Swedish Undiscovered Gems Featuring engcon And Two Promising Small Caps

Reviewed by Simply Wall St

As global markets experience heightened volatility and mixed economic signals, investors are increasingly turning their attention to small-cap stocks for potential growth opportunities. In this dynamic environment, Sweden offers a fertile ground for undiscovered gems, including engcon and two other promising small-cap companies. Identifying strong stocks in such conditions often involves looking at innovative business models, solid financial health, and the ability to navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 9.47% | 15.07% | ★★★★★★ |

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.31% | 29.94% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Rederiaktiebolaget Gotland | NA | -14.29% | 18.06% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Karnell Group | 44.29% | 22.04% | 39.45% | ★★★★★☆ |

We'll examine a selection from our screener results.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) engages in the design, production, and sale of excavator tools globally and has a market cap of SEK15.91 billion.

Operations: The company generates revenue primarily from the Construction Machinery & Equipment segment, which reported SEK 1.54 billion. The net profit margin for the latest period is notable at 15%.

Earnings for engcon have faced a challenging year, with net income dropping to SEK 55 million in Q2 2024 from SEK 83 million last year. Sales also fell to SEK 450 million from SEK 508 million. The company's debt situation is satisfactory with an 8.5% net debt to equity ratio, and interest payments are well covered by EBIT at a multiple of 20.4x. Despite high-quality earnings, profit margins dipped from last year's 18% to the current 9.9%.

- Click here and access our complete health analysis report to understand the dynamics of engcon.

Examine engcon's past performance report to understand how it has performed in the past.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products across Sweden, Norway, the rest of Europe, and the United States, with a market cap of SEK3.21 billion.

Operations: Haypp Group generates revenue primarily from the sale of tobacco-free nicotine pouches and snus products. The company's market cap stands at SEK3.21 billion.

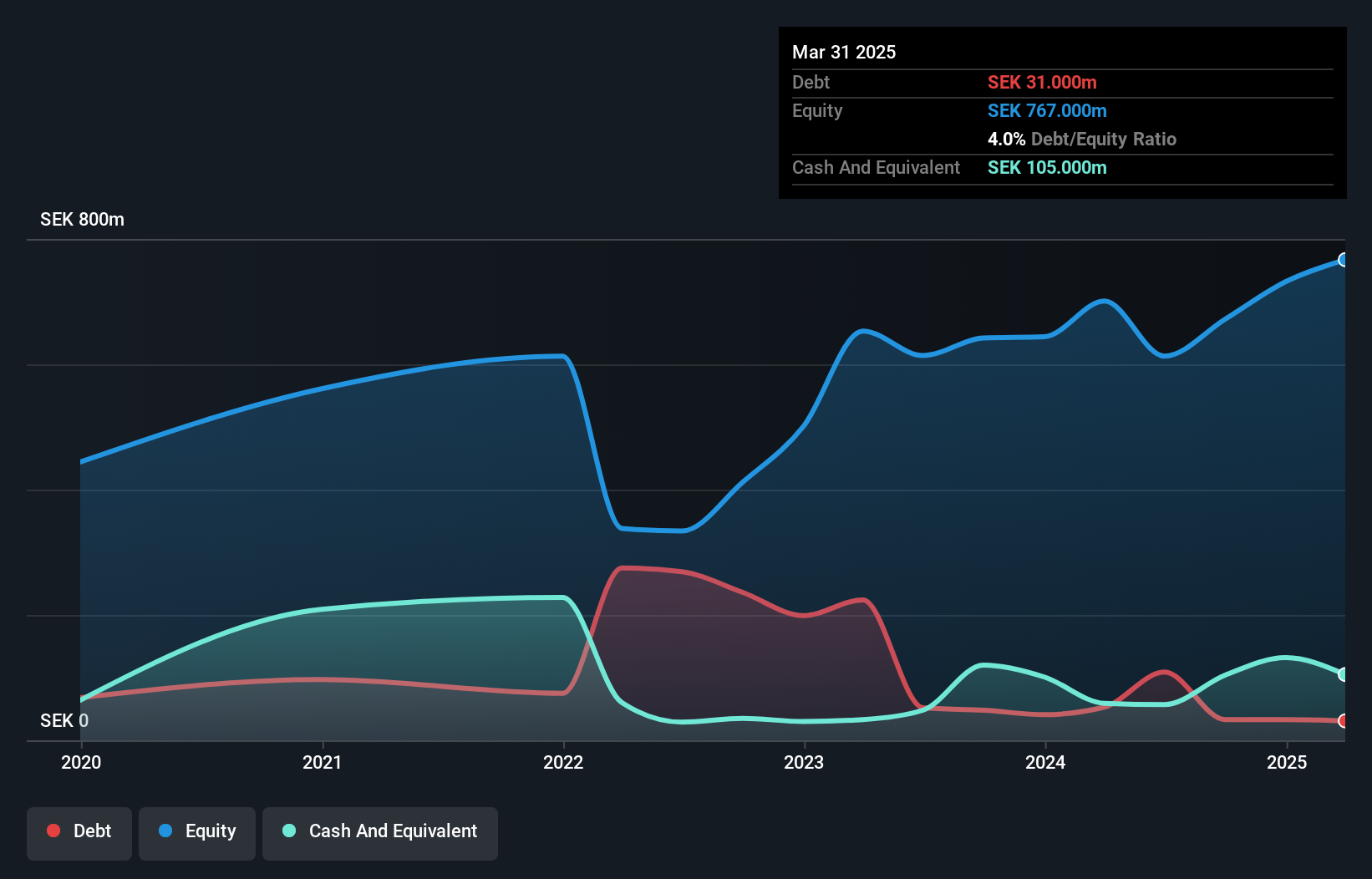

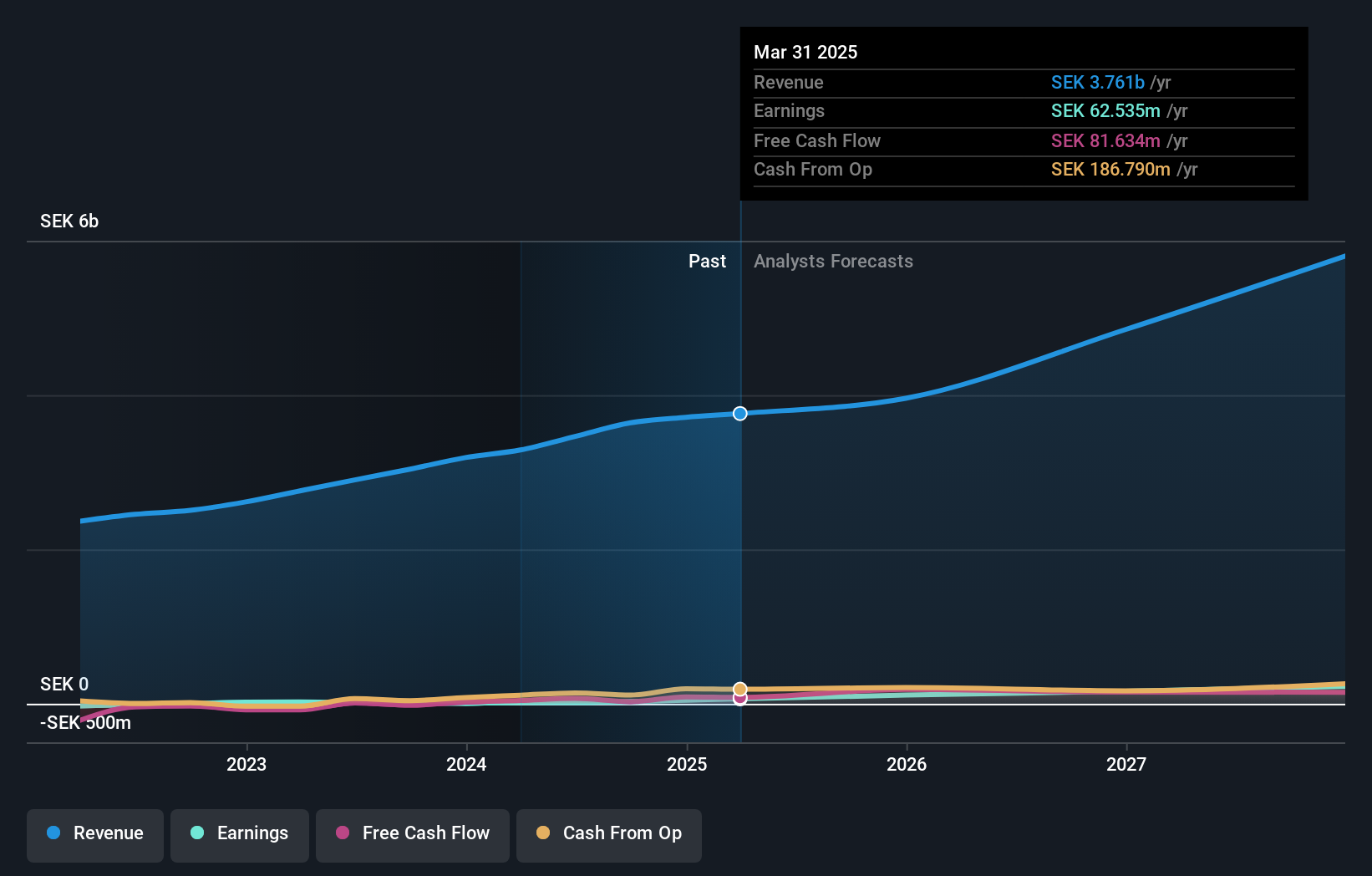

Haypp Group has demonstrated robust earnings growth, with a 20.5% increase over the past year, surpassing the Specialty Retail industry’s 12.4%. Trading at 81.8% below its estimated fair value, it presents a compelling valuation. The company reported SEK 950 million in sales for Q2 2024 compared to SEK 774 million last year and net income of SEK 0.031 million versus SEK 0.44 million previously. Its debt-to-equity ratio improved significantly from 33.1% to just 6.3% over five years, highlighting strong financial management.

- Get an in-depth perspective on Haypp Group's performance by reading our health report here.

Review our historical performance report to gain insights into Haypp Group's's past performance.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★★★★

Overview: VBG Group AB (publ) is a company that develops, manufactures, markets, and sells various industrial products globally with a market cap of approximately SEK10.54 billion.

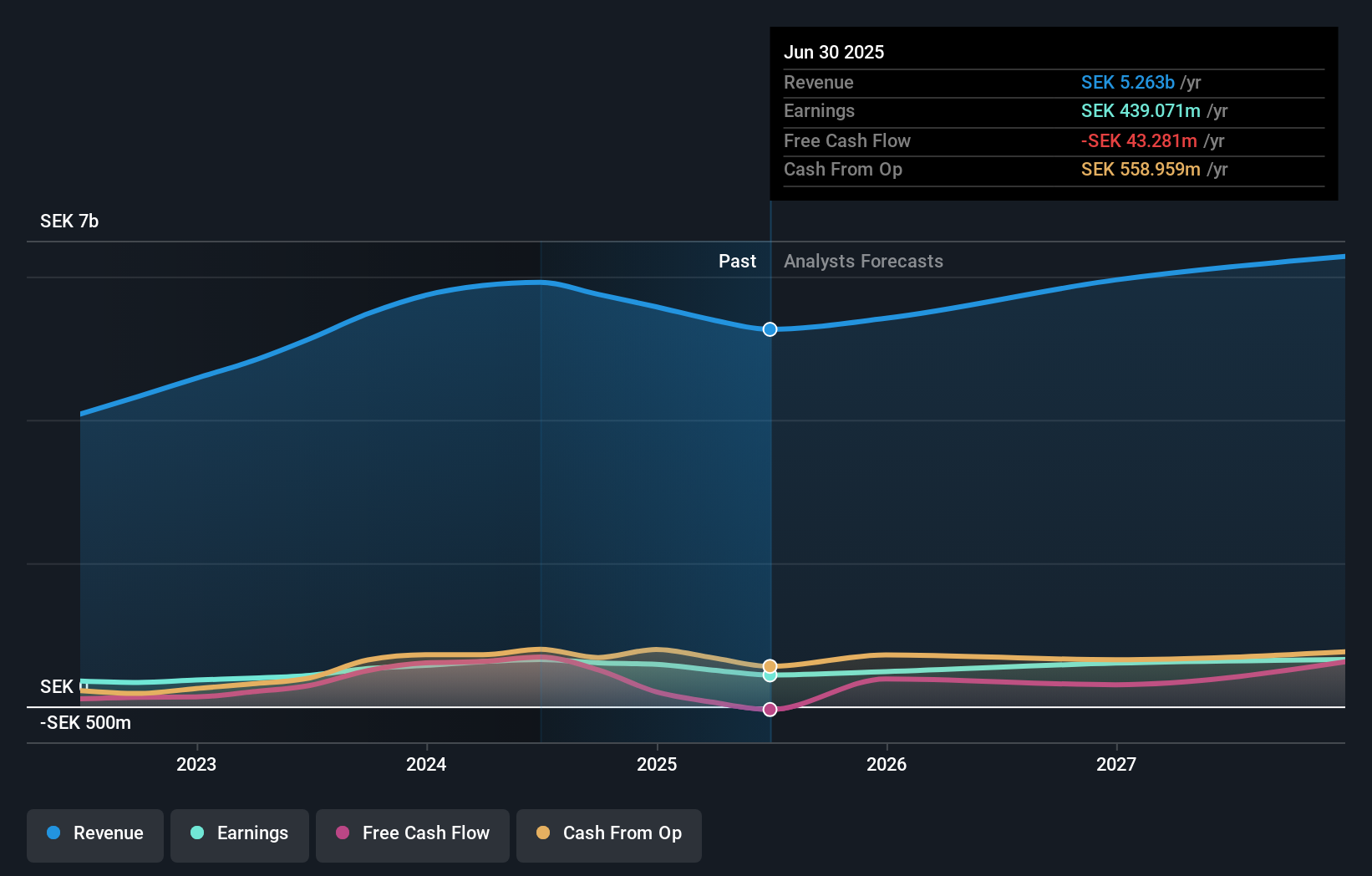

Operations: The company generates revenue primarily from three segments: Mobile Thermal Solutions (SEK3.33 billion), Truck & Trailer Equipment (SEK1.62 billion), and RINGFEDER Power Transmission (SEK962.30 million).

VBG Group, a notable player in the machinery industry, has shown impressive financial health and growth. Its earnings surged by 50.3% last year, outpacing the industry average of 0.9%. The company trades at a favorable P/E ratio of 16.2x compared to the Swedish market's 22.9x and boasts high-quality earnings with EBIT covering interest payments 31 times over. Recent expansions include a CAD 108 million investment in consolidating its Toronto operations into one facility, aiming for efficiency gains and market growth.

- Dive into the specifics of VBG Group here with our thorough health report.

Evaluate VBG Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Swedish Undiscovered Gems With Strong Fundamentals screener has unearthed 51 more companies for you to explore.Click here to unveil our expertly curated list of 54 Swedish Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, the United States, rest of North America, Brazil, Australia, New Zealand, China, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives