- Sweden

- /

- Commercial Services

- /

- OM:LOOMIS

Here's Why We Think Loomis (STO:LOOMIS) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Loomis (STO:LOOMIS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Loomis' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Loomis managed to grow EPS by 15% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

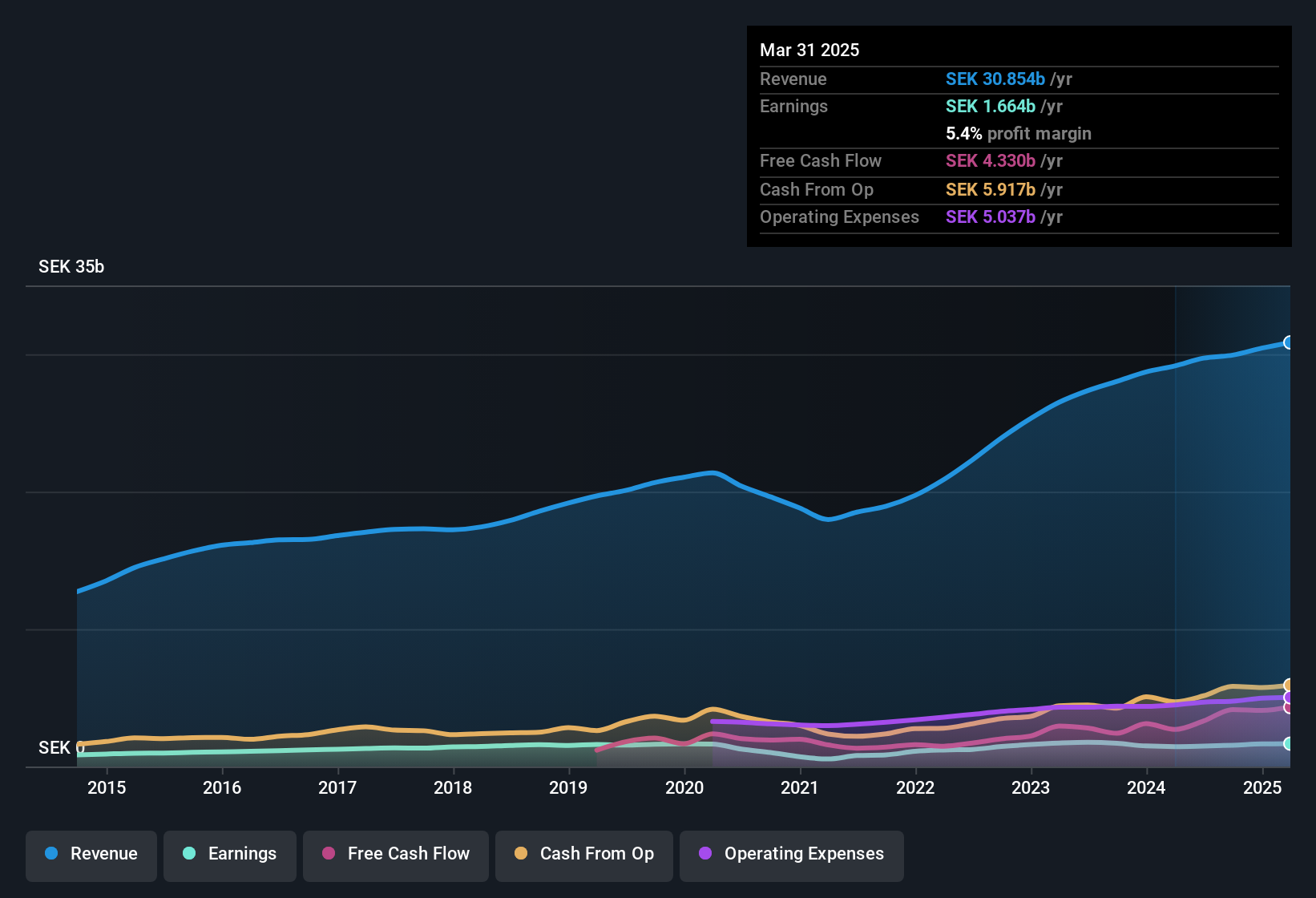

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Loomis achieved similar EBIT margins to last year, revenue grew by a solid 5.9% to kr31b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

View our latest analysis for Loomis

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Loomis.

Are Loomis Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Loomis shareholders can gain quiet confidence from the fact that insiders shelled out kr2.1m to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by President & CEO of Loomis USA Bjorn Zuger for kr1.4m worth of shares, at about kr380 per share.

Is Loomis Worth Keeping An Eye On?

As previously touched on, Loomis is a growing business, which is encouraging. While some companies are struggling to grow EPS, Loomis seems free from that morose affliction. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. You still need to take note of risks, for example - Loomis has 1 warning sign we think you should be aware of.

The good news is that Loomis is not the only stock with insider buying. Here's a list of small cap, undervalued companies in SE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:LOOMIS

Loomis

Provides secure payment solutions in the United States, France, Switzerland, Spain, the United Kingdom, Sweden, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives