Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Systemair (STO:SYSR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Systemair

How Fast Is Systemair Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Systemair has achieved impressive annual EPS growth of 55%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

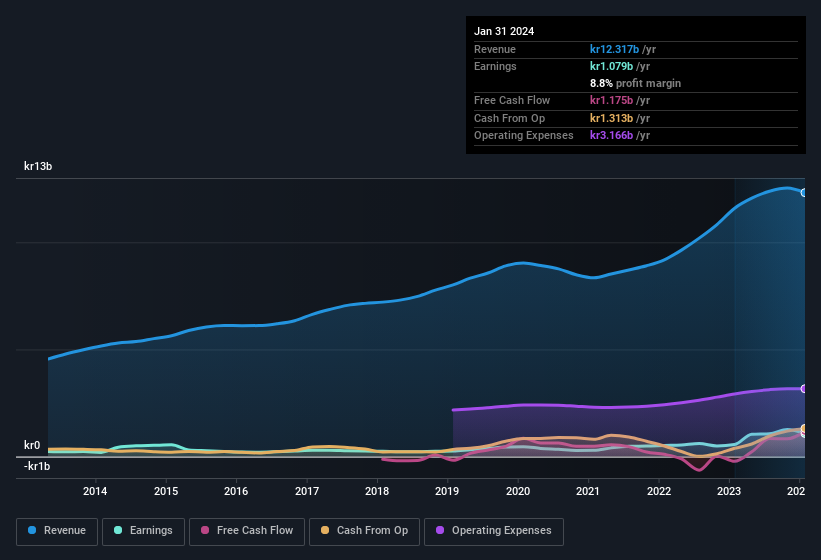

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Systemair maintained stable EBIT margins over the last year, all while growing revenue 6.3% to kr12b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Systemair.

Are Systemair Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's nice to see that there have been no reports of any insiders selling shares in Systemair in the previous 12 months. With that in mind, it's heartening that Lars Nolaker, the Independent Deputy Chairman of the Board of the company, paid kr460k for shares at around kr57.54 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Systemair.

On top of the insider buying, we can also see that Systemair insiders own a large chunk of the company. Actually, with 43% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. This is an incredible endorsement from them.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Systemair's CEO, Roland Kasper, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Systemair with market caps between kr11b and kr35b is about kr8.7m.

Systemair's CEO took home a total compensation package worth kr6.9m in the year leading up to April 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Systemair Deserve A Spot On Your Watchlist?

Systemair's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Systemair belongs near the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Systemair (1 is potentially serious) you should be aware of.

The good news is that Systemair is not the only growth stock with insider buying. Here's a list of growth-focused companies in SE with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SYSR

Systemair

Manufactures and sells of ventilation, heating and cooling products, and systems in Europe, North America, the Middle East, Asia, Australia, and Africa.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026