VBG Group (OM:VBG B) Margin Decline Challenges Historical Growth Narrative

Reviewed by Simply Wall St

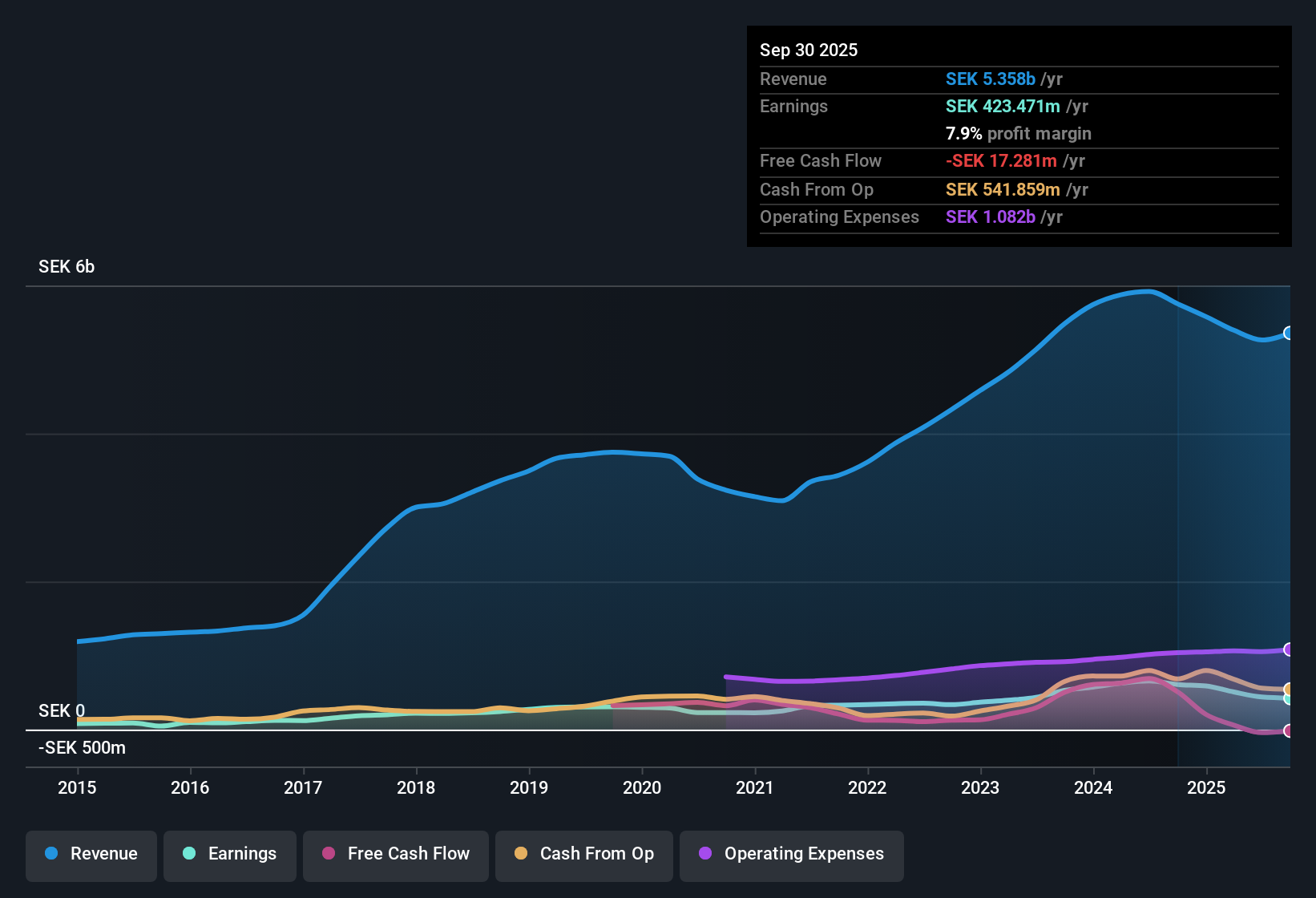

VBG Group (OM:VBG B) reported a net profit margin of 7.9%, down from 10.6% a year ago, diverging from its strong five-year earnings growth trend of 16.3% per year. Despite the recent dip, earnings are forecast to climb 17.4% annually and revenue is expected to grow at 6.8% per year, both outpacing Swedish market averages. With attractive valuation metrics and earnings momentum projected to pick up, investors have reason to focus on the growth outlook. However, recent margin compression and a minor dividend sustainability risk remain on the radar.

See our full analysis for VBG Group.Now, let’s see how these numbers match up against the market’s prevailing narratives, as some storylines might be reinforced while others could be left open for debate.

See what the community is saying about VBG Group

Gross Margins Stay Above 32% Despite FX Headwinds

- VBG Group managed to keep gross margins above 32%, even as a stronger Swedish krona and adverse foreign exchange rates pressured reported revenues and EBITA margins.

- Consensus narrative notes that operational resilience and strong pricing power are supporting profit margins. The company is diversifying geographically through recent acquisitions and is prepared to benefit from global demand for efficient transport solutions.

- Sustained margins and pricing support suggest that margin rebound is possible as volume and acquisition integration improve.

- However, the narrative flags that heavy reliance on traditional products and ongoing FX headwinds could limit short-term earnings momentum and require adaptation as electrification accelerates in key markets.

Analysts say margin performance and expansion efforts drive future resilience, but new entrants and shifting demand keep the consensus narrative in debate. 📊 Read the full VBG Group Consensus Narrative.

7.7% Annual Sales Growth Expected Through Acquisitions

- Analysts expect VBG Group's annual revenue to grow by 7.7% over the next three years, mainly reflecting recent acquisitions like Ledson, Malmedie, and Italytec, along with the completed North American destocking cycle due to improved order intake.

- According to the consensus narrative, acquisition-driven diversification boosts top-line growth assumptions, but challenges remain as slow integration and rising compliance costs threaten to offset synergy benefits.

- The projected growth performance is noteworthy since it outpaces the broader Swedish market’s 3.8% forecast.

- Still, execution risk from complex integration may moderate the pace and sustainability of future expansion if cost controls slip.

Valuation: 58% Discount to DCF Fair Value

- At SEK 361, VBG Group trades at a 58% discount to its DCF fair value of SEK 862.41 and below the industry average price-to-earnings ratio (21.3x versus the sector’s 24.4x), supporting the idea of good relative value for investors.

- Consensus narrative suggests that for the current price to close the gap with the SEK 425.0 analyst target, investors need to believe strong future growth, profit margin expansion, and sustained integration wins will be achieved.

- This valuation could invite attention if growth materializes as forecast and sector multiples hold up.

- However, downside exists if FX headwinds, rising costs, or lagging integration erode those expected margins before they are realized.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for VBG Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? You can quickly shape your perspective into a personal narrative in just a few minutes. Do it your way

A great starting point for your VBG Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

VBG Group faces short-term earnings uncertainty as margin compression, FX pressures, and integration challenges may limit the pace and consistency of its growth.

If you want to target more predictable growth, check out stable growth stocks screener (2119 results) to focus on companies delivering steadier performance regardless of market shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, the United States, rest of North America, Brazil, Australia, New Zealand, China, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)