- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Loomis And 2 More Swedish Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets react to recent interest rate cuts by the European Central Bank, the Swedish market remains a focal point for investors seeking stability and growth. With this backdrop, dividend stocks in Sweden present an attractive option for those looking to boost their portfolios through consistent income streams. In this article, we will explore three compelling Swedish dividend stocks: Loomis and two others that stand out in today's economic climate.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Betsson (OM:BETS B) | 5.72% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.85% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 3.65% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.60% | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.31% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.04% | ★★★★★☆ |

| Duni (OM:DUNI) | 5.11% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.42% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.97% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.72% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Swedish Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables with a market cap of SEK 23.39 billion.

Operations: Loomis AB (publ) generates revenue primarily from its operations in Europe and Latin America (SEK 14.32 billion), the United States of America (SEK 15.45 billion), and Loomis Pay (SEK 77 million).

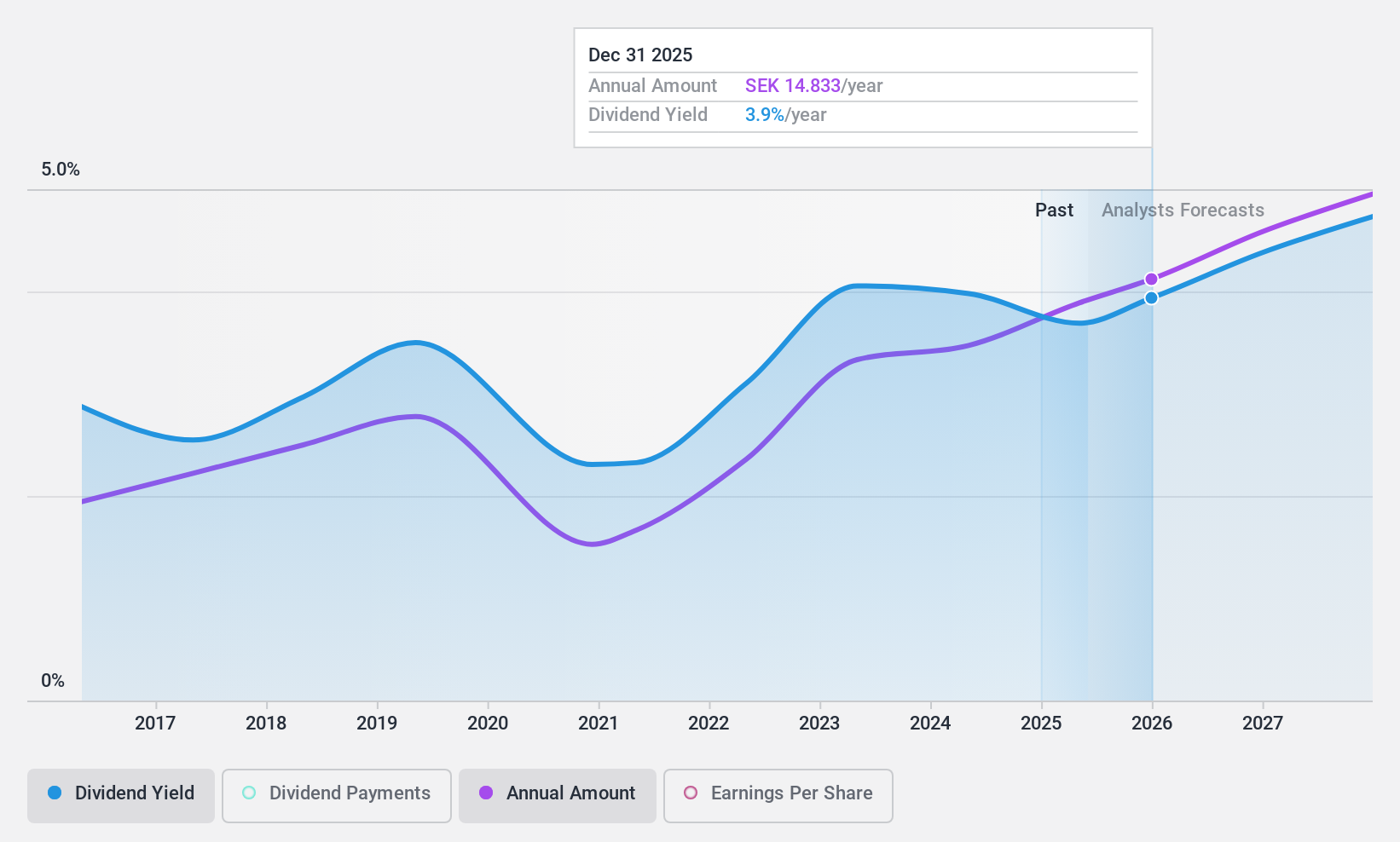

Dividend Yield: 3.7%

Loomis has shown consistent revenue growth, with Q2 2024 sales at SEK 7.64 billion and net income at SEK 396 million. Despite a volatile dividend history, recent payments are well-covered by earnings and cash flows, with payout ratios of 59.4% and 26.3%, respectively. The company completed a €300 million fixed-income offering in September and has been actively repurchasing shares, indicating strong financial management despite its lower-than-top-tier dividend yield of 3.72%.

- Delve into the full analysis dividend report here for a deeper understanding of Loomis.

- According our valuation report, there's an indication that Loomis' share price might be on the cheaper side.

Solid Försäkringsaktiebolag (OM:SFAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag (publ) offers non-life insurance to private and business customers across several European countries, with a market cap of SEK1.60 billion.

Operations: Solid Försäkringsaktiebolag (publ) generates revenue from three main segments: Product (SEK320.51 million), Assistance (SEK351.63 million), and Personal Safety (SEK435.09 million).

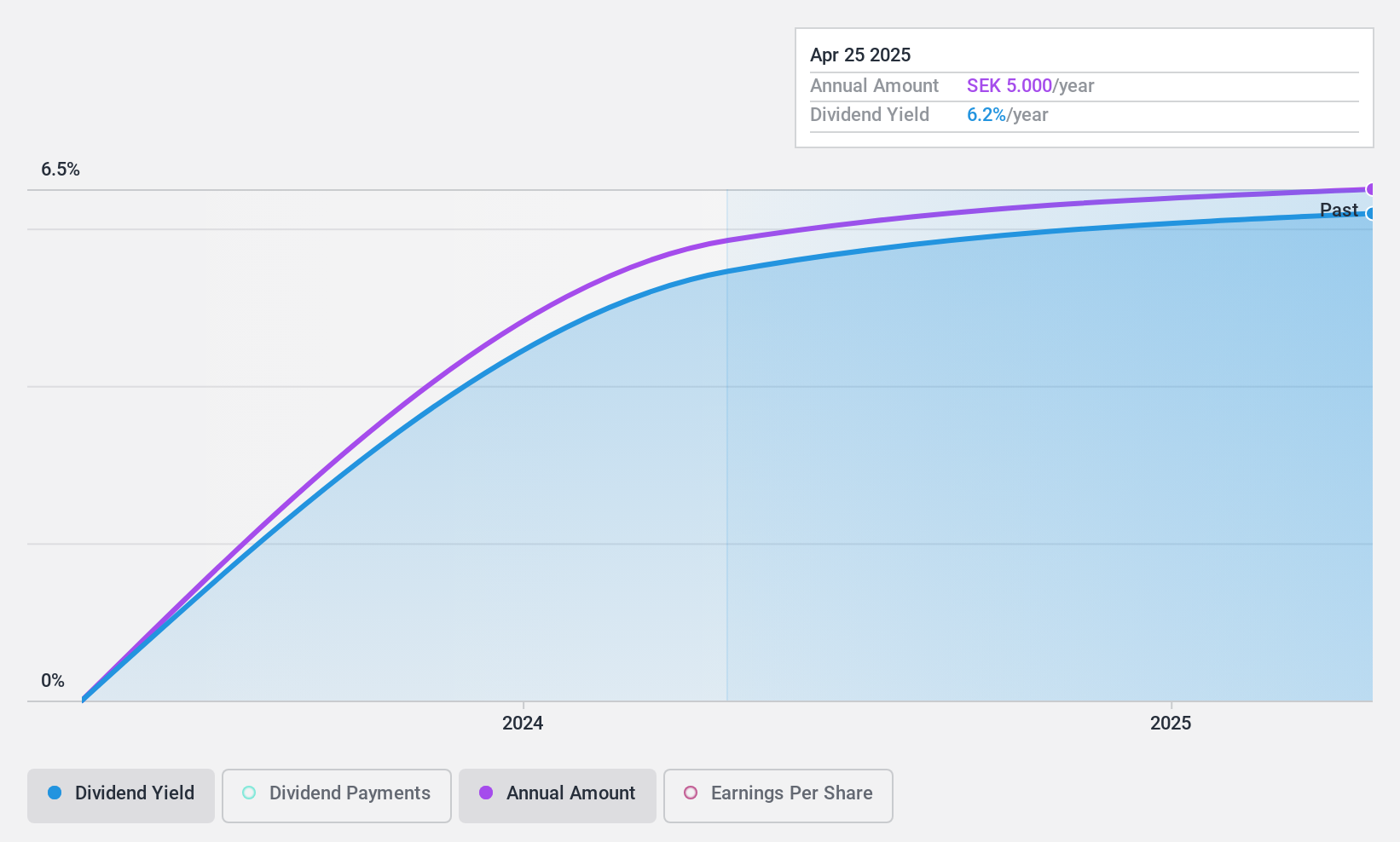

Dividend Yield: 5.1%

Solid Försäkringsaktiebolag's dividend is well-covered by earnings (49.1% payout ratio) and cash flows (73.7% cash payout ratio). However, it’s too early to assess the reliability or growth of its dividends as they recently started. The company repurchased 122,188 shares for SEK 10.19 million in July 2024, part of a broader buyback program aimed at enhancing shareholder value and optimizing capital structure. Recent earnings show steady growth with Q2 net income at SEK 40.95 million.

- Navigate through the intricacies of Solid Försäkringsaktiebolag with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Solid Försäkringsaktiebolag is priced lower than what may be justified by its financials.

Zinzino (OM:ZZ B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zinzino AB (publ) is a direct sales company that offers dietary supplements and skincare products in Sweden and internationally, with a market cap of SEK 2.82 billion.

Operations: Zinzino AB (publ) generates revenue primarily from its Zinzino (including VMA Life) segment at SEK 1.83 billion and Faun segment at SEK 170.31 million.

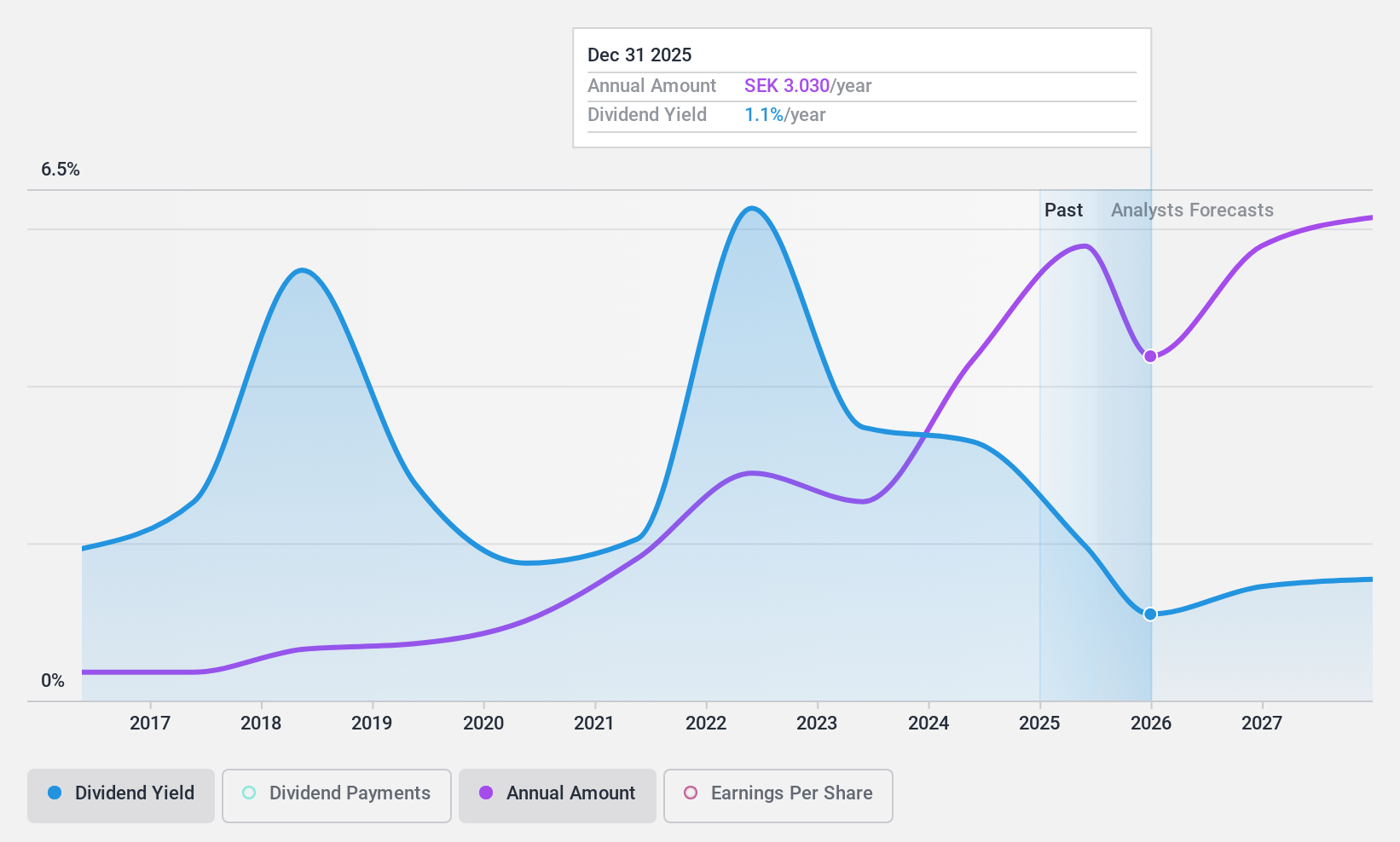

Dividend Yield: 3.6%

Zinzino AB's dividend payments are well-covered by earnings (56.3% payout ratio) and cash flows (47.4% cash payout ratio). The company has a reliable history of dividend payments over the past 10 years, with consistent growth and stability. Recent financial results show strong revenue growth, with August 2024 revenues up 39% year-on-year to SEK 178.7 million, supporting its ability to sustain dividends despite a relatively low yield of 3.65%.

- Click here to discover the nuances of Zinzino with our detailed analytical dividend report.

- The analysis detailed in our Zinzino valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Take a closer look at our Top Swedish Dividend Stocks list of 20 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LOOMIS

Loomis

Provides solutions for the distribution, payments, handling, storage, and recycling of cash and other valuables.

Flawless balance sheet, undervalued and pays a dividend.