- France

- /

- Auto Components

- /

- ENXTPA:OPM

European Dividend Stocks: CaixaBank And Two More Top Picks

Reviewed by Simply Wall St

In recent weeks, European markets have experienced a downturn, with the STOXX Europe 600 Index dropping 2.21% amid concerns over inflated AI stock valuations and diminishing expectations for a U.S. interest rate cut. Despite these challenges, dividend stocks remain an attractive option for investors seeking stability and income in uncertain times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.35% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 3.98% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.16% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| Evolution (OM:EVO) | 4.82% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.22% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.71% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.56% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.73% | ★★★★★★ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

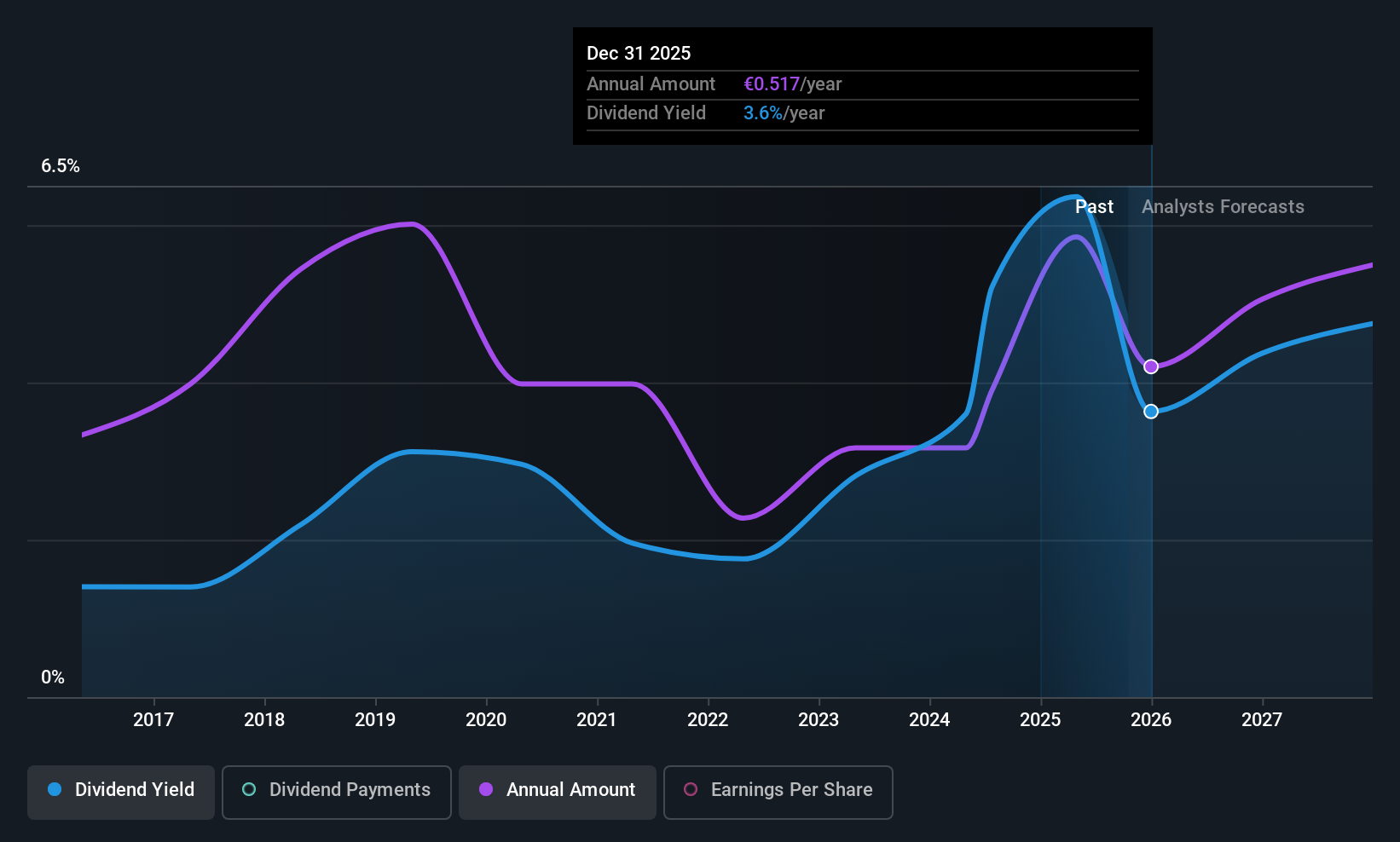

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CaixaBank, S.A. is a financial institution offering a range of banking products and services both in Spain and internationally, with a market capitalization of approximately €66.99 billion.

Operations: CaixaBank, S.A. generates revenue from its Portuguese Investment Bank (BPI) segment, which accounts for €1.14 billion.

Dividend Yield: 4.8%

CaixaBank's dividend strategy shows a mixed profile for investors. The company's dividends are currently covered by earnings with a payout ratio of 56.4%, suggesting sustainability, though the track record has been volatile over the past decade. Recent buyback programs, including a €500 million plan to repurchase up to 10% of its share capital, indicate efforts to enhance shareholder value. However, its dividend yield of 4.77% is below Spain's top quartile payers and it faces challenges with high bad loans at 2.3%.

- Click to explore a detailed breakdown of our findings in CaixaBank's dividend report.

- In light of our recent valuation report, it seems possible that CaixaBank is trading beyond its estimated value.

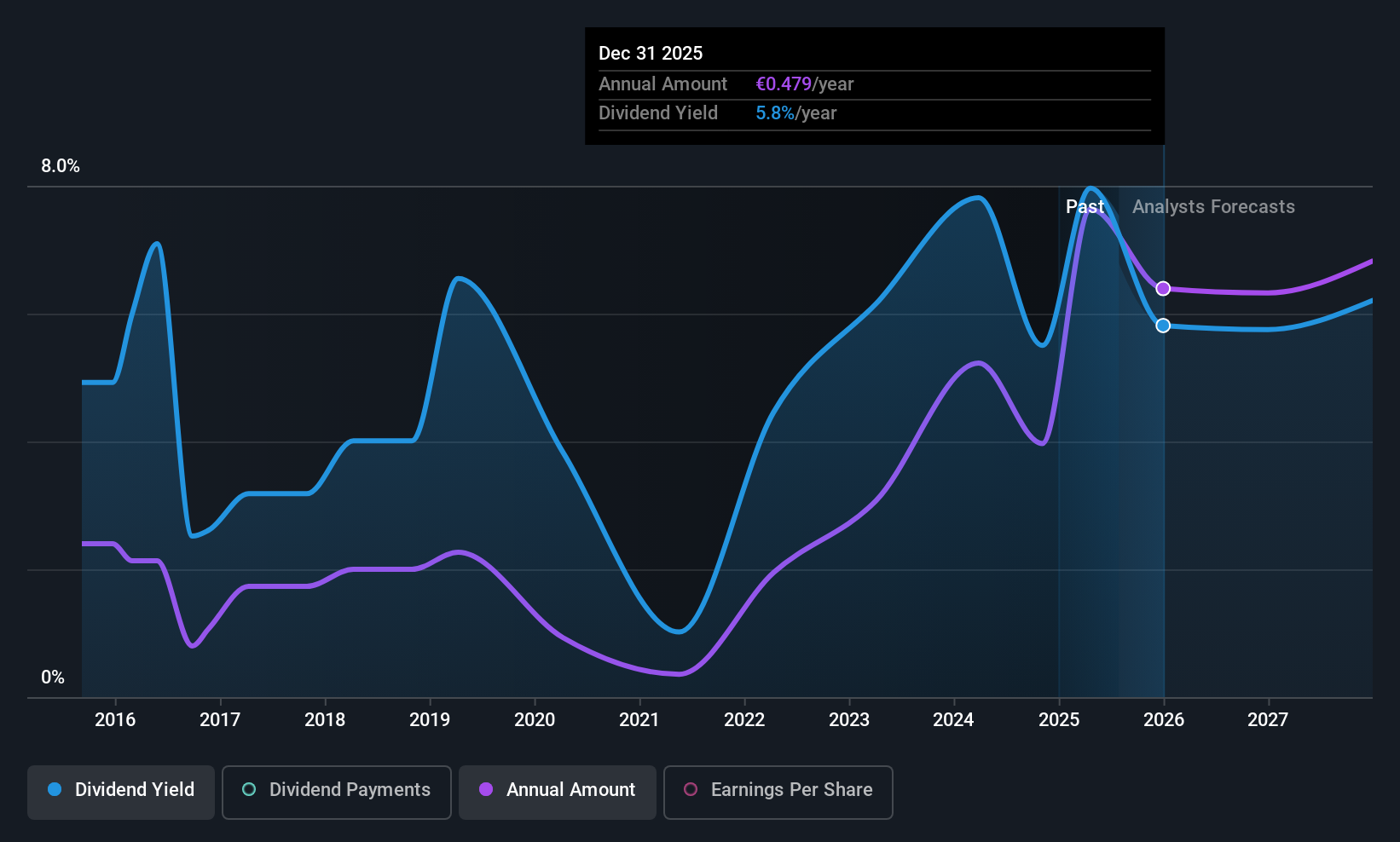

OPmobility (ENXTPA:OPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OPmobility SE designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for mobility sectors worldwide, with a market cap of €2.07 billion.

Operations: OPmobility SE generates revenue from its key segments: Modules (€3.15 billion), Powertrain (€2.62 billion), and Exterior Systems (€4.70 billion).

Dividend Yield: 5%

OPmobility's dividend strategy presents a complex picture. While dividends are well-covered by earnings and cash flows, with payout ratios of 32.2% and 50.2% respectively, their track record over the past decade has been volatile. Recent executive changes may influence future strategic direction, but the company remains committed to improving financial metrics despite declining revenue in recent quarters. Trading at a discount to estimated fair value offers potential upside, although its dividend yield is below top-tier French payers.

- Get an in-depth perspective on OPmobility's performance by reading our dividend report here.

- According our valuation report, there's an indication that OPmobility's share price might be on the expensive side.

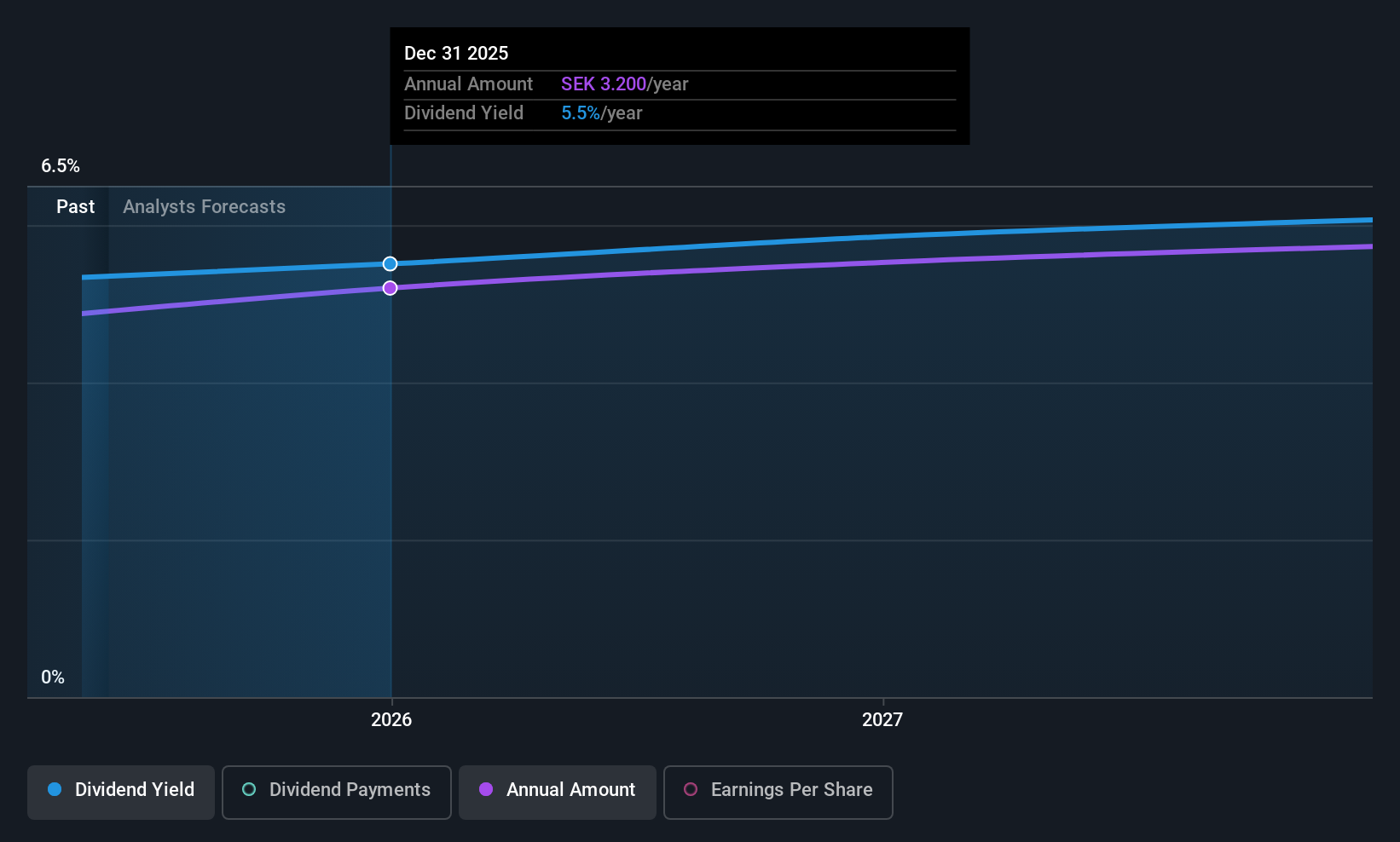

Björn Borg (OM:BORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Björn Borg AB (publ) and its subsidiaries manufacture, distribute, and sell underwear, sportswear, footwear, bags, and eyewear under the Björn Borg brand with a market cap of SEK1.56 billion.

Operations: Björn Borg AB generates revenue from its diverse product lines, including underwear, sportswear, footwear, bags, and eyewear.

Dividend Yield: 4.8%

Björn Borg's dividend yield of 4.85% ranks in the top 25% of Swedish payers, yet its sustainability is questionable given a high cash payout ratio of 133.5%, indicating dividends are not well-covered by cash flows. Despite recent earnings growth and trading below fair value, the company's dividend history has been volatile with inconsistent payments over the past decade. Recent financial results show steady revenue and net income growth, but dividend coverage remains a concern.

- Dive into the specifics of Björn Borg here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Björn Borg shares in the market.

Seize The Opportunity

- Gain an insight into the universe of 216 Top European Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OPM

OPmobility

Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success