- Sweden

- /

- Commercial Services

- /

- OM:SBOK

ScandBook Holding AB (publ) (STO:SBOK) Soars 28% But It's A Story Of Risk Vs Reward

ScandBook Holding AB (publ) (STO:SBOK) shareholders have had their patience rewarded with a 28% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 2.7% isn't as impressive.

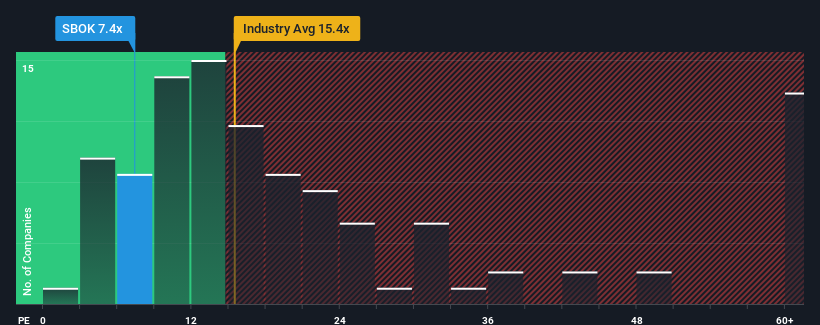

Although its price has surged higher, given about half the companies in Sweden have price-to-earnings ratios (or "P/E's") above 21x, you may still consider ScandBook Holding as a highly attractive investment with its 7.4x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that ScandBook Holding's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for ScandBook Holding

How Is ScandBook Holding's Growth Trending?

ScandBook Holding's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. Even so, admirably EPS has lifted 91% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that ScandBook Holding is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

ScandBook Holding's recent share price jump still sees its P/E sitting firmly flat on the ground. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that ScandBook Holding currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for ScandBook Holding you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SBOK

ScandBook Holding

Manufactures and sells hard/soft cover books for book publishers in Sweden.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives