- Sweden

- /

- Commercial Services

- /

- OM:RO

Companies Like Rolling Optics Holding (STO:RO) Can Afford To Invest In Growth

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Rolling Optics Holding (STO:RO) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Rolling Optics Holding

How Long Is Rolling Optics Holding's Cash Runway?

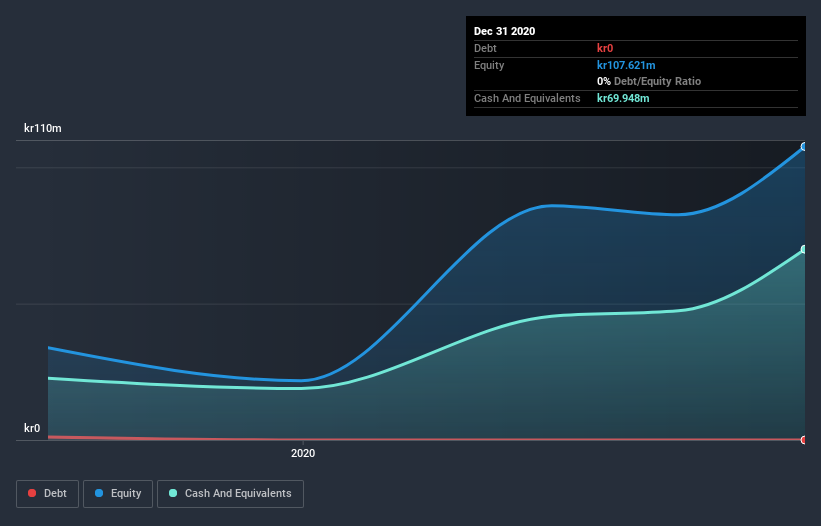

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In December 2020, Rolling Optics Holding had kr70m in cash, and was debt-free. Looking at the last year, the company burnt through kr16m. That means it had a cash runway of about 4.2 years as of December 2020. Importantly, though, the one analyst we see covering the stock thinks that Rolling Optics Holding will reach cashflow breakeven before then. If that happens, then the length of its cash runway, today, would become a moot point. You can see how its cash balance has changed over time in the image below.

How Well Is Rolling Optics Holding Growing?

At first glance it's a bit worrying to see that Rolling Optics Holding actually boosted its cash burn by 14%, year on year. Having said that, it's revenue is up a very solid 90% in the last year, so there's plenty of reason to believe in the growth story. Of course, with spend going up shareholders will want to see fast growth continue. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Rolling Optics Holding Raise Cash?

We are certainly impressed with the progress Rolling Optics Holding has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Rolling Optics Holding has a market capitalisation of kr568m and burnt through kr16m last year, which is 2.9% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Rolling Optics Holding's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way Rolling Optics Holding is burning through its cash. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. Although its increasing cash burn does give us reason for pause, the other metrics we discussed in this article form a positive picture overall. Shareholders can take heart from the fact that at least one analyst is forecasting it will reach breakeven. After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 4 warning signs for Rolling Optics Holding that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Rolling Optics Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Rolling Optics Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:RO

Rolling Optics Holding

Provides secure visual anti-counterfeit solutions based on complex and patented micro-optical technology in Sweden.

Flawless balance sheet low.