Volvo (OM:VOLV B): Margin Decline Counters Bullish Valuation Narrative as Net Margins Fall to 7.6%

Reviewed by Simply Wall St

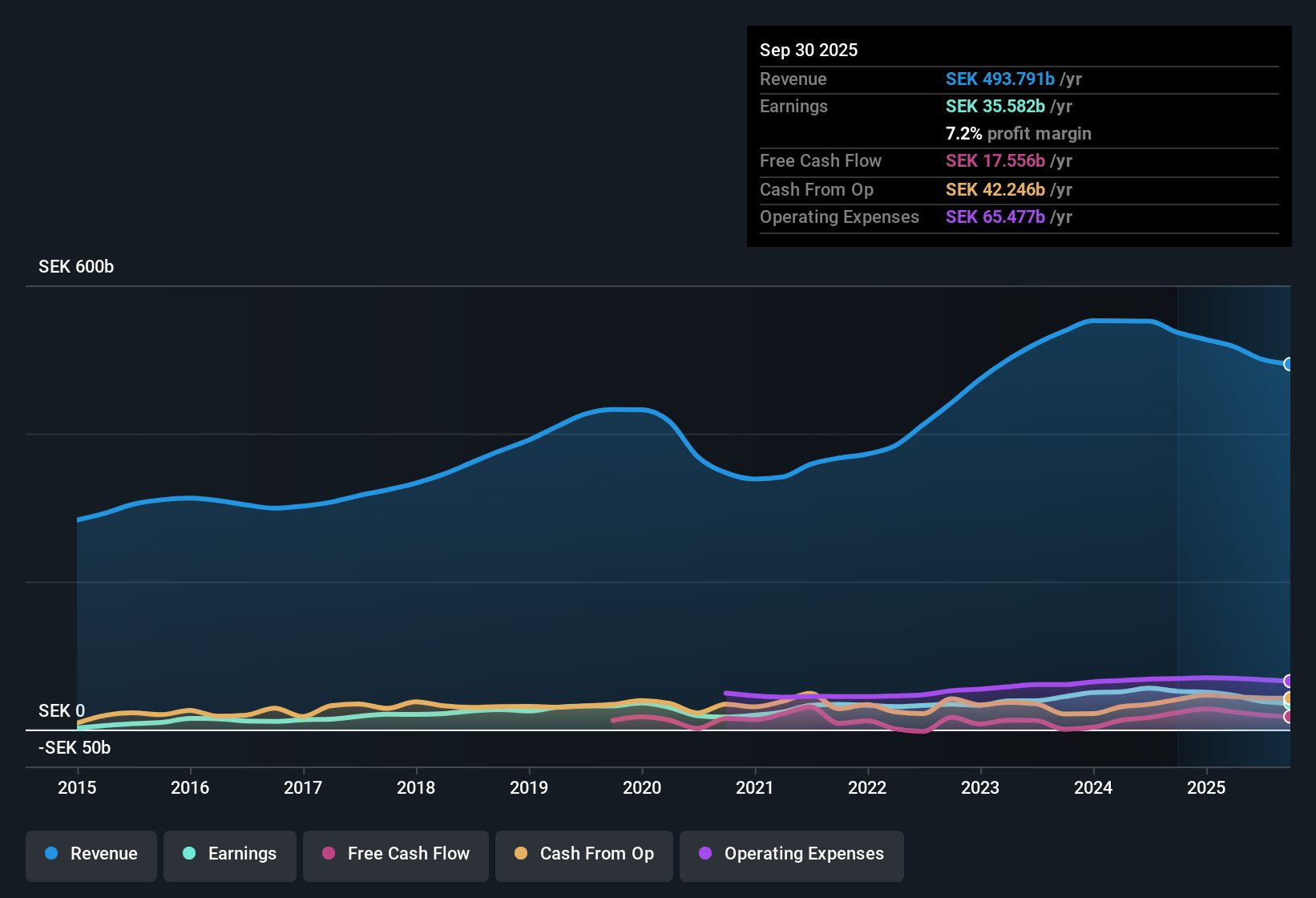

AB Volvo (OM:VOLV B) delivered annual earnings growth of 17.7% over the last five years. Forecasts point to a continued, but slower, pace of 10.56% per year ahead. Revenue is expected to rise 3.4% annually, edging past the Swedish market average, even as profit margins narrowed from 10.1% to 7.6% in the most recent period. With VOLV B trading at SEK 247.4, below its estimated fair value and carrying a price-to-earnings ratio of 13.2x compared to the industry’s higher averages, investors are weighing mixed signals of robust growth and undervaluation against tightening profitability.

See our full analysis for AB Volvo.The next step is to see how these headline results stack up against the prevailing narratives. Some long-held assumptions may be reinforced, while others could be up for debate.

See what the community is saying about AB Volvo

Margins Expected to Rebound to 9.6%

- Analysts forecast profit margins will climb from 7.6% today up to 9.6% in three years, reversing the recent drop from last year's 10.1% and suggesting medium-term operating improvement is possible.

- According to the analysts' consensus view, margin expansion is driven by portfolio optimization and a strategic focus on higher-value services and aftermarket streams.

- Ongoing digitalization and new service platforms are highlighted as supporting long-term earnings stability even as market cycles fluctuate.

- The shift to recurring revenue, including connected vehicle and fleet management services, is expected to improve overall business quality and offset some cyclical pressures in truck sales.

- Consensus narrative links the push for margin growth to investments in digitalization and service businesses, suggesting profitability may become smoother as these efforts mature.

📊 Read the full AB Volvo Consensus Narrative.

Valuation: 37% Discount to DCF Fair Value

- VOLV B shares trade at SEK 247.4, which is 37% below the DCF fair value estimate of SEK 390.86 and 17% below the peer group's average price-to-earnings ratio, highlighting the company's value positioning within the sector.

- Consensus narrative points to the company's low multiples, with a 13.2x PE versus the Swedish Machinery industry’s 23.1x, as a mark of attractive relative value. It is also noted that the current share price sits 16% under the analyst price target of SEK 298.41.

- Bulls see this discount as an opportunity, especially if Volvo delivers on projected earnings and margin growth.

- Cautious investors note that with only a modest premium to analyst price target, the market may already be anticipating some of these improvements.

Risks: Electrification and Currency Volatility Weigh on Outlook

- A SEK 4.5 billion impairment related to slower-than-expected zero-emission vehicle adoption highlights electrification challenges. Management has also cited currency fluctuations, especially the Swedish krona, as a recurring drag on operating income and reported sales.

- Consensus narrative contends that while Volvo’s early push into electric trucks and construction equipment may fuel future growth, ongoing trade barriers, FX pressures, and divestments in China add complexity to sustaining topline growth and margin improvement.

- Execution risk remains if societal transition to zero-emission vehicles lags, which could prompt additional one-off costs and R&D expenses.

- Increased competition in China and portfolio adjustments may constrain longer-term revenue opportunities, testing the durability of Volvo’s global growth ambitions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AB Volvo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? It only takes a few minutes to craft your own perspective and share it with the community. Do it your way

A great starting point for your AB Volvo research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Tighter profit margins and ongoing volatility from currency swings and electrification challenges cast doubt on the consistency of AB Volvo’s longer-term earnings growth.

If you’re looking for companies that consistently deliver steady results, check out stable growth stocks screener (2084 results) to find stocks with reliable earnings expansion even as markets shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLV B

AB Volvo

Manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Europe, the United States, Asia, Africa, and Oceania.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives