- Sweden

- /

- Professional Services

- /

- OM:REJL B

ITAB Shop Concept And These 3 Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

Amidst a backdrop of record highs in major U.S. indices and geopolitical developments influencing market sentiment, investors are navigating an environment marked by both opportunity and caution. As small-cap stocks join their larger peers in reaching new heights, the focus turns to stable income sources such as dividend stocks, which can offer potential resilience and steady returns even when broader economic conditions fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.56% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.85% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.48% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) specializes in solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.87 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue primarily from its Furniture & Fixtures segment, amounting to SEK6.42 billion.

Dividend Yield: 3.2%

ITAB Shop Concept's dividend payments are well covered by earnings and cash flows, with payout ratios of 46.4% and 39.2%, respectively. However, the dividends have been volatile over the past decade, indicating an unstable track record. Recent earnings showed a mixed picture with increased nine-month sales to SEK 4.81 billion but lower Q3 net income at SEK 43 million compared to last year. A recent SEK 850 million equity offering may impact future shareholder returns.

- Click to explore a detailed breakdown of our findings in ITAB Shop Concept's dividend report.

- The valuation report we've compiled suggests that ITAB Shop Concept's current price could be quite moderate.

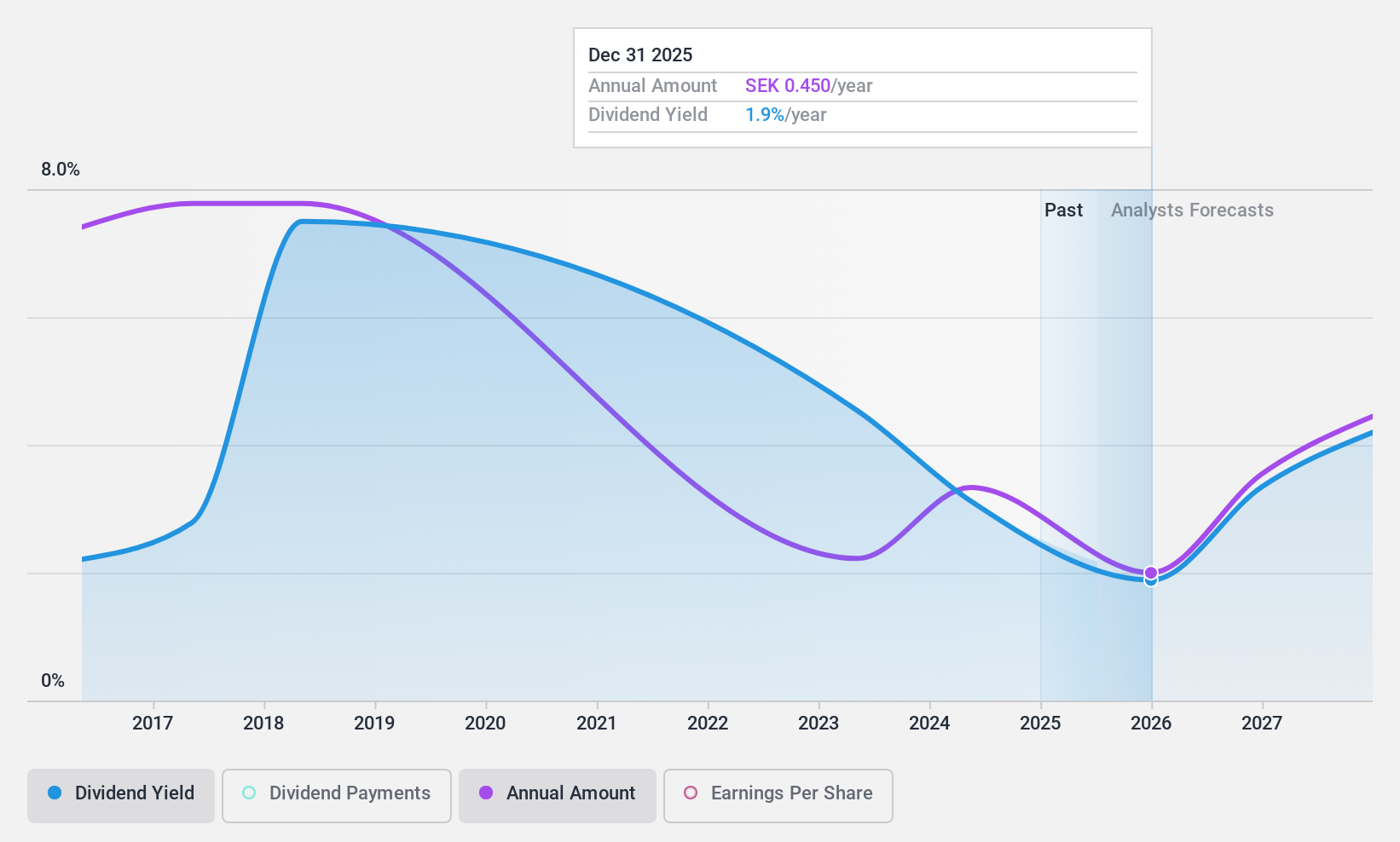

Rejlers (OM:REJL B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rejlers AB (publ) is a company that provides technical and engineering consultancy services in Sweden, Finland, Norway, and the United Arab Emirates, with a market cap of SEK3.15 billion.

Operations: Rejlers AB generates revenue from its consultancy services primarily in Sweden (SEK2.66 billion), followed by Finland (SEK1.39 billion) and Norway, including Embriq (SEK309.80 million).

Dividend Yield: 3.1%

Rejlers' dividend payments are well covered by earnings and cash flows, with payout ratios of 47.6% and 35.7%, respectively, but have been volatile over the past decade. The company reported increased nine-month sales to SEK 3.21 billion and a rise in Q3 net income to SEK 27.8 million year-over-year. Recent projects like the Koskela tram depot highlight Rejlers' focus on sustainable infrastructure, potentially supporting long-term growth despite its low dividend yield compared to top Swedish payers.

- Unlock comprehensive insights into our analysis of Rejlers stock in this dividend report.

- Our valuation report unveils the possibility Rejlers' shares may be trading at a discount.

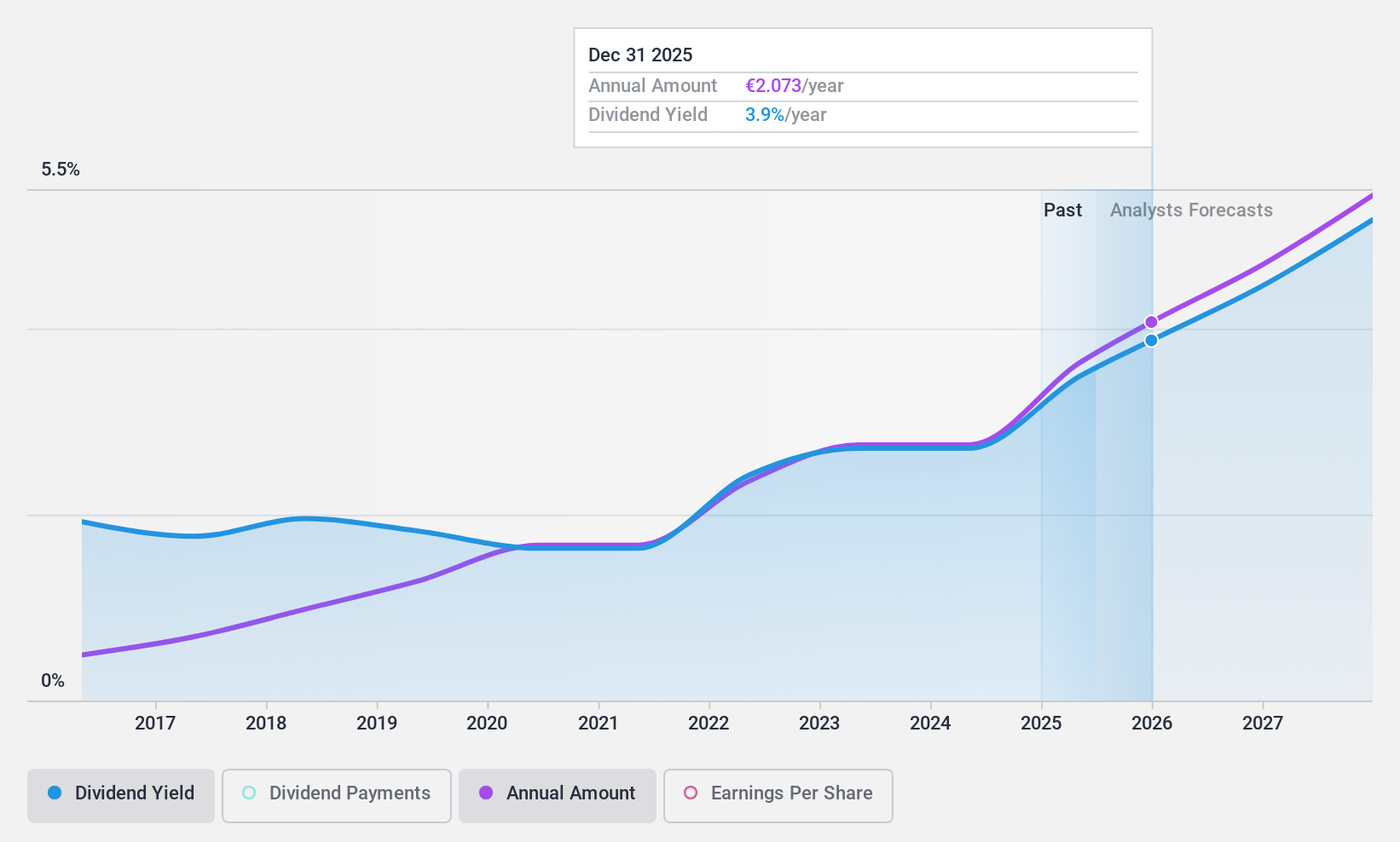

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling solutions in Germany and internationally, with a market cap of €905.72 million.

Operations: Mensch und Maschine Software SE generates revenue from its M+M Software segment, amounting to €107.95 million, and its M+M Digitization segment, totaling €242.22 million.

Dividend Yield: 3%

Mensch und Maschine Software's dividends have been stable and growing over the past decade, supported by a cash payout ratio of 60.8% and an earnings payout ratio of 87.2%. Despite a modest dividend yield of 2.97%, lower than top German payers, recent financials show robust growth with Q3 sales at €94.11 million and net income rising to €6.43 million year-over-year, indicating strong operational performance supporting dividend sustainability.

- Dive into the specifics of Mensch und Maschine Software here with our thorough dividend report.

- Our valuation report here indicates Mensch und Maschine Software may be overvalued.

Seize The Opportunity

- Reveal the 1948 hidden gems among our Top Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:REJL B

Rejlers

Engages in the provision of engineering consultancy services in Sweden, Finland, Norway, and Abu Dhabi.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives