- Sweden

- /

- Professional Services

- /

- OM:REJL B

Some Investors May Be Willing To Look Past Rejlers' (STO:REJL B) Soft Earnings

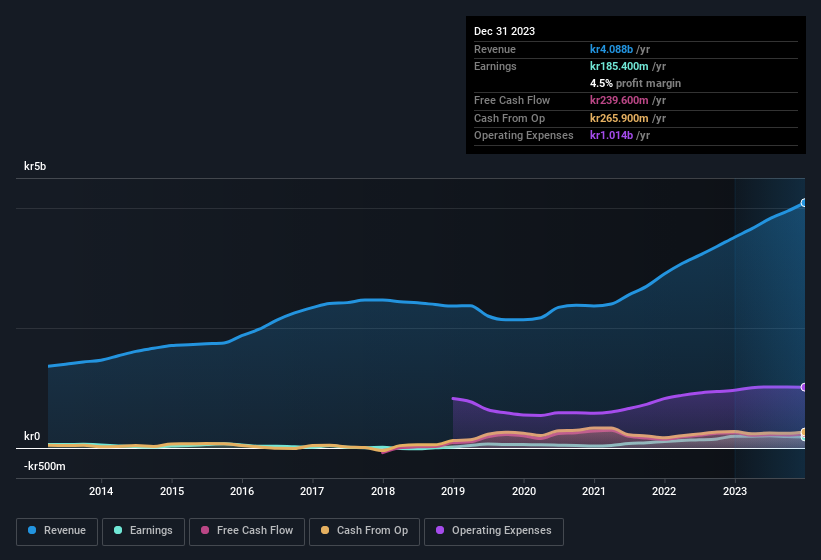

Shareholders appeared unconcerned with Rejlers AB (publ)'s (STO:REJL B) lackluster earnings report last week. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

See our latest analysis for Rejlers

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Rejlers issued 8.5% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. Check out Rejlers' historical EPS growth by clicking on this link.

A Look At The Impact Of Rejlers' Dilution On Its Earnings Per Share (EPS)

As you can see above, Rejlers has been growing its net income over the last few years, with an annualized gain of 470% over three years. But EPS was only up 418% per year, in the exact same period. Net income was down 5.6% over the last twelve months. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 12%. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Rejlers' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

On top of the dilution, we should also consider the kr71m impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If Rejlers doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Rejlers' Profit Performance

To sum it all up, Rejlers took a hit from unusual items which pushed its profit down; without that, it would have made more money. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Given the contrasting considerations, we don't have a strong view as to whether Rejlers's profits are an apt reflection of its underlying potential for profit. So while earnings quality is important, it's equally important to consider the risks facing Rejlers at this point in time. In terms of investment risks, we've identified 3 warning signs with Rejlers, and understanding these should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:REJL B

Rejlers

Engages in the provision of engineering consultancy services in Sweden, Finland, Norway, and Abu Dhabi.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives