European Stocks Priced Below Estimated Value In October 2025

Reviewed by Simply Wall St

As European markets reach record levels, buoyed by a rally in technology stocks and expectations of lower U.S. borrowing costs, investors are keenly examining opportunities for undervalued stocks within this promising landscape. In such an environment, identifying stocks priced below their estimated value can offer potential advantages, especially when supported by strong fundamentals and resilient market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.16 | €2.30 | 49.6% |

| SBO (WBAG:SBO) | €27.10 | €53.22 | 49.1% |

| Midsummer (OM:MIDS) | SEK2.71 | SEK5.36 | 49.4% |

| LINK Mobility Group Holding (OB:LINK) | NOK29.90 | NOK59.75 | 50% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.08 | 49.4% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.50 | €12.62 | 48.5% |

| E-Globe (BIT:EGB) | €0.665 | €1.31 | 49.1% |

| DSV (CPSE:DSV) | DKK1339.50 | DKK2649.40 | 49.4% |

| Atea (OB:ATEA) | NOK143.20 | NOK278.18 | 48.5% |

| Aquafil (BIT:ECNL) | €1.93 | €3.85 | 49.8% |

Let's review some notable picks from our screened stocks.

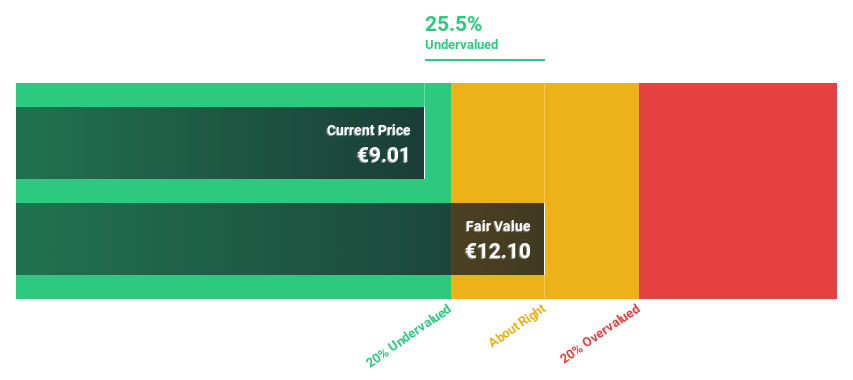

Neste Oyj (HLSE:NESTE)

Overview: Neste Oyj, with a market cap of €12.41 billion, operates internationally through its subsidiaries to provide renewable diesel and sustainable aviation fuel across Finland, other Nordic countries, the Baltic Rim, other European regions, and the United States.

Operations: The company's revenue segments include Oil Products at €11.86 billion, Renewable Products at €7.36 billion, and Marketing & Services at €4.38 billion.

Estimated Discount To Fair Value: 17.2%

Neste Oyj, trading at €16.16, is undervalued by 17.2% compared to its estimated fair value of €19.51, but not significantly so. Despite a volatile share price and high debt levels, the company is expected to become profitable within three years with earnings projected to grow annually by 65.38%. Recent financials show a net loss for Q2 2025 of €36 million amidst declining sales, yet revenue growth outpaces the Finnish market average.

- Our expertly prepared growth report on Neste Oyj implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Neste Oyj's balance sheet by reading our health report here.

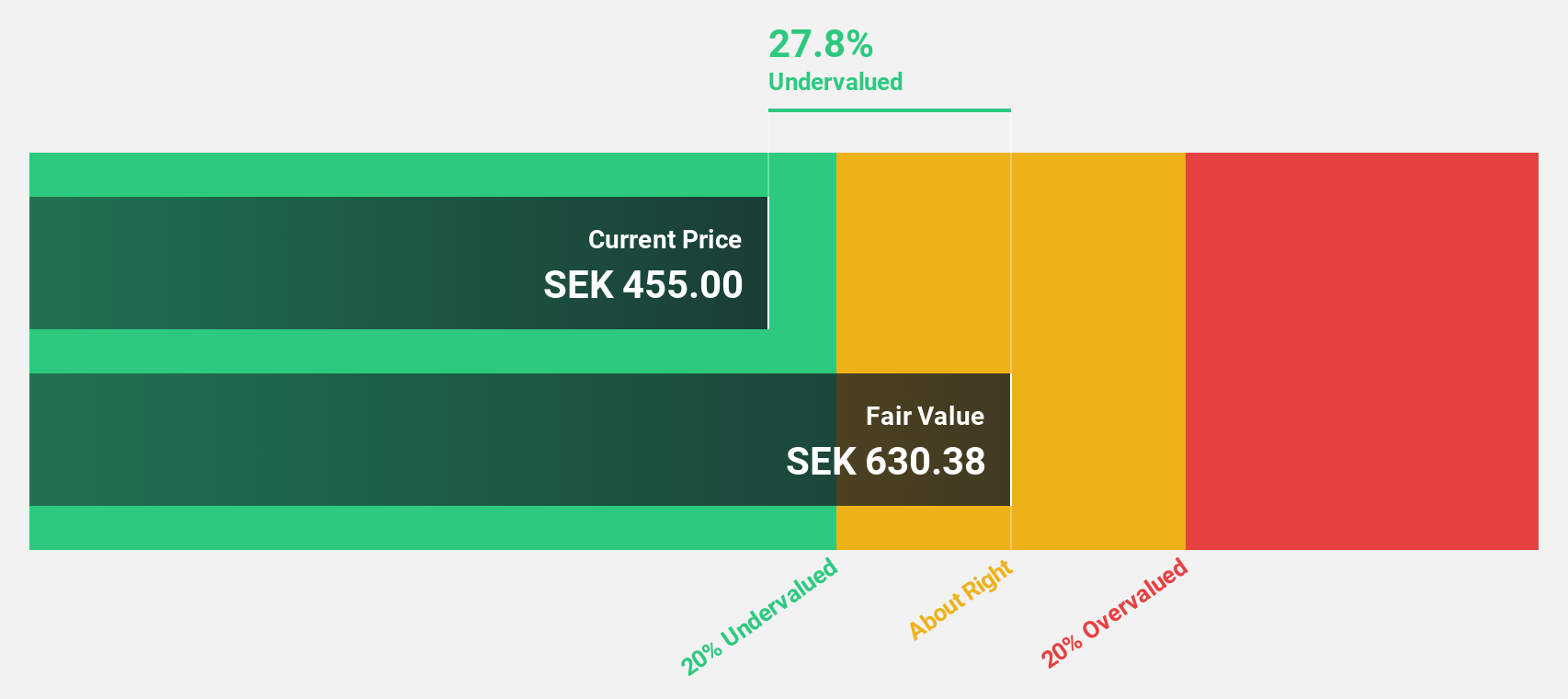

Mips (OM:MIPS)

Overview: Mips AB (publ) develops, manufactures, and sells helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK9.36 billion.

Operations: The company generates revenue from its Sporting Goods segment, amounting to SEK518 million.

Estimated Discount To Fair Value: 34%

Mips, trading at SEK353.2, is significantly undervalued by 34% compared to its fair value estimate of SEK535.42, with robust earnings growth of 70.7% over the past year and a forecasted annual profit increase of 41.75%. Despite recent earnings showing a slight decline in net income for Q2 2025, Mips's revenue is expected to grow faster than both the Swedish market and analysts' expectations, making it an attractive prospect based on cash flow valuation metrics.

- In light of our recent growth report, it seems possible that Mips' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Mips.

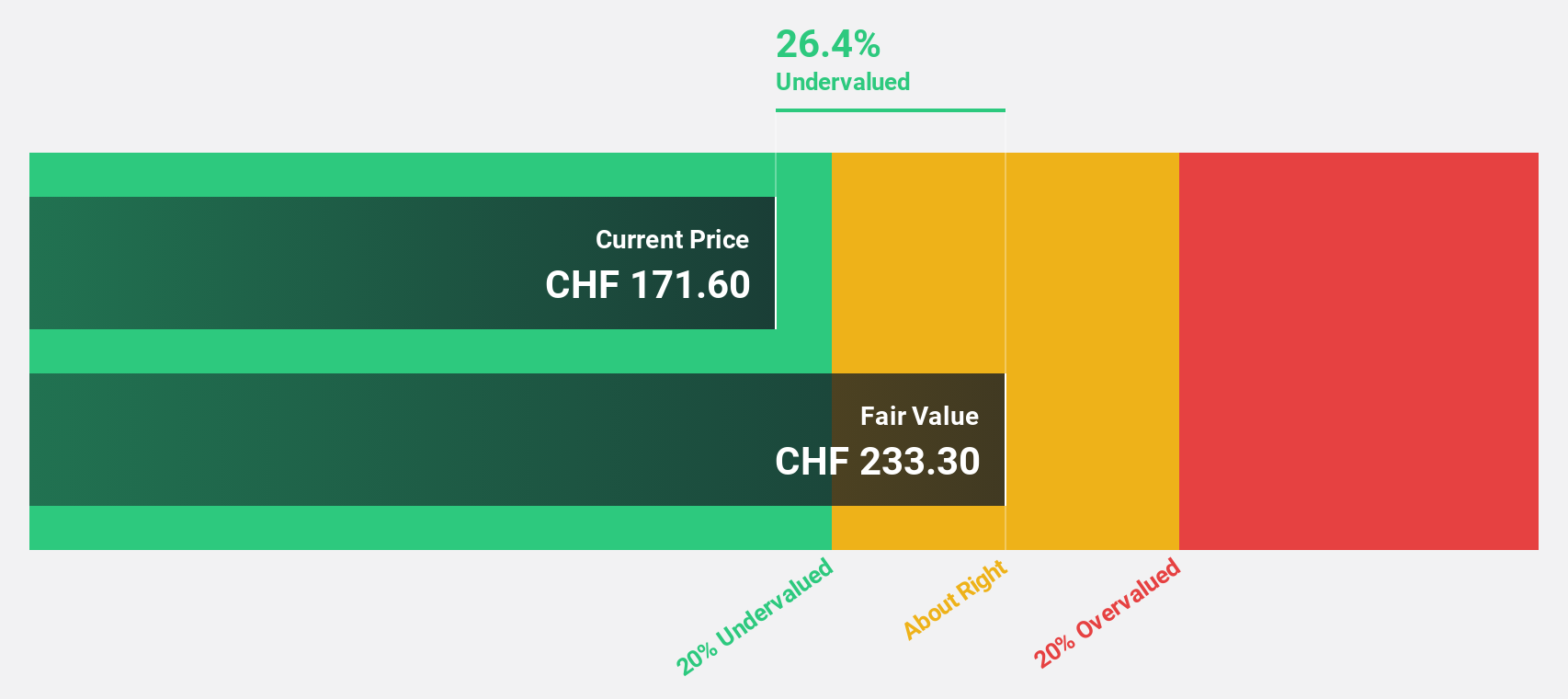

Bossard Holding (SWX:BOSN)

Overview: Bossard Holding AG is a company that offers industrial fastening and assembly solutions across Europe, the United States, and Asia with a market cap of CHF1.32 billion.

Operations: The company's revenue from Industrial Fastening Technology is CHF1.02 billion.

Estimated Discount To Fair Value: 26.2%

Bossard Holding, trading at CHF171.8, is undervalued by over 20% relative to its estimated fair value of CHF232.82 and showcases a promising annual earnings growth forecast of 17.7%, surpassing the Swiss market average. Despite a slight dip in net income for H1 2025, Bossard's collaboration with ETH Zurich on sustainable initiatives like rechargeable batteries for SmartBins underscores its commitment to innovation and environmental sustainability, potentially enhancing long-term cash flow stability amidst high debt levels.

- Our comprehensive growth report raises the possibility that Bossard Holding is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Bossard Holding's balance sheet health report.

Make It Happen

- Click through to start exploring the rest of the 204 Undervalued European Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MIPS

Mips

Develops, manufactures, and sells helmet-based safety systems in North America, Europe, Sweden, Asia, and Australia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives