- Sweden

- /

- Construction

- /

- OM:VESTUM

With EPS Growth And More, Vestum (STO:VESTUM) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Vestum (STO:VESTUM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Vestum with the means to add long-term value to shareholders.

See our latest analysis for Vestum

Vestum's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. Commendations have to be given in seeing that Vestum grew its EPS from kr0.0053 to kr0.39, in one short year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

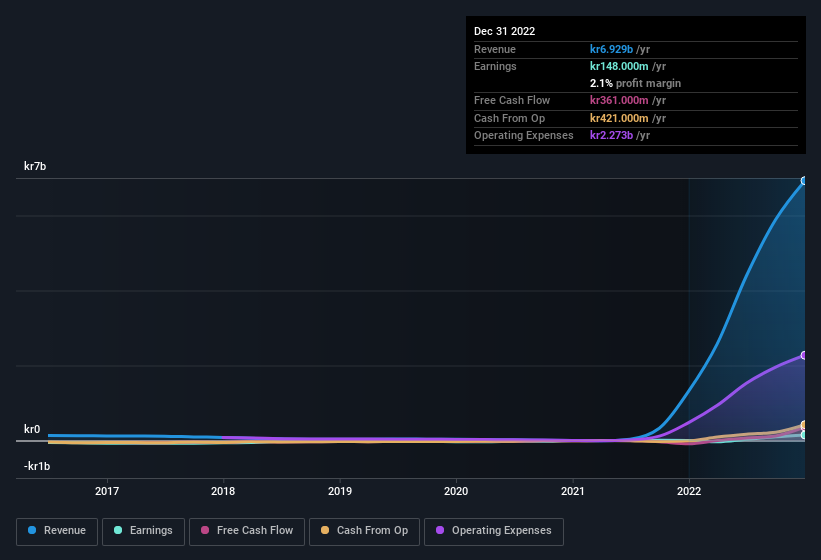

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Vestum maintained stable EBIT margins over the last year, all while growing revenue 427% to kr6.9b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Vestum's future profits.

Are Vestum Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent kr21m buying Vestum shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Per-Arne Ahlgren for kr3.4m worth of shares, at about kr23.07 per share.

On top of the insider buying, we can also see that Vestum insiders own a large chunk of the company. In fact, they own 44% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. In terms of absolute value, insiders have kr2.0b invested in the business, at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Does Vestum Deserve A Spot On Your Watchlist?

Vestum's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Vestum belongs near the top of your watchlist. It is worth noting though that we have found 2 warning signs for Vestum (1 makes us a bit uncomfortable!) that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Vestum, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VESTUM

Vestum

Engages in the infrastructure, water, and service businesses in Sweden and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives