As European markets face renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, the pan-European STOXX Europe 600 Index recently ended 2.21% lower, reflecting broader market unease. In this environment, dividend stocks can offer investors a measure of stability and income potential, as they often represent companies with solid fundamentals and consistent cash flow—key attributes during periods of economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.48% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 3.98% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.13% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.74% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.11% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.54% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.64% | ★★★★★★ |

Click here to see the full list of 215 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

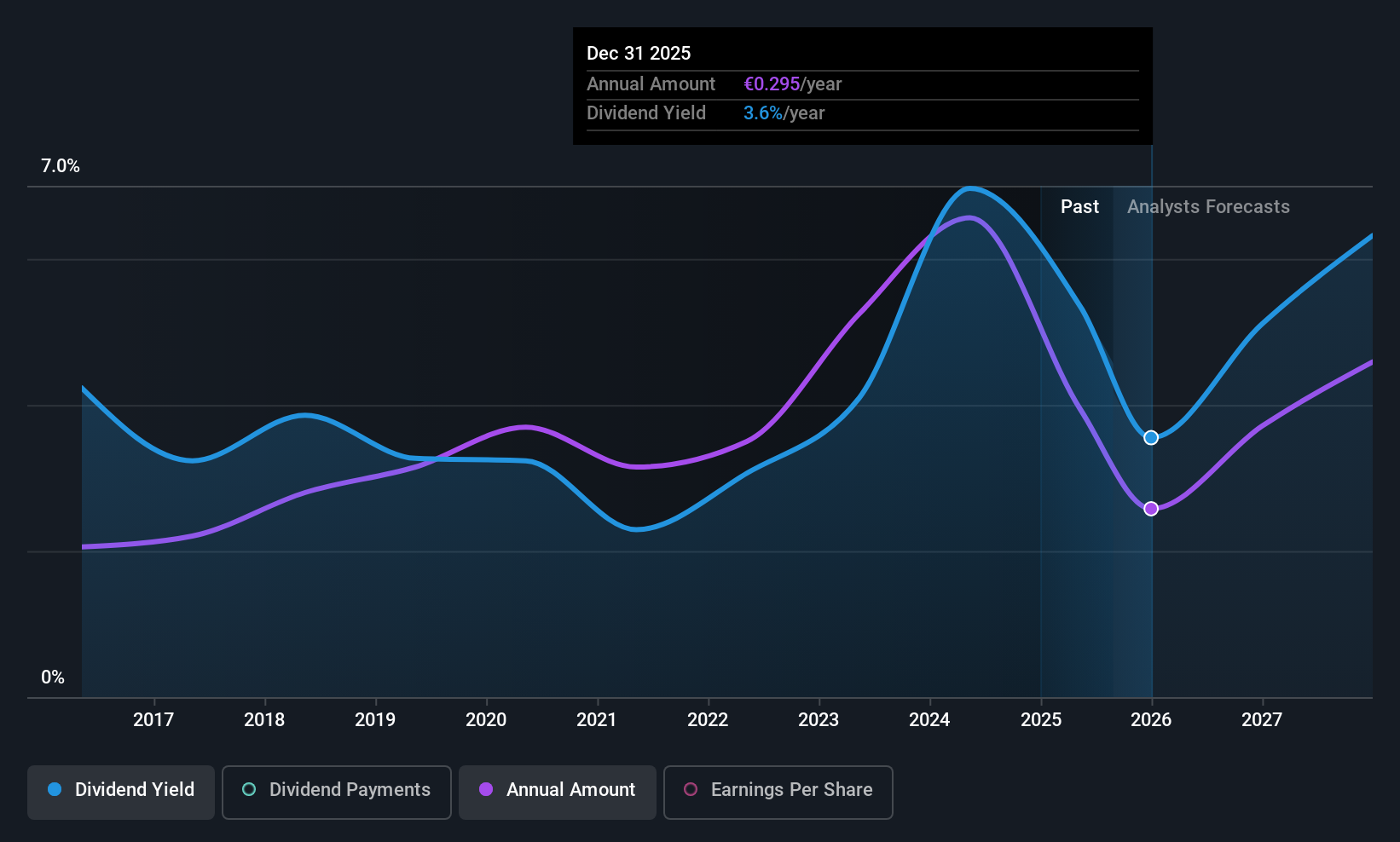

Zignago Vetro (BIT:ZV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zignago Vetro S.p.A., along with its subsidiaries, produces, markets, and sells hollow glass containers across Italy, the rest of Europe, and internationally with a market cap of €637.28 million.

Operations: Zignago Vetro S.p.A. generates revenue through the production, marketing, and sale of hollow glass containers across various regions including Italy, the rest of Europe, and international markets.

Dividend Yield: 6.2%

Zignago Vetro's dividend yield of 6.23% ranks in the top 25% of Italian market payers, but its dividends have been volatile and not consistently covered by earnings, with a high payout ratio of 115.6%. Despite reasonable cash flow coverage (51.2%), financial stability is challenged by high debt levels and declining profit margins, as recent earnings show reduced net income and sales compared to last year. The stock trades at a discount to its estimated fair value.

- Get an in-depth perspective on Zignago Vetro's performance by reading our dividend report here.

- Our expertly prepared valuation report Zignago Vetro implies its share price may be lower than expected.

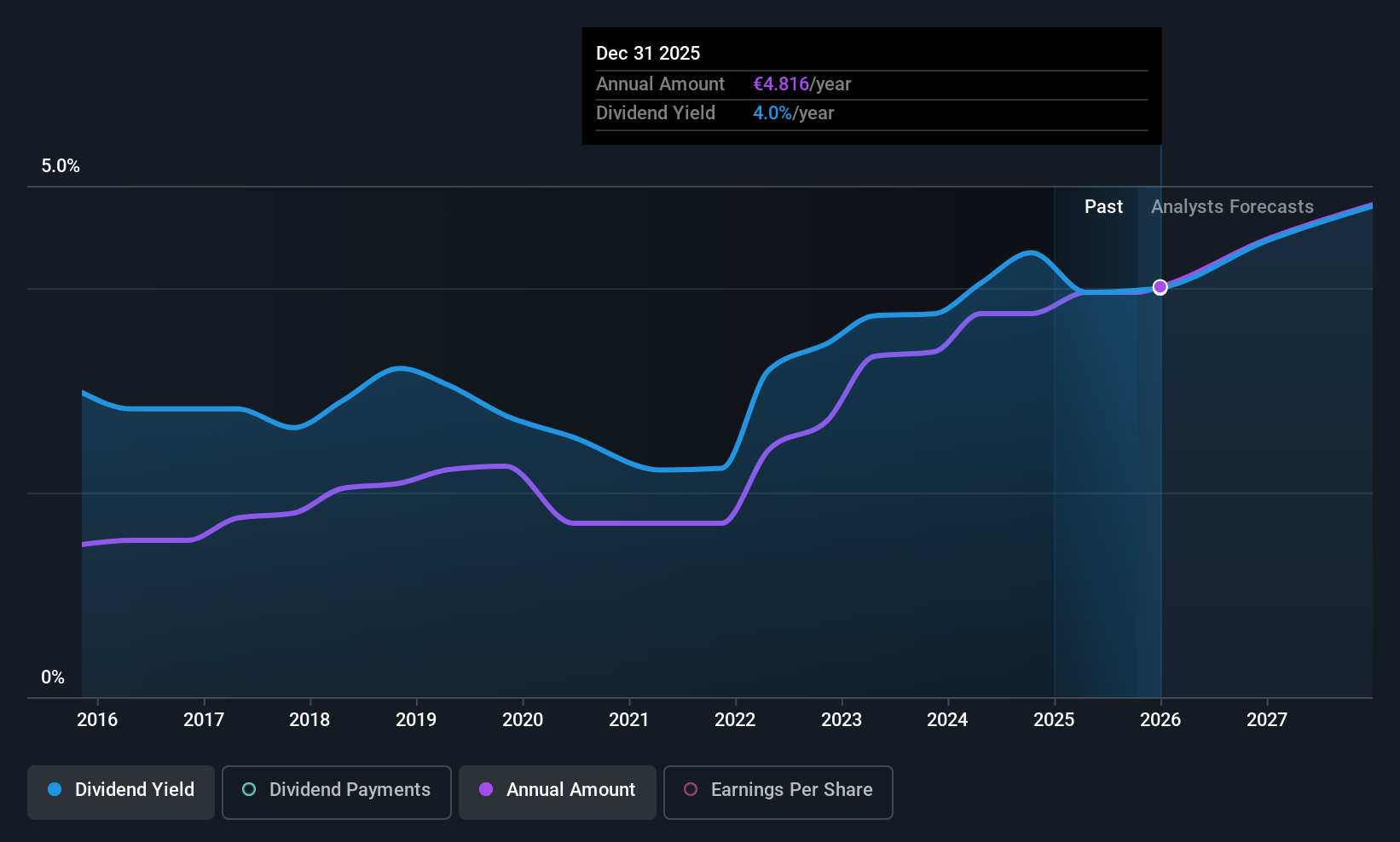

Vinci (ENXTPA:DG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci SA, with a market cap of €65.94 billion, operates in concessions, energy, and construction sectors both in France and internationally through its subsidiaries.

Operations: Vinci SA's revenue segments include VINCI Construction (Including Eurovia) at €31.67 billion, VINCI Energies at €20.87 billion, Concessions - VINCI Autoroutes at €7.21 billion, Cobra IS at €7.40 billion, Concessions - VINCI Airports at €5.00 billion, and Concessions - Other Concessions (VINCI Highways, VINCI Railways and VINCI Stadium) at €0.74 billion.

Dividend Yield: 3.9%

Vinci SA's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 56.4% and a cash payout ratio of 34.2%, despite a history of volatility over the past decade. The company's recent revenue growth to €54.3 billion for the first nine months of 2025 suggests solid operational performance, although an additional €0.4 billion tax charge in France may impact net income. Vinci trades at a favorable P/E ratio compared to the French market but carries high debt levels, which could affect financial stability long-term.

- Click here and access our complete dividend analysis report to understand the dynamics of Vinci.

- Our valuation report here indicates Vinci may be undervalued.

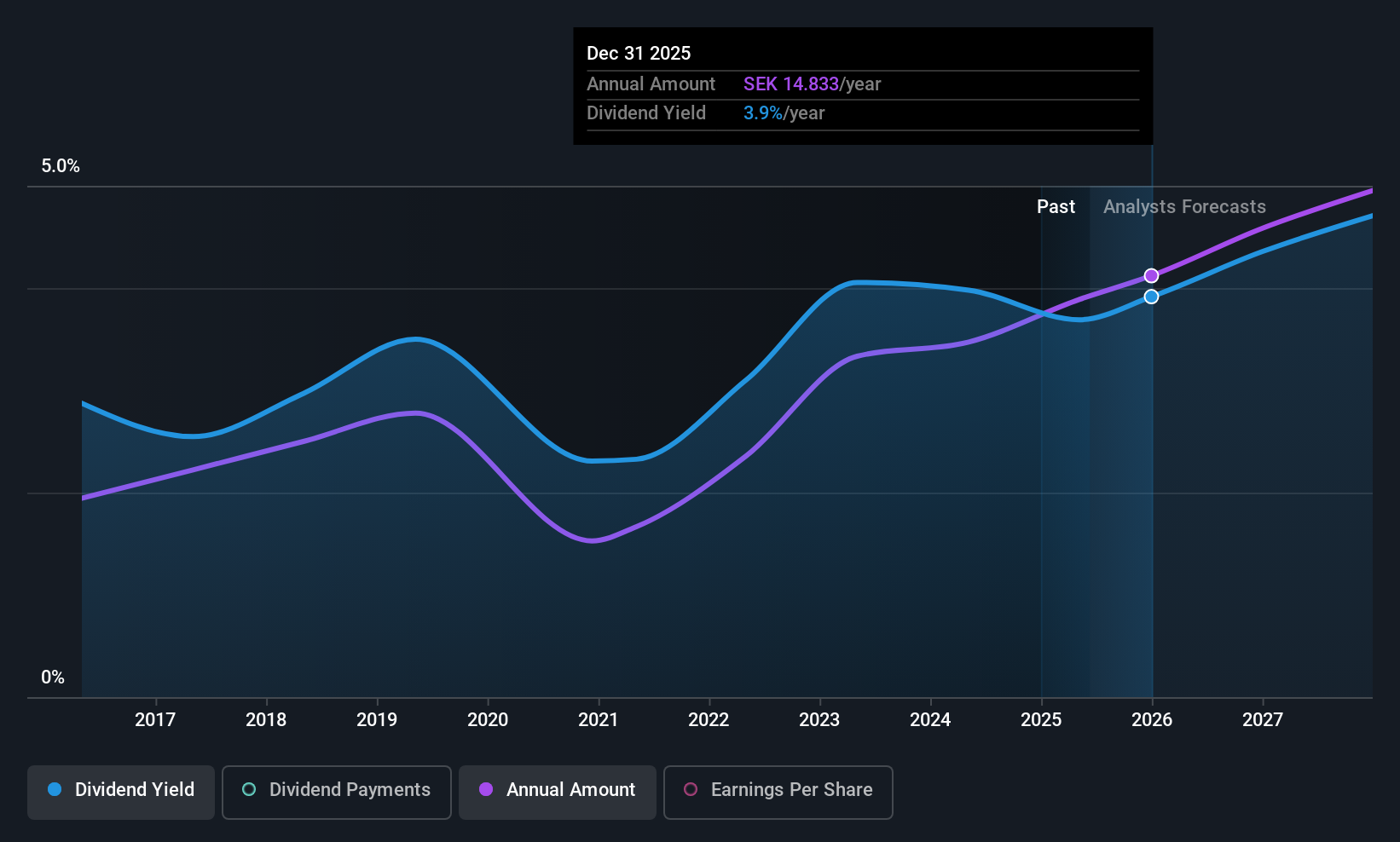

Loomis (OM:LOOMIS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loomis AB (publ) offers secure payment solutions across various countries including the United States, France, and Sweden, with a market cap of SEK25.20 billion.

Operations: Loomis AB (publ) generates revenue from its operations in Europe and Latin America, contributing SEK14.78 billion, and the United States of America, adding SEK15.93 billion.

Dividend Yield: 3.7%

Loomis's dividend payments have been inconsistent over the past decade, with a payout ratio of 53.4% and cash payout ratio of 30.4%, indicating coverage by earnings and cash flows despite volatility. Recent buybacks totaling SEK 399.23 million might support shareholder value, while Q3 sales reached SEK 7.64 billion with net income at SEK 528 million, reflecting steady financial performance amidst sustainability-linked bond issuance aimed at reducing emissions by 2027.

- Click to explore a detailed breakdown of our findings in Loomis' dividend report.

- In light of our recent valuation report, it seems possible that Loomis is trading behind its estimated value.

Where To Now?

- Click through to start exploring the rest of the 212 Top European Dividend Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zignago Vetro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ZV

Zignago Vetro

Produces, markets, and sells hollow glass containers in Italy, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026