How Investors May Respond To AB Volvo (OM:VOLV B) Q3 Earnings Decline and Alternative Fuel JV Progress

Reviewed by Sasha Jovanovic

- AB Volvo reported third quarter and nine-month results for 2025, showing sales of SEK104.12 billion and net income of SEK7.54 billion for Q3, both down from the previous year, alongside earnings per share declines for the periods compared.

- Separately, Westport Fuel Systems announced that Cespira, its joint venture with Volvo Group, secured a contract to supply HPDI component sets for a major truck trial with a leading OEM, advancing industry validation for alternative fuel technologies.

- Given the recent declines in both sales and net income, we’ll explore how these results may affect Volvo's investment thesis and future outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

AB Volvo Investment Narrative Recap

To be a shareholder in AB Volvo, you must believe in its ability to lead the global transition toward next-generation trucks and construction equipment, powered by advances in electrification, digitalization, and new revenue streams from connected services. While the third quarter's earnings decline weighs on sentiment, this event does not materially alter Volvo's most important near-term catalyst: accelerating adoption of zero-emission vehicles. However, it highlights the risk that persistent market uncertainties could dampen volumes and pressure margins further.

Among Volvo's recent announcements, the new joint venture contract between Cespira and a global OEM to trial HPDI component sets stands out. This supports Volvo's push into alternative fuel technologies and carries potential to reinforce the company’s innovation credentials in sustainable heavy-duty transport, even as the electrification journey remains a long-term process.

Conversely, investors should be aware that persistent weakness in North and South American truck demand, combined with ongoing production adjustments, means Volvo still faces...

Read the full narrative on AB Volvo (it's free!)

AB Volvo's outlook anticipates SEK557.0 billion in revenue and SEK53.6 billion in earnings by 2028. This reflects a 3.7% annual revenue growth rate and a SEK15.5 billion increase in earnings from the current SEK38.1 billion.

Uncover how AB Volvo's forecasts yield a SEK294.88 fair value, a 15% upside to its current price.

Exploring Other Perspectives

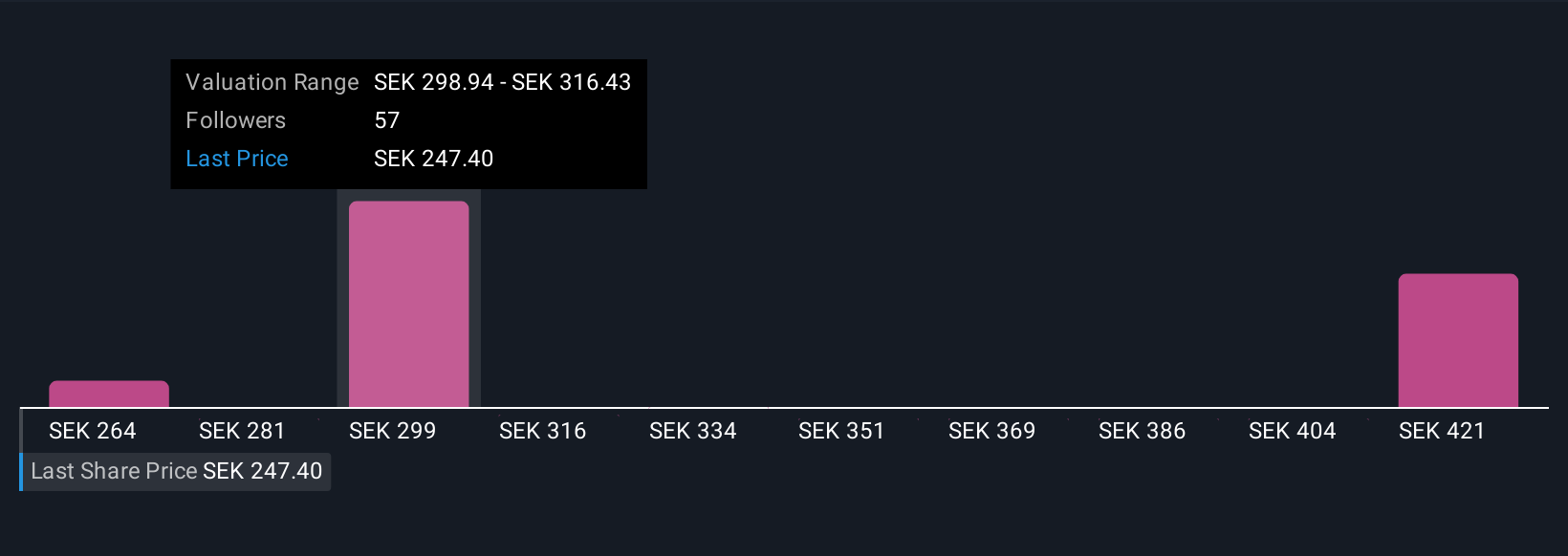

Private investors in the Simply Wall St Community have estimated AB Volvo’s fair value in a wide range from SEK270 to SEK438.80 across nine analyses. While views differ, market cyclicality and uncertain truck demand continue to shape the outlook for Volvo’s next phase of growth; explore these perspectives for a fuller picture.

Explore 9 other fair value estimates on AB Volvo - why the stock might be worth as much as 71% more than the current price!

Build Your Own AB Volvo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AB Volvo research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AB Volvo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AB Volvo's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VOLV B

AB Volvo

Manufactures and sells trucks, buses, construction equipment, and marine and industrial engines in Europe, the United States, Asia, Africa, and Oceania.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives