Exploring 3 Top Undervalued Small Caps With Recent Insider Buying

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyed by optimism surrounding potential trade deals and a surge in AI-related investments, with major indices like the S&P 500 reaching record highs. However, large-cap stocks have generally outperformed their smaller-cap counterparts, highlighting an opportunity for investors to explore potentially undervalued small-cap stocks that may benefit from insider buying trends. Identifying such opportunities often involves assessing a company's growth potential and market position amidst evolving economic conditions.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 20.9x | 5.3x | 29.00% | ★★★★★★ |

| Maharashtra Seamless | 9.3x | 1.6x | 41.41% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 35.08% | ★★★★★☆ |

| East West Banking | 3.2x | 0.7x | 33.14% | ★★★★★☆ |

| THG | NA | 0.3x | 27.19% | ★★★★★☆ |

| Gamma Communications | 22.3x | 2.3x | 38.98% | ★★★★☆☆ |

| Paradeep Phosphates | 25.1x | 0.8x | 26.08% | ★★★★☆☆ |

| PSC | 7.8x | 0.4x | 42.07% | ★★★★☆☆ |

| Logistri Fastighets | 12.4x | 8.8x | 41.37% | ★★★★☆☆ |

| Yixin Group | 7.2x | 0.7x | -2614.11% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

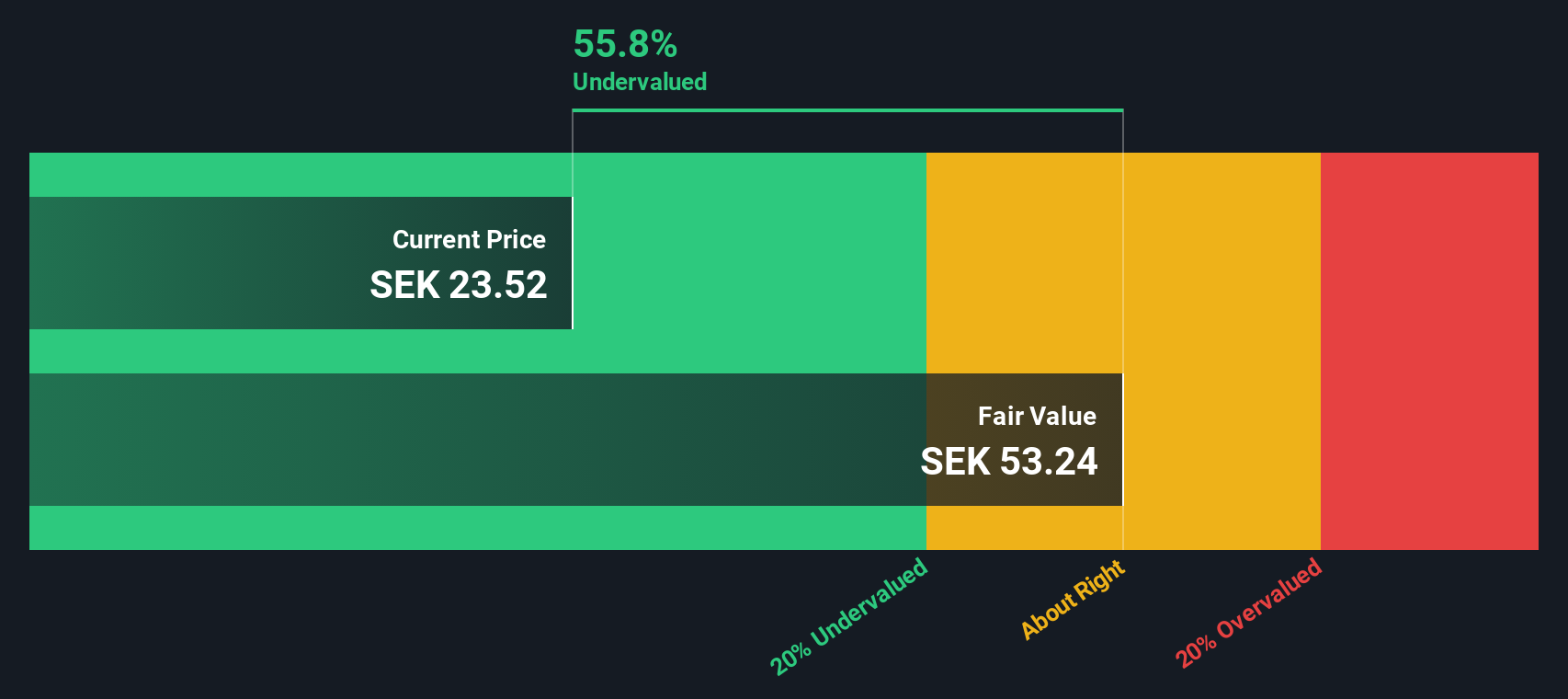

BHG Group (OM:BHG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BHG Group is a company engaged in the e-commerce and retail sectors, focusing on home improvement and living products, with a market capitalization of approximately SEK 2.72 billion.

Operations: BHG Group's revenue streams are primarily derived from its Value Home, Premium Living, and Home Improvement segments, with the Home Improvement segment generating the highest revenue at SEK 5.16 billion. The company's gross profit margin has shown fluctuations over recent periods, with a notable increase to 18.81% as of September 2023 before declining to 16.48% by January 2025.

PE: -9.7x

BHG, a company with external borrowing as its sole funding source, is experiencing insider confidence through recent share purchases. Despite reporting a net loss of SEK 441.7 million for Q4 2024, the company anticipates earnings growth of 107% annually. Recent leadership changes see Johan Engström taking charge of the Value Home business area, potentially steering BHG towards improved performance. While challenges persist, these strategic shifts and expected growth highlight potential opportunities in this smaller market segment.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: VBG Group is a diversified industrial company that operates through its Mobile Thermal Solutions, Truck & Trailer Equipment, and RINGFEDER Power Transmission segments, with a market capitalization of approximately SEK 9.12 billion.

Operations: The company generates revenue primarily from Mobile Thermal Solutions, Truck & Trailer Equipment, and RINGFEDER Power Transmission. Over recent periods, the net income margin has shown an upward trend, reaching 11.01% by June 2024. Operating expenses have been a significant component of costs, with Sales & Marketing and General & Administrative expenses being notable contributors.

PE: 12.8x

VBG Group, a smaller company in the automotive sector, is navigating its financial landscape with all liabilities sourced from external borrowing. Despite this riskier funding approach, earnings are projected to grow at 2.29% annually. Insider confidence is evident as insiders have increased their share purchases over recent months. The appointment of Ola Hermansson as Division CEO for Truck & Trailer Equipment brings seasoned leadership and could enhance strategic growth initiatives across global markets.

- Delve into the full analysis valuation report here for a deeper understanding of VBG Group.

Explore historical data to track VBG Group's performance over time in our Past section.

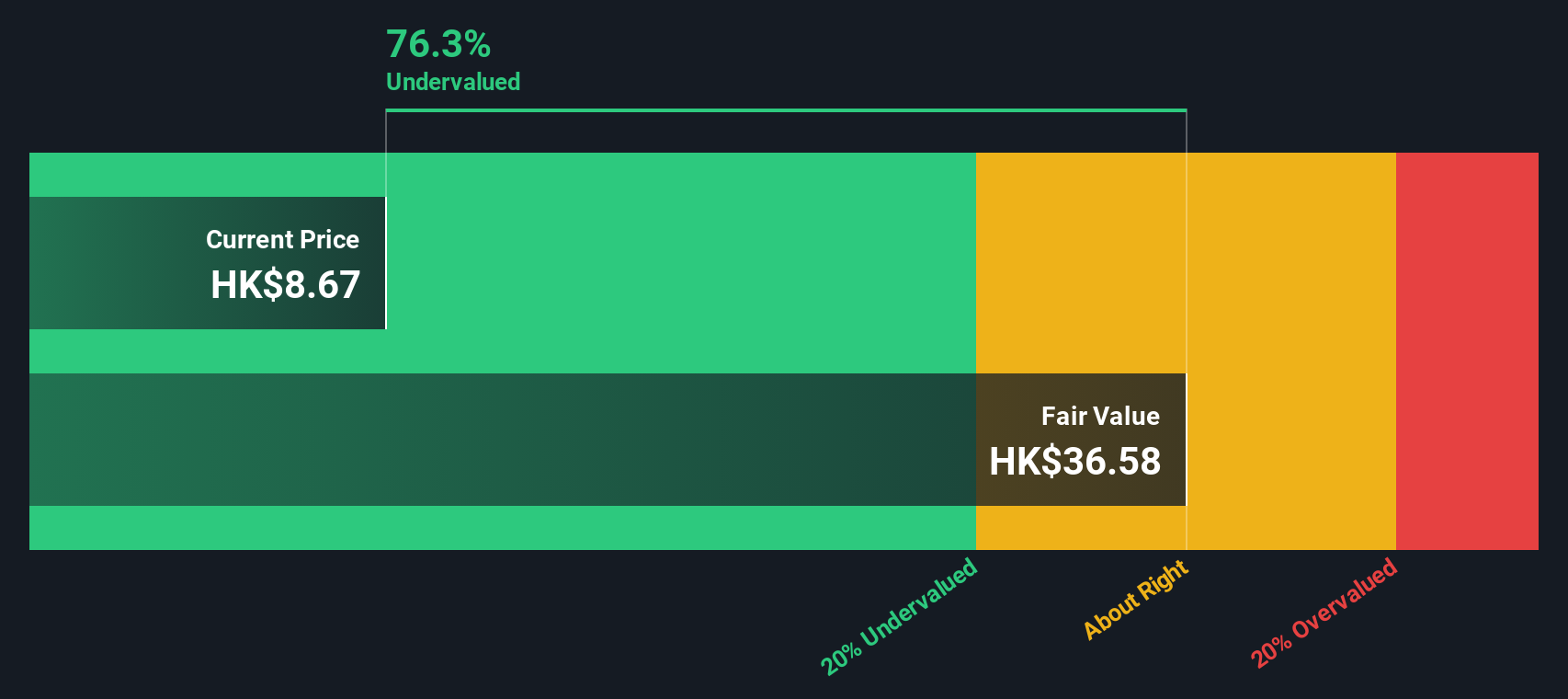

Wasion Holdings (SEHK:3393)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wasion Holdings operates in the advanced metering infrastructure sector, focusing on power, communication, and fluid metering solutions with a market cap of CN¥1.5 billion.

Operations: The company's revenue streams are primarily from Advanced Distribution Operations, Power Advanced Metering Infrastructure, and Communication and Fluid Advanced Metering Infrastructure. Over the periods analyzed, gross profit margin showed a notable trend of fluctuating between 35.08% and 28.51%, with recent figures indicating an upward trajectory to 35.17%. Operating expenses have consistently been a significant cost component, including substantial allocations for sales & marketing and R&D expenses.

PE: 11.1x

Wasion Holdings, a small company, is drawing attention due to insider confidence shown by Founder & Executive Chairman Wei Ji's purchase of 1 million shares for approximately CNY 5.1 million in January 2025. This move signifies potential belief in the company's prospects despite reliance on external borrowing as its sole funding source, which carries inherent risk. With earnings projected to grow annually by over 22%, Wasion presents an intriguing opportunity within its industry landscape.

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this valuation report.

Evaluate Wasion Holdings' historical performance by accessing our past performance report.

Summing It All Up

- Delve into our full catalog of 180 Undervalued Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VBG B

VBG Group

Develops, manufactures, markets, and sells various industrial products in Sweden, Germany, rest of the Nordic countries and Europe, the United States, rest of North America, Brazil, Australia, New Zealand, China, and internationally.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)