- Sweden

- /

- Construction

- /

- OM:VESTUM

We Ran A Stock Scan For Earnings Growth And Vestum (STO:VESTUM) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vestum (STO:VESTUM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Vestum

How Fast Is Vestum Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It's an outstanding feat for Vestum to have grown EPS from kr0.10 to kr0.49 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

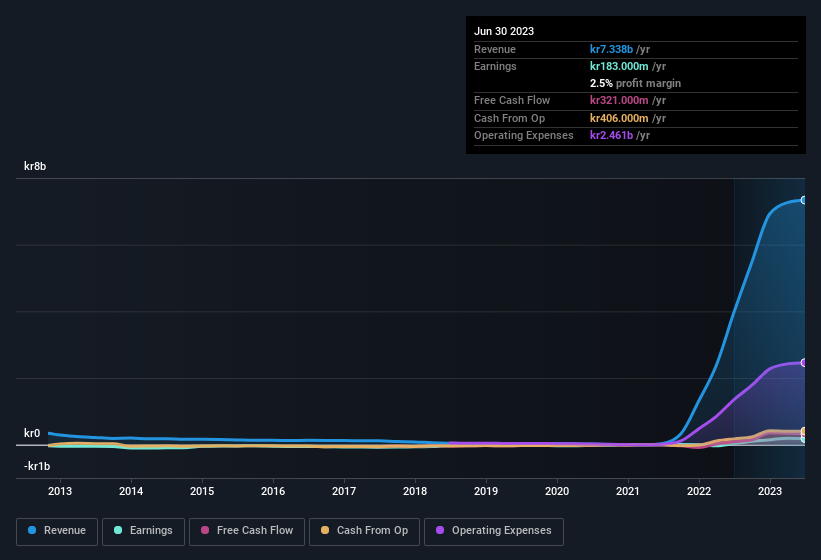

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Vestum remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 84% to kr7.3b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Vestum isn't a huge company, given its market capitalisation of kr1.7b. That makes it extra important to check on its balance sheet strength.

Are Vestum Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that Vestum insiders spent a staggering kr9.1m on acquiring shares in just one year, without single share being sold in the meantime. Knowing this, Vestum will have have all eyes on them in anticipation for the what could happen in the near future. It is also worth noting that it was Independent Chairman of the Board Per-Arne Ahlgren who made the biggest single purchase, worth kr1.2m, paying kr12.63 per share.

On top of the insider buying, we can also see that Vestum insiders own a large chunk of the company. In fact, they own 37% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. To give you an idea, the value of insiders' holdings in the business are valued at kr634m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Vestum Worth Keeping An Eye On?

Vestum's earnings per share have been soaring, with growth rates sky high. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Vestum belongs near the top of your watchlist. You still need to take note of risks, for example - Vestum has 2 warning signs (and 1 which can't be ignored) we think you should know about.

Keen growth investors love to see insider buying. Thankfully, Vestum isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:VESTUM

Vestum

Engages in the infrastructure, water, and service businesses in Sweden and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives