- Sweden

- /

- Commercial Services

- /

- OM:ITAB

A Piece Of The Puzzle Missing From ITAB Shop Concept AB (publ)'s (STO:ITAB) 26% Share Price Climb

ITAB Shop Concept AB (publ) (STO:ITAB) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

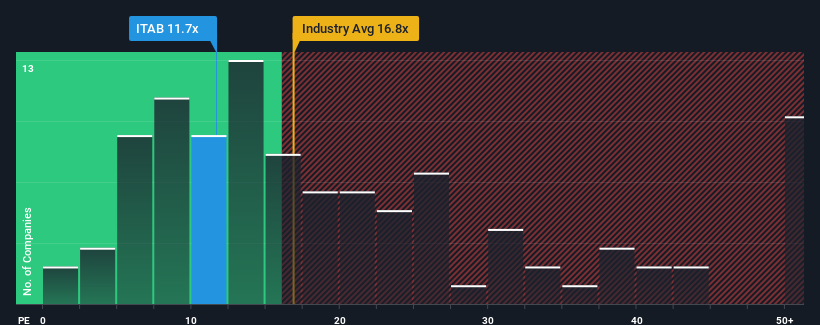

Although its price has surged higher, ITAB Shop Concept may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.7x, since almost half of all companies in Sweden have P/E ratios greater than 23x and even P/E's higher than 40x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, ITAB Shop Concept has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for ITAB Shop Concept

Does Growth Match The Low P/E?

In order to justify its P/E ratio, ITAB Shop Concept would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 29% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 23% growth forecast for the broader market.

With this information, we find it odd that ITAB Shop Concept is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From ITAB Shop Concept's P/E?

Despite ITAB Shop Concept's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of ITAB Shop Concept's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - ITAB Shop Concept has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on ITAB Shop Concept, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives