- Netherlands

- /

- Logistics

- /

- ENXTAM:INPST

InPost And 2 Additional European Value Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As the European markets experience a positive shift with the pan-European STOXX Europe 600 Index rising by 0.90% amid slowing inflation and easing monetary policy from the European Central Bank, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals and resilience to economic fluctuations, making it potentially undervalued despite broader market gains.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trøndelag Sparebank (OB:TRSB) | NOK114.00 | NOK223.37 | 49% |

| Sparebank 68° Nord (OB:SB68) | NOK179.38 | NOK357.46 | 49.8% |

| Montana Aerospace (SWX:AERO) | CHF19.50 | CHF38.68 | 49.6% |

| Exsitec Holding (OM:EXS) | SEK128.50 | SEK254.56 | 49.5% |

| doValue (BIT:DOV) | €2.258 | €4.45 | 49.3% |

| DigiTouch (BIT:DGT) | €1.89 | €3.67 | 48.5% |

| Airbus (ENXTPA:AIR) | €163.92 | €325.62 | 49.7% |

| adidas (XTRA:ADS) | €212.90 | €415.66 | 48.8% |

| Absolent Air Care Group (OM:ABSO) | SEK212.00 | SEK416.49 | 49.1% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.70 | €72.88 | 49.6% |

Here's a peek at a few of the choices from the screener.

InPost (ENXTAM:INPST)

Overview: InPost S.A. operates as an out-of-home e-commerce enablement platform offering parcel locker services across Poland and other European countries, with a market cap of €7.27 billion.

Operations: The company generates revenue through its parcel locker services in Poland and other European nations.

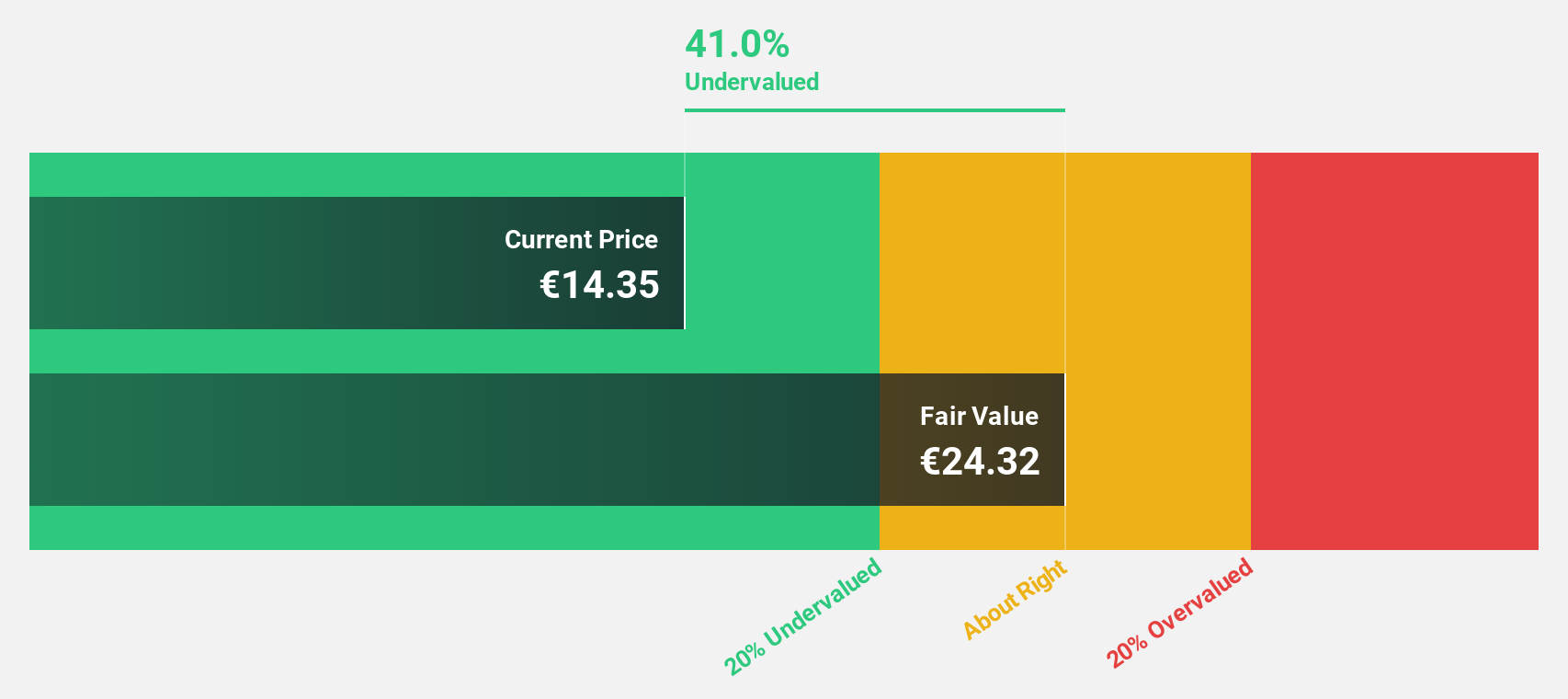

Estimated Discount To Fair Value: 40.4%

InPost is trading at €14.6, significantly below its estimated fair value of €24.48, suggesting undervaluation based on cash flows. Despite a high debt level and recent volatility in share price, the company forecasts significant earnings growth of 23.8% annually over the next three years, surpassing market averages. Recent earnings show sales growth but a decline in net income year-over-year; however, revenue is expected to grow robustly across regions this year.

- Upon reviewing our latest growth report, InPost's projected financial performance appears quite optimistic.

- Dive into the specifics of InPost here with our thorough financial health report.

Mips (OM:MIPS)

Overview: Mips AB (publ) develops, manufactures, and sells helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK12.21 billion.

Operations: The company generates revenue from its helmet safety systems primarily through the Sporting Goods segment, which accounts for SEK516 million.

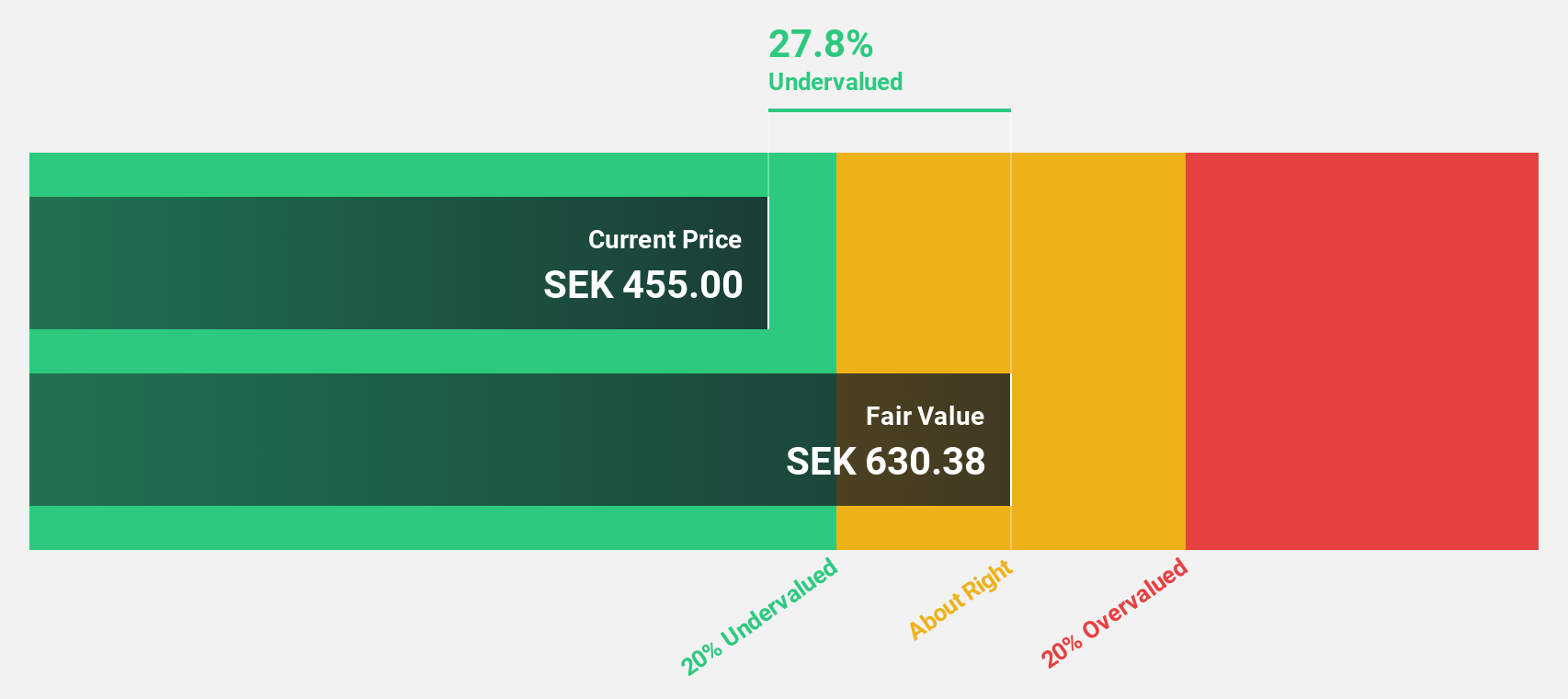

Estimated Discount To Fair Value: 26.9%

Mips is trading at SEK 460.8, well below its estimated fair value of SEK 630.38, indicating potential undervaluation based on cash flows. The company has demonstrated strong financial performance with Q1 sales increasing to SEK 116 million and net income rising to SEK 19 million year-on-year. Analysts forecast robust revenue growth of 25% annually and significant earnings expansion at a rate surpassing the Swedish market average, highlighting its attractive growth prospects despite current undervaluation.

- Our expertly prepared growth report on Mips implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Mips with our detailed financial health report.

Sonova Holding (SWX:SOON)

Overview: Sonova Holding AG is a global provider of hearing care solutions for both children and adults, with operations spanning Switzerland, the United States, the rest of the Americas, Europe, the Middle East, Africa, and the Asia Pacific; it has a market cap of CHF15.43 billion.

Operations: Sonova generates revenue from two primary segments: Hearing Instruments, which accounts for CHF3.57 billion, and Cochlear Implants, contributing CHF307.50 million.

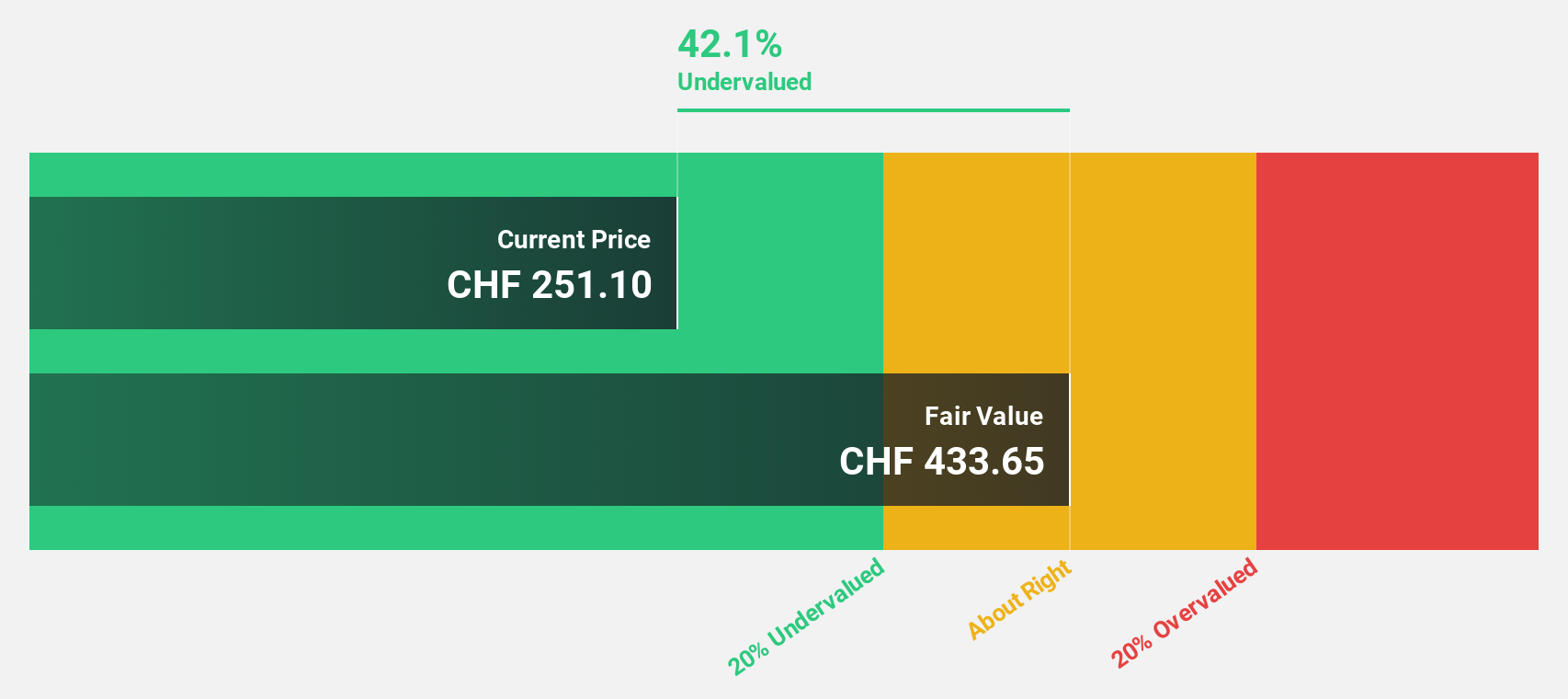

Estimated Discount To Fair Value: 39.8%

Sonova Holding is trading at CHF 258.8, significantly below its estimated fair value of CHF 429.55, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow faster than the Swiss market at 10.9% annually, although revenue growth is expected to be moderate at 5.5% per year. Recent leadership changes and confirmed sales guidance for a modest increase further underscore the need for careful monitoring of its strategic direction amidst these transitions.

- Our earnings growth report unveils the potential for significant increases in Sonova Holding's future results.

- Delve into the full analysis health report here for a deeper understanding of Sonova Holding.

Next Steps

- Click through to start exploring the rest of the 179 Undervalued European Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INPST

InPost

Operates as an out-of-home e-commerce enablement platform providing parcel locker services in Poland and other European countries.

High growth potential and good value.

Market Insights

Community Narratives