European Dividend Stocks To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As European markets face volatility due to proposed tariffs from the U.S., major indices like Germany's DAX and France's CAC 40 have seen declines, highlighting the uncertainty in the region. In such an environment, dividend stocks can offer investors a measure of stability and income, making them an attractive option for those looking to enhance their portfolios with reliable returns amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.36% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.80% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.37% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.96% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.87% | ★★★★★★ |

| ERG (BIT:ERG) | 5.58% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.70% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

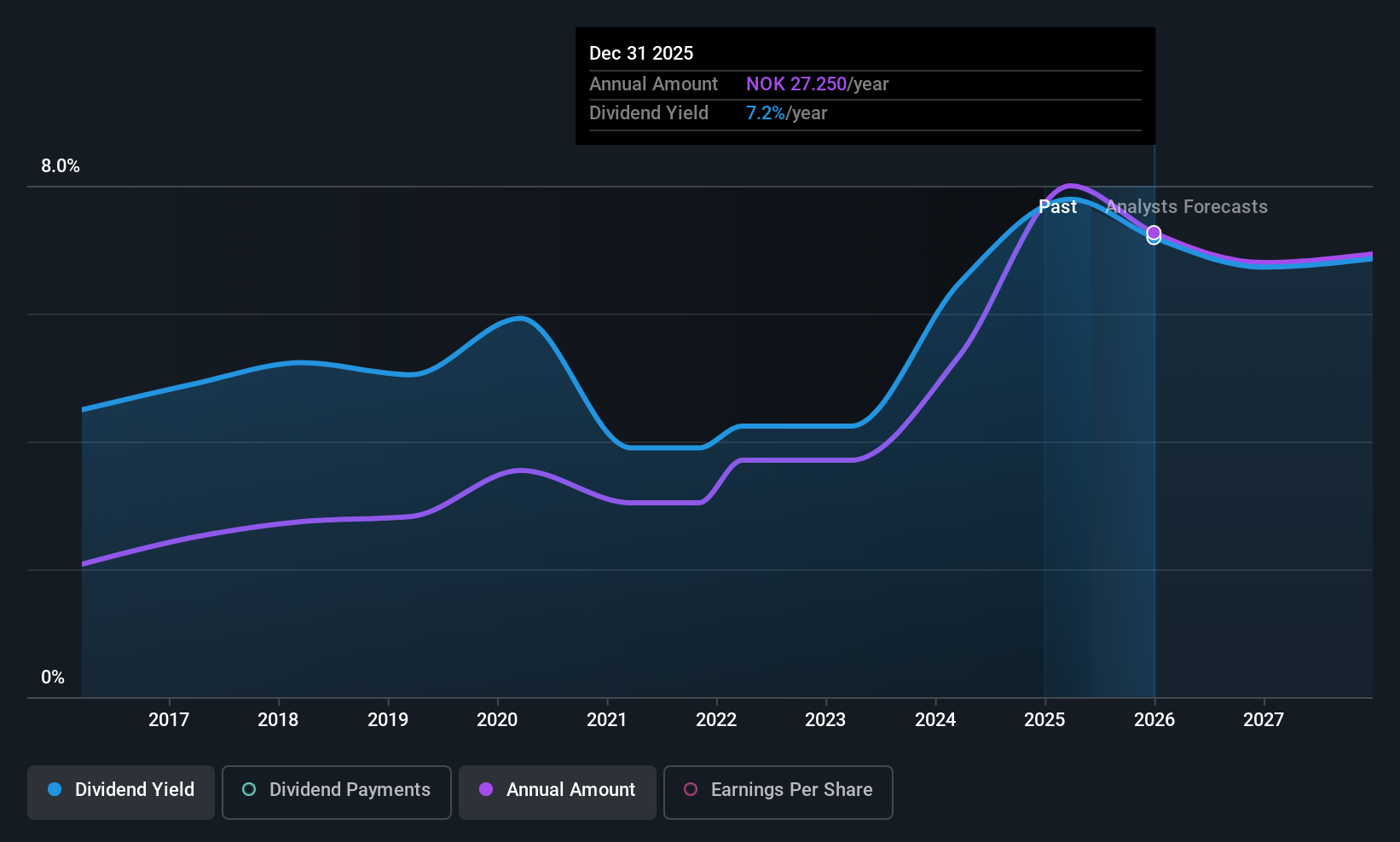

SpareBank 1 Ringerike Hadeland (OB:RING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Ringerike Hadeland is a financial institution offering a range of banking products and services to both private and corporate customers in Norway, with a market cap of NOK6.16 billion.

Operations: SpareBank 1 Ringerike Hadeland generates its revenue through a diverse array of banking products and services tailored for both individual and business clients in Norway.

Dividend Yield: 7.6%

SpareBank 1 Ringerike Hadeland offers a reliable dividend, with payments growing steadily over the past decade and currently covered by earnings at a payout ratio of 68.3%. Despite recent earnings growth of 44.9%, future earnings are expected to decline by an average of 4.7% annually over the next three years, though dividends remain forecasted to be covered at a 71.2% payout ratio. The current yield is attractive but below Norway's top-tier dividend payers.

- Dive into the specifics of SpareBank 1 Ringerike Hadeland here with our thorough dividend report.

- The valuation report we've compiled suggests that SpareBank 1 Ringerike Hadeland's current price could be quite moderate.

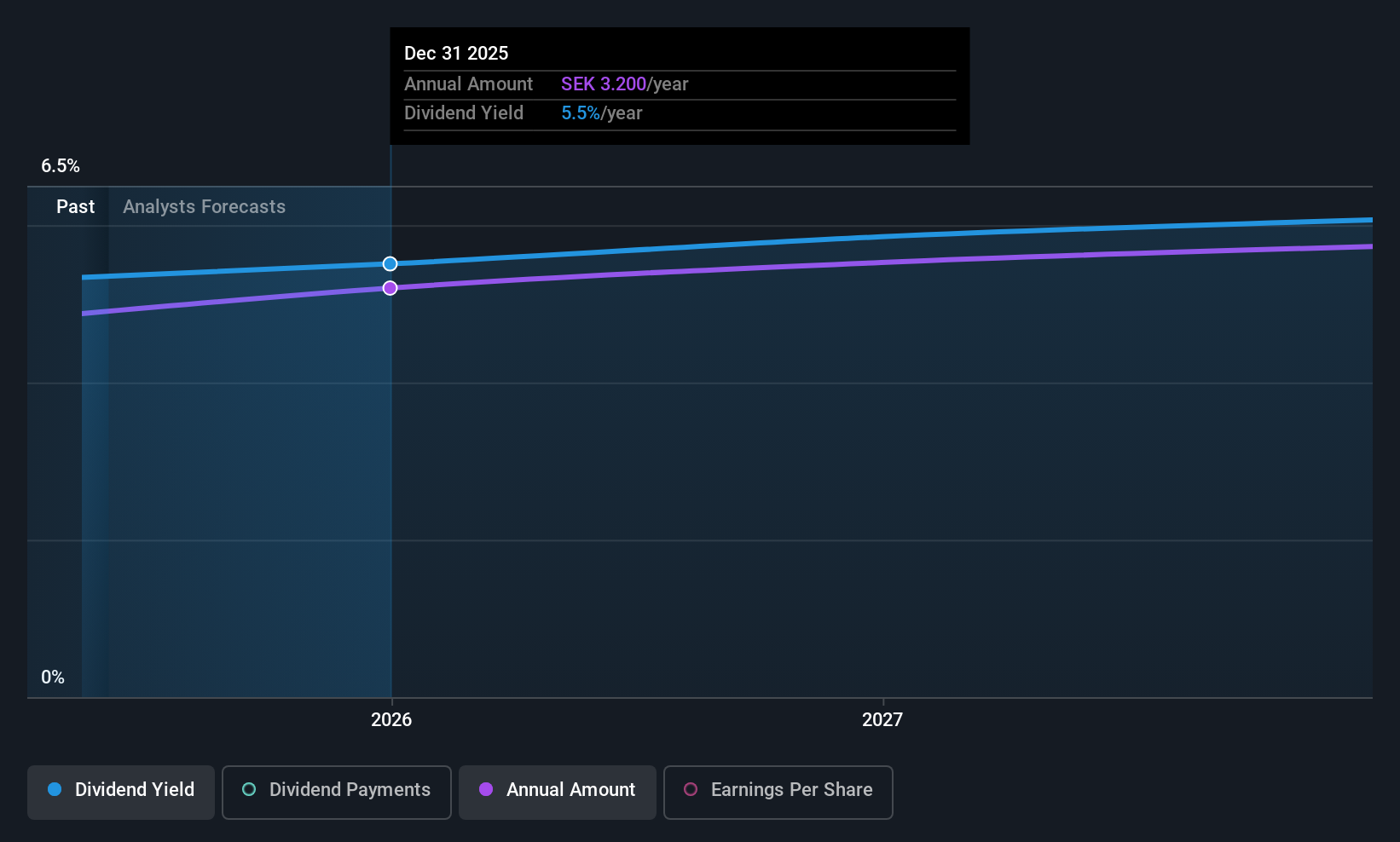

Björn Borg (OM:BORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Björn Borg AB (publ) and its subsidiaries manufacture, distribute, and sell underwear, sportswear, footwear, bags, and eyewear under the Björn Borg brand with a market cap of SEK1.48 billion.

Operations: Björn Borg AB generates revenue through the sale of underwear, sportswear, footwear, bags, and eyewear.

Dividend Yield: 5.1%

Björn Borg's dividend yield of 5.09% ranks in the top 25% of Swedish dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 143.6%, indicating dividends are not well-covered by free cash flow. Although earnings have grown by 20.7% over the past year, dividends have been volatile and unreliable over the last decade. Recent AGM decisions affirmed a SEK 3 per share dividend for 2025, split into two payments.

- Take a closer look at Björn Borg's potential here in our dividend report.

- The valuation report we've compiled suggests that Björn Borg's current price could be inflated.

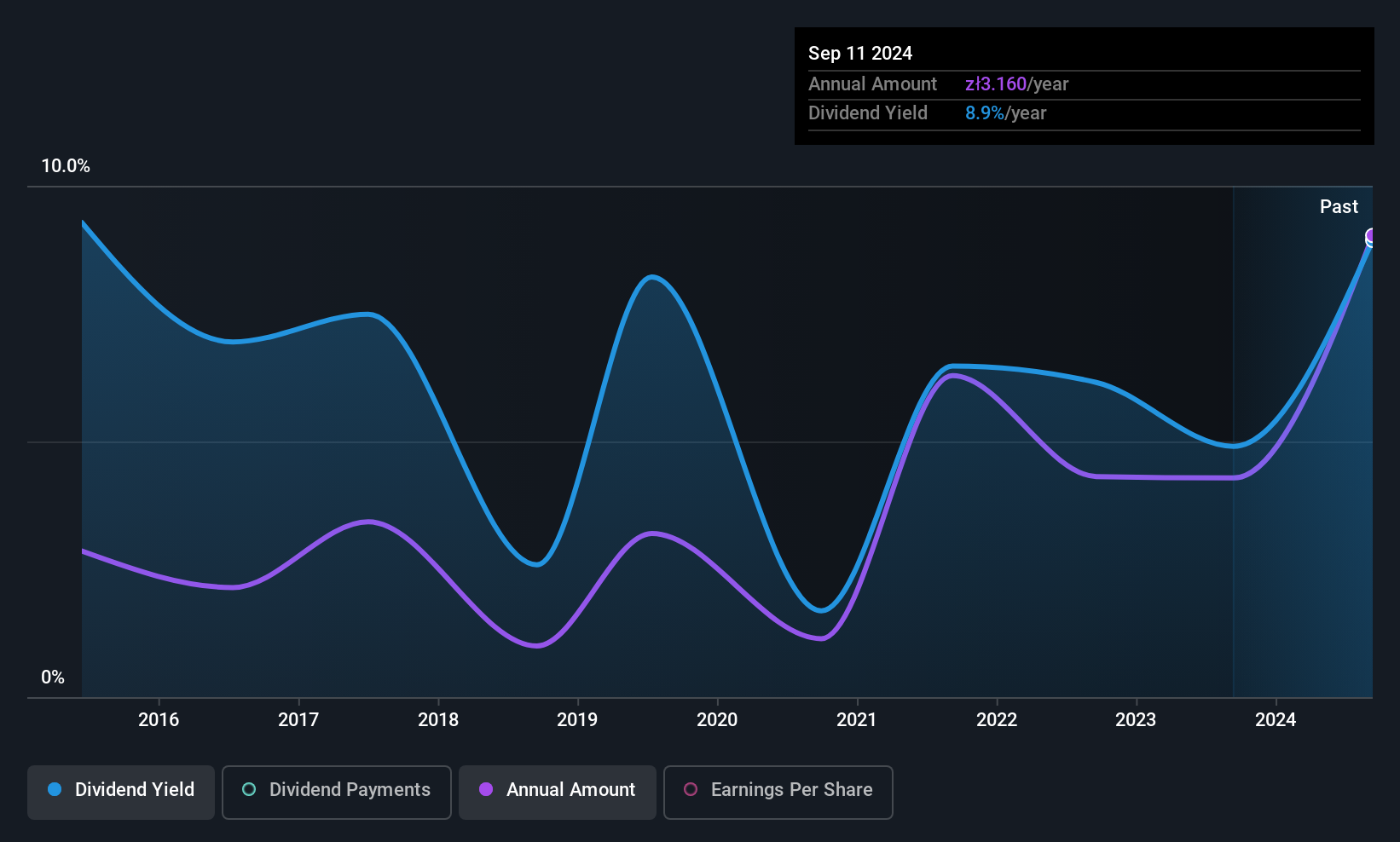

FERRO (WSE:FRO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FERRO S.A. manufactures and sells sanitary and plumbing fixtures in Poland and internationally, with a market cap of PLN764.74 million.

Operations: FERRO S.A.'s revenue is primarily derived from Sanitary Fittings at PLN371.37 million, Installation Fittings at PLN263.05 million, and Heat Sources at PLN132.49 million.

Dividend Yield: 8.8%

FERRO S.A.'s dividend yield is among the top 25% in Poland, but its history of volatile payments raises concerns about reliability. Despite this, recent earnings growth of 21.2% and a payout ratio of 88% indicate dividends are covered by earnings. The cash payout ratio stands at a manageable 43.1%, suggesting dividends are well-supported by cash flows. Trading significantly below estimated fair value, FERRO's potential for dividend growth remains noteworthy amidst its unstable dividend track record.

- Click to explore a detailed breakdown of our findings in FERRO's dividend report.

- Our valuation report unveils the possibility FERRO's shares may be trading at a discount.

Make It Happen

- Reveal the 235 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:RING

SpareBank 1 Ringerike Hadeland

A financial institution, provides various banking products and services to private and corporate customers in Norway.

Solid track record established dividend payer.

Market Insights

Community Narratives