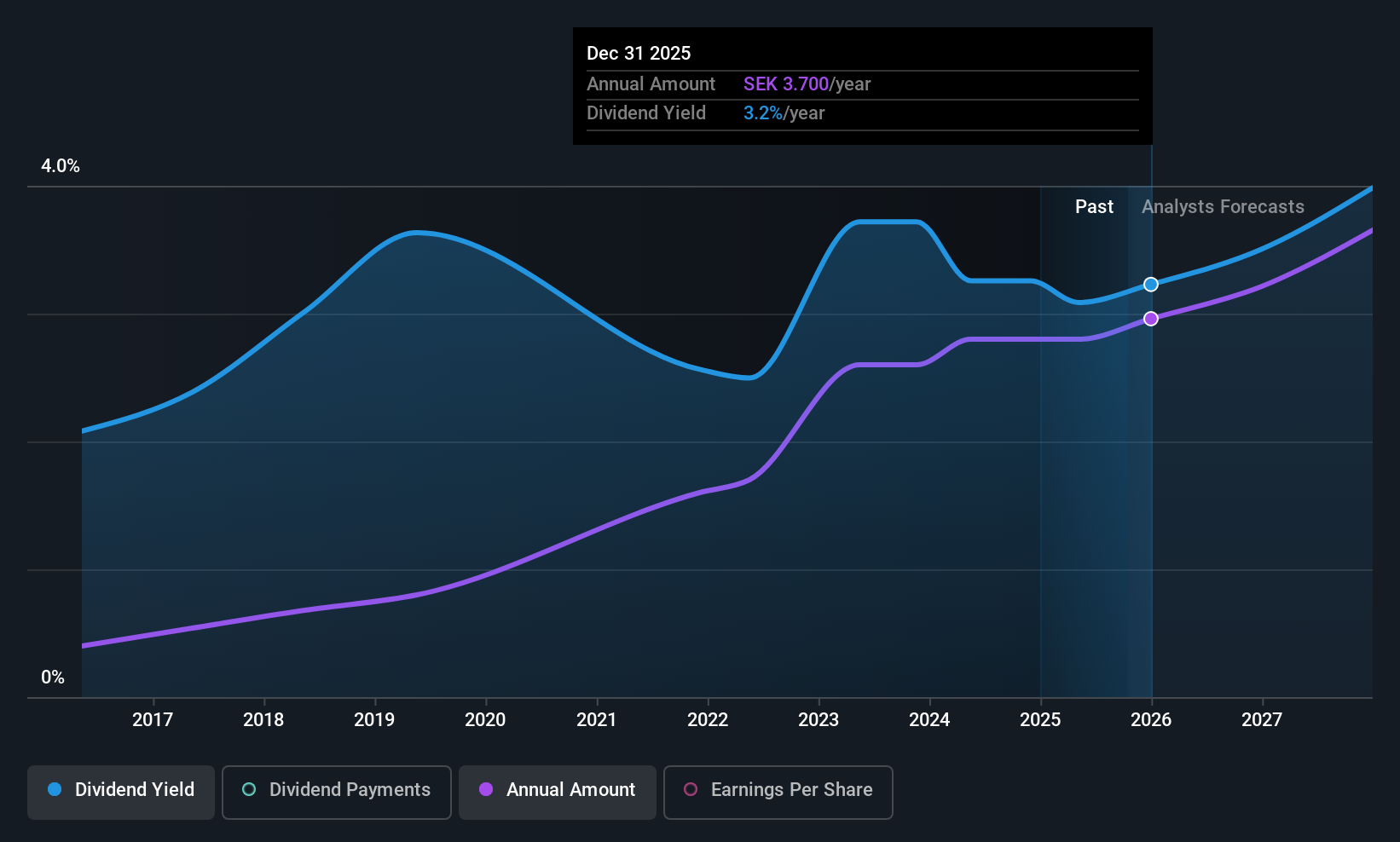

New Wave Group (OM:NEWA B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products across the corporate, sports, gifts, and home furnishings sectors globally with a market cap of SEK15.13 billion.

Operations: New Wave Group's revenue segments are divided into Corporate (SEK4.73 billion), Sports & Leisure (SEK4.03 billion), and Gifts & Home Furnishings (SEK853.50 million).

Dividend Yield: 3.1%

New Wave Group's dividend payments have been volatile and unreliable over the past decade, despite recent growth. The dividend yield of 3.07% is lower than the Swedish market's top 25%. However, dividends are covered by earnings with a payout ratio of 54% and cash flows with a cash payout ratio of 65.4%. Trading at a good value, New Wave is priced 38.1% below its estimated fair value amidst stable earnings growth forecasts.

- Click to explore a detailed breakdown of our findings in New Wave Group's dividend report.

- The analysis detailed in our New Wave Group valuation report hints at an deflated share price compared to its estimated value.

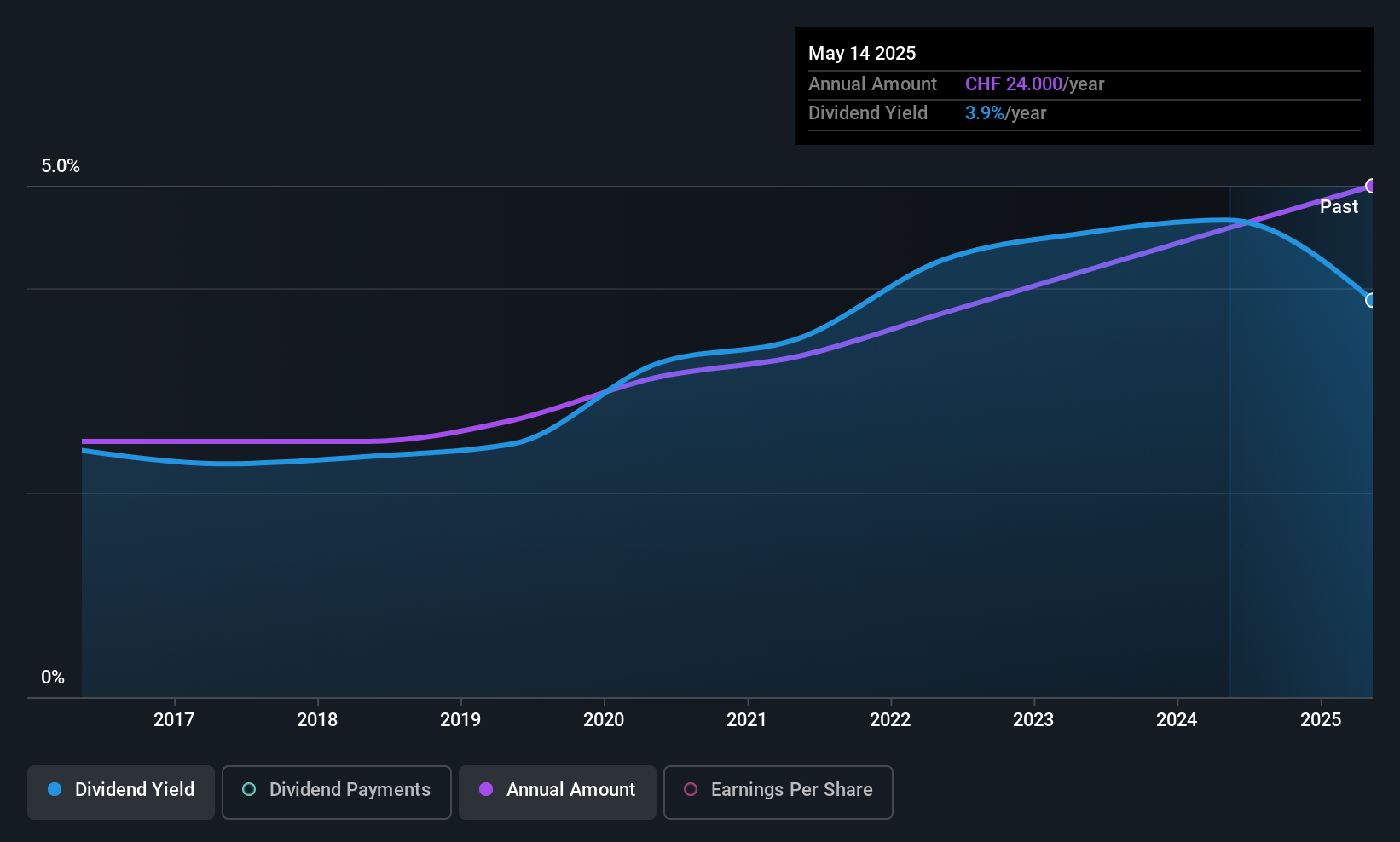

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF1.85 billion.

Operations: Vaudoise Assurances Holding SA generates revenue from its insurance products and services primarily within Switzerland.

Dividend Yield: 3.8%

Vaudoise Assurances Holding's dividend payments have been stable and reliable over the past decade, though not covered by free cash flows. The dividend yield of 3.76% is slightly below the top 25% in the Swiss market. Despite a low payout ratio of 46.5%, dividends are not fully supported by earnings or cash flows. Recently added to the S&P Global BMI Index, Vaudoise trades at a significant discount to its estimated fair value amidst modest earnings growth.

- Get an in-depth perspective on Vaudoise Assurances Holding's performance by reading our dividend report here.

- Our valuation report here indicates Vaudoise Assurances Holding may be undervalued.

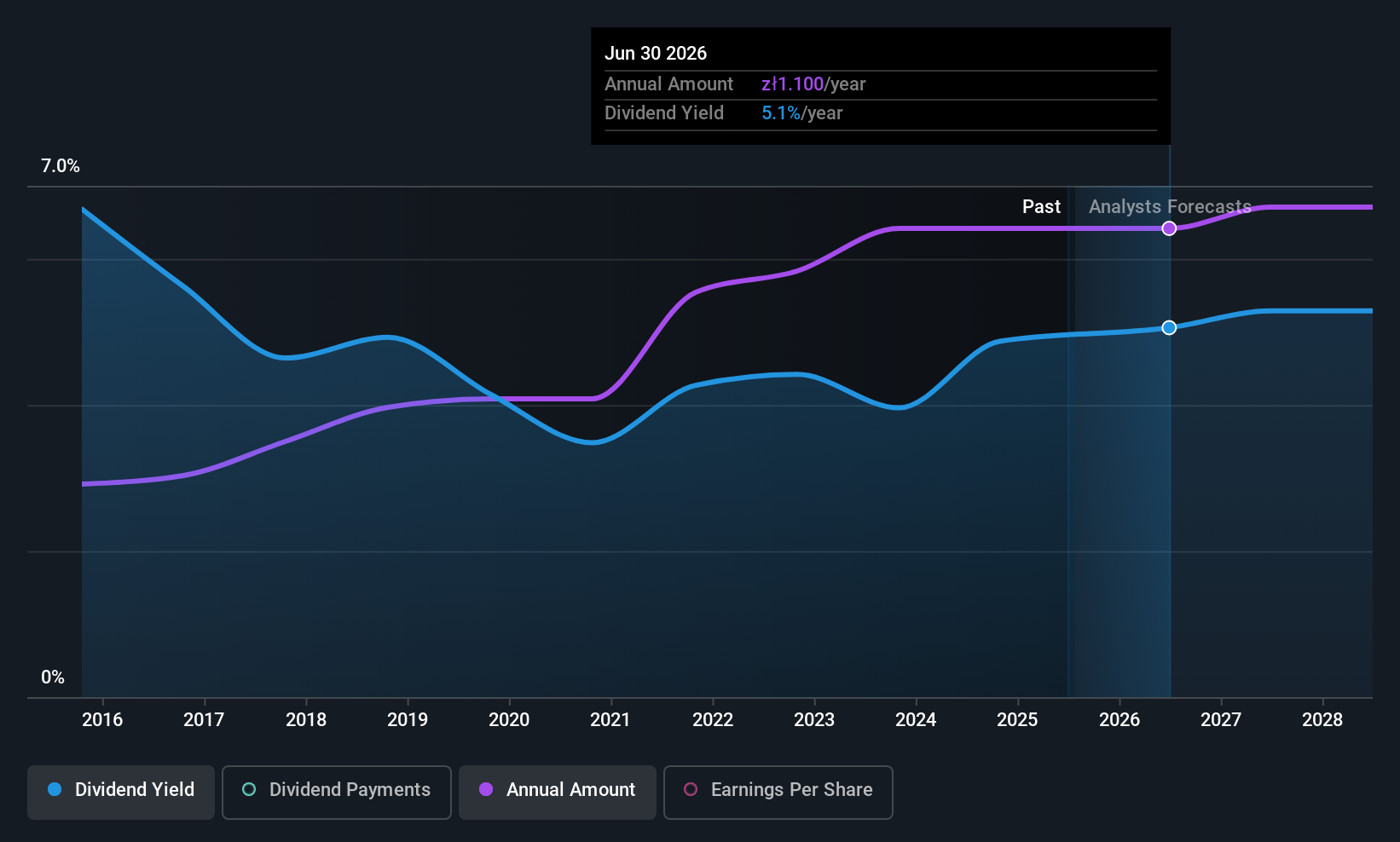

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A. and its subsidiaries are involved in the manufacture, import, and distribution of grape wines across Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN497.58 million.

Operations: Ambra S.A.'s revenue is primarily generated from its operations in Poland (PLN663.52 million), followed by Romania (PLN184.54 million), and the Czech Republic and Slovakia (PLN80.84 million).

Dividend Yield: 5.6%

Ambra S.A.'s dividend payments have been stable and growing over the past decade, supported by a payout ratio of 62% and a cash payout ratio of 39.1%, indicating sustainability. The dividend yield of 5.57% is below Poland's top quartile but remains attractive due to reliability. Recent earnings showed a decline, with net income at PLN 44.73 million, yet the annual dividend was affirmed at PLN 1.10 per share, reflecting continued commitment to shareholders despite financial challenges.

- Take a closer look at Ambra's potential here in our dividend report.

- Upon reviewing our latest valuation report, Ambra's share price might be too pessimistic.

Key Takeaways

- Click through to start exploring the rest of the 221 Top European Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:AMB

Ambra

Engages in the manufacture, import, and distribution of grape wines in Poland, the Czech Republic, Slovakia, and Romania.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives