QleanAir AB (publ) (STO:QAIR) Soars 28% But It's A Story Of Risk Vs Reward

Despite an already strong run, QleanAir AB (publ) (STO:QAIR) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

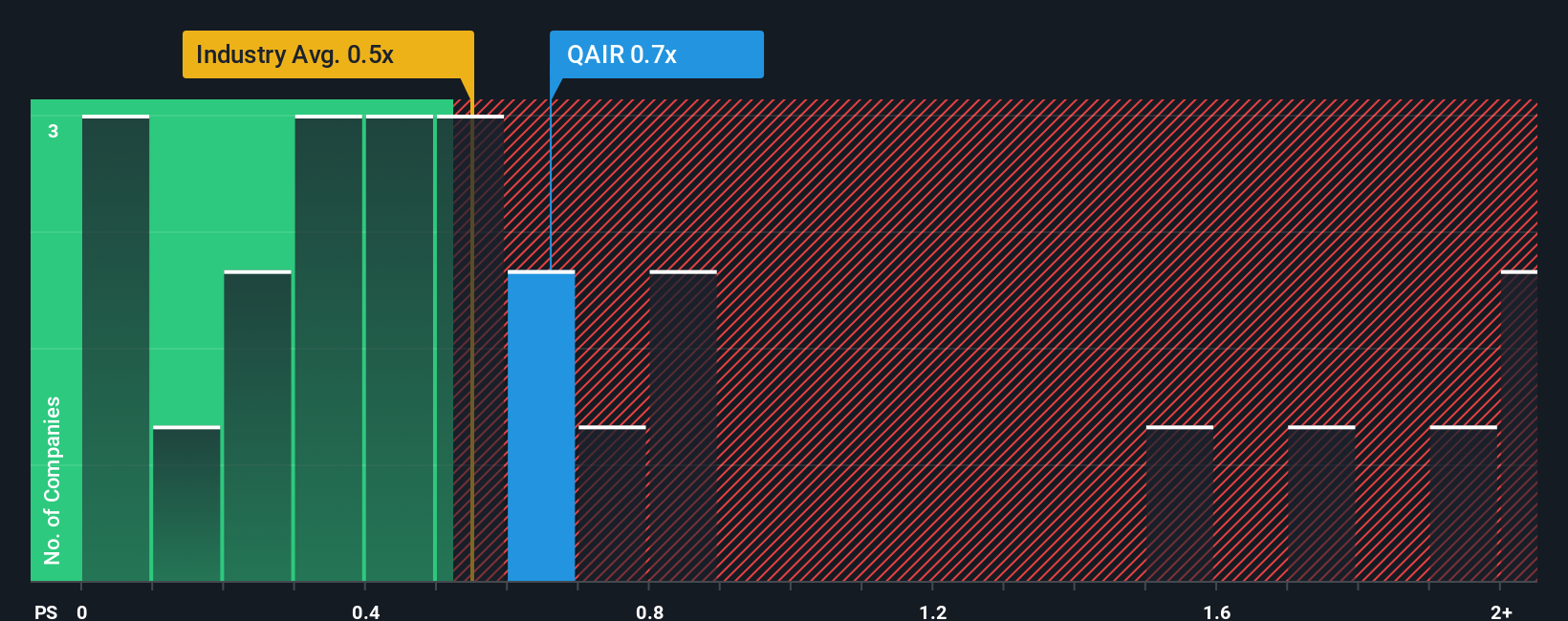

Even after such a large jump in price, you could still be forgiven for feeling indifferent about QleanAir's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Sweden is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for QleanAir

What Does QleanAir's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, QleanAir's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on QleanAir.How Is QleanAir's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like QleanAir's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 1.8% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 10% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.2%, which is noticeably less attractive.

With this information, we find it interesting that QleanAir is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On QleanAir's P/S

Its shares have lifted substantially and now QleanAir's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that QleanAir currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 2 warning signs for QleanAir (1 shouldn't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if QleanAir might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:QAIR

QleanAir

Provides air cleaning solutions for indoor environments in Sweden and internationally.

High growth potential and fair value.

Market Insights

Community Narratives