The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Teqnion (STO:TEQ), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Our analysis indicates that TEQ is potentially overvalued!

Teqnion's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, Teqnion has achieved impressive annual EPS growth of 58%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

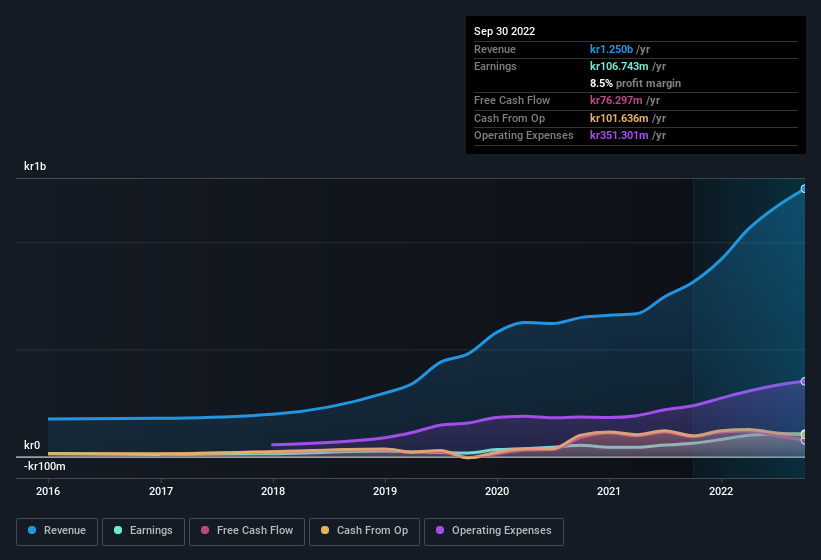

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Teqnion achieved similar EBIT margins to last year, revenue grew by a solid 54% to kr1.3b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Teqnion is no giant, with a market capitalisation of kr1.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Teqnion Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

A great takeaway for shareholders is that company insiders within Teqnion have collectively spent kr440k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling. We also note that it was the company insider, Susanna Helgesen, who made the biggest single acquisition, paying kr257k for shares at about kr135 each.

On top of the insider buying, it's good to see that Teqnion insiders have a valuable investment in the business. Indeed, they hold kr363m worth of its stock. This considerable investment should help drive long-term value in the business. Those holdings account for over 20% of the company; visible skin in the game.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Teqnion's CEO, Johan Steene, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Teqnion, with market caps between kr1.1b and kr4.5b, is around kr5.1m.

Teqnion's CEO took home a total compensation package worth kr2.8m in the year leading up to December 2021. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Teqnion To Your Watchlist?

Teqnion's earnings per share have been soaring, with growth rates sky high. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Teqnion belongs near the top of your watchlist. Still, you should learn about the 1 warning sign we've spotted with Teqnion.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Teqnion, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Teqnion, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Teqnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:TEQ

Teqnion

A diversified industrial company, provides a range of products in selected niche markets.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives