- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

Undiscovered Gems in Europe Promising Stocks for August 2025

Reviewed by Simply Wall St

As European markets experience a boost, buoyed by optimism around potential U.S. rate cuts and rising business activity, investors are increasingly looking to the region for promising opportunities. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial for those seeking to capitalize on the positive market sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

SP Group (CPSE:SPG)

Simply Wall St Value Rating: ★★★★☆☆

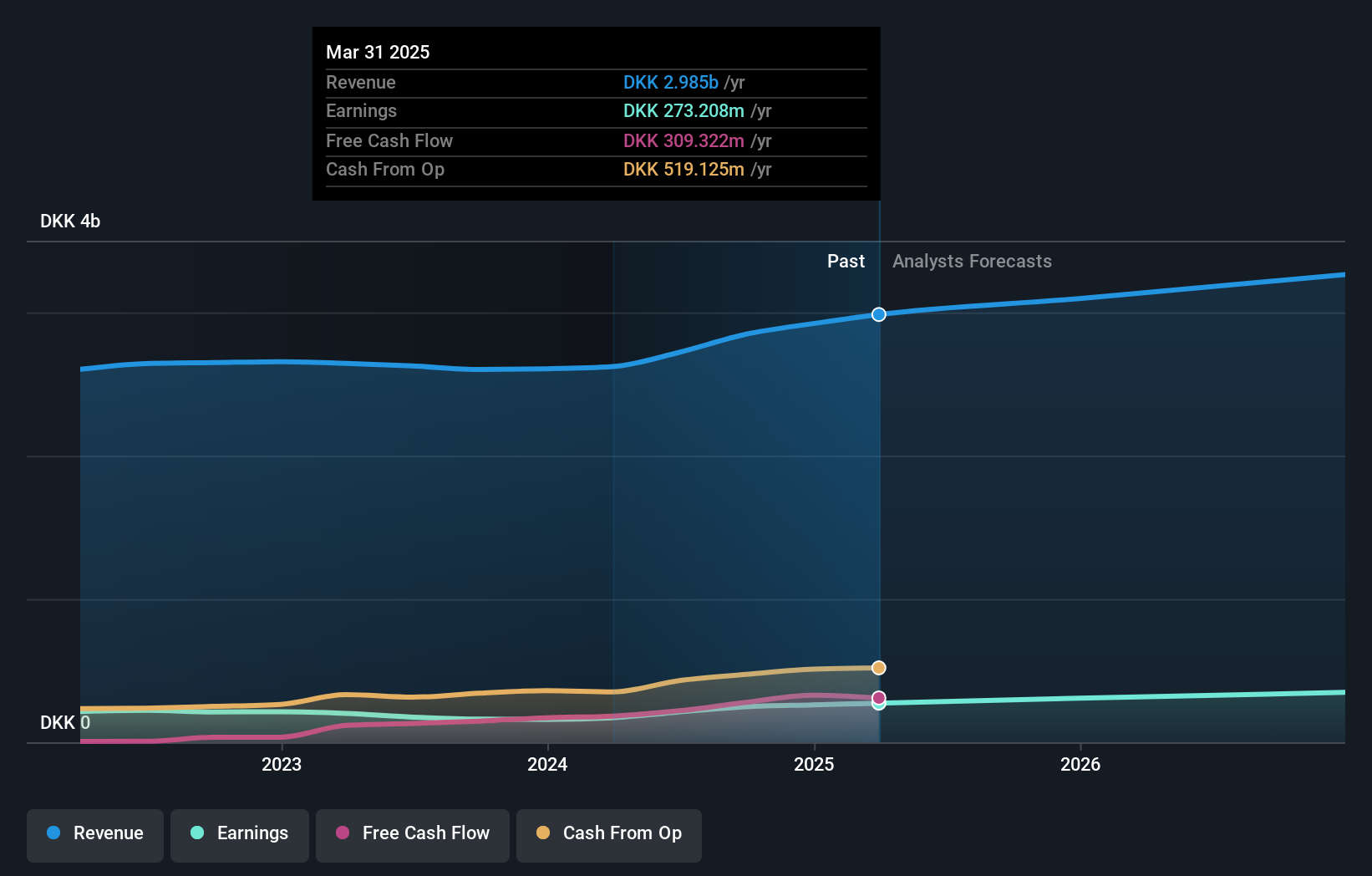

Overview: SP Group A/S, with a market cap of DKK3.25 billion, operates globally through its subsidiaries to manufacture and sell moulded plastic and composite components across various regions including Denmark, Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Operations: SP Group generates revenue primarily from its Plastics & Rubber segment, amounting to DKK2.90 billion.

SP Group, a smaller entity in the chemicals sector, has demonstrated robust earnings growth of 18.7% over the past year, outpacing the industry average of 6%. Currently trading at 54.4% below its estimated fair value, it presents a compelling opportunity relative to peers. Despite high debt levels with a net debt to equity ratio of 52.9%, interest payments are well-covered by EBIT at 6.6x coverage. Recent earnings reveal decreased sales and net income for Q2 and H1 2025 compared to last year, prompting lowered revenue guidance for this year amidst volatile market conditions and evolving consumer preferences towards sustainable alternatives.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★★

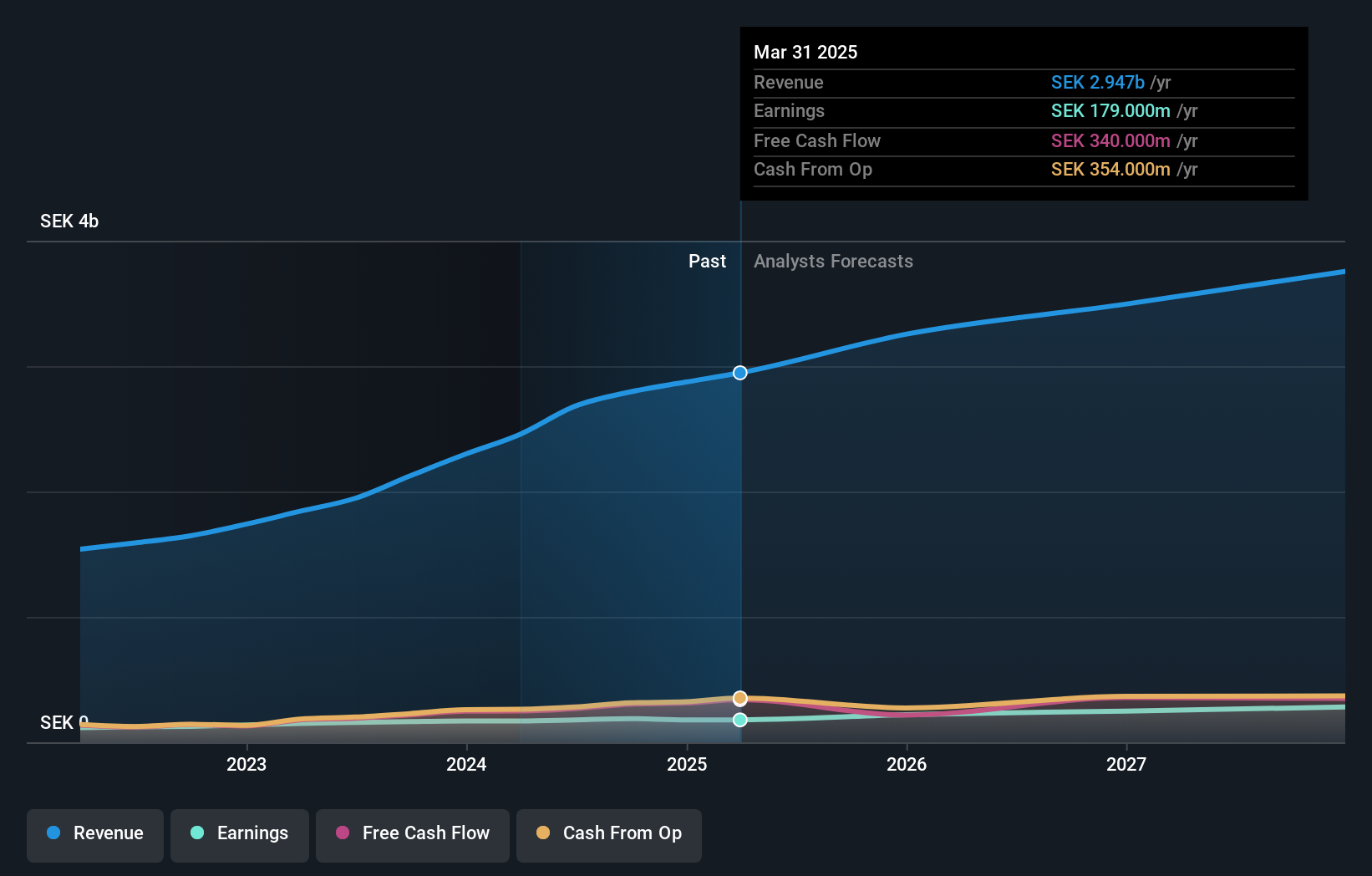

Overview: Momentum Group AB (publ) is a company that provides industrial components and services to the industrial sector across Sweden, Norway, Denmark, Finland, and internationally, with a market cap of SEK7.59 billion.

Operations: Momentum Group generates revenue primarily from its Industry and Infrastructure segments, with SEK1.74 billion and SEK1.29 billion respectively. The company has a net profit margin of 5.6%.

Momentum Group, a nimble player in the European market, leverages its strategic focus on sustainability and efficiency to drive growth. The company reported sales of SEK 1.56 billion for the first half of 2025, up from SEK 1.43 billion last year, while net income slightly decreased to SEK 93 million from SEK 94 million. With a satisfactory net debt to equity ratio of 15.6% and robust cash flow generation (SEK 340 million as of March), it stands resilient against short-term risks despite recent earnings challenges (-1.1%). Analysts forecast revenue growth at an annual rate of 9.7%, with profit margins expected to improve significantly by August 2028, though acquisition reliance remains a concern amidst economic uncertainties.

Svedbergs Group (OM:SVED B)

Simply Wall St Value Rating: ★★★★★★

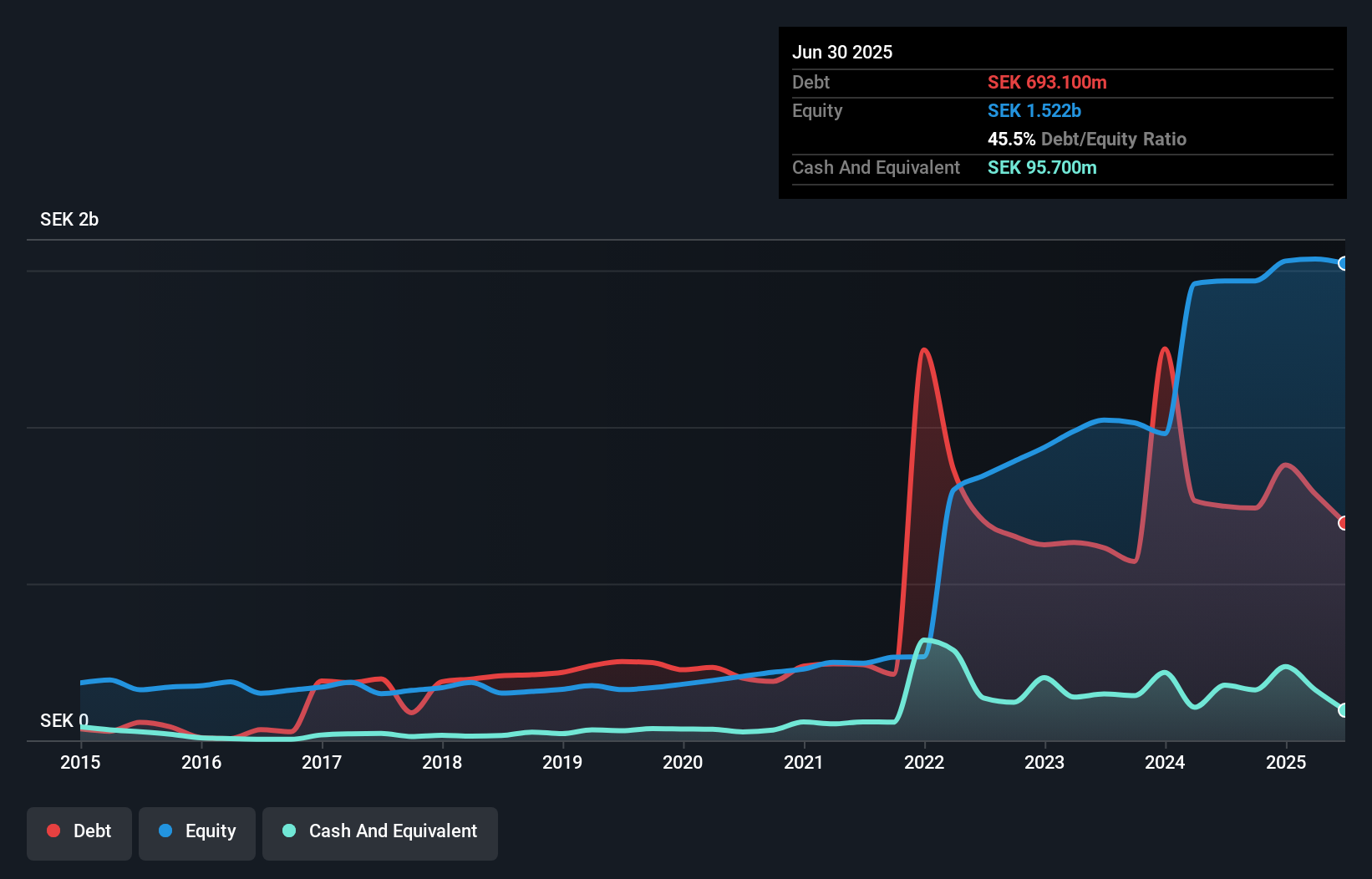

Overview: Svedbergs Group AB (publ) is engaged in the development, manufacturing, and marketing of bathroom products across the Nordic region, the United Kingdom, and the Netherlands with a market capitalization of approximately SEK3.01 billion.

Operations: The group's revenue streams are primarily driven by Roper Rhodes, contributing SEK1.17 billion, followed by Thebalux at SEK413.20 million and Sved-Bergs at SEK393.50 million. Other segments include Macro Design with SEK171.50 million and Cassoe with SEK82.70 million in revenue.

Svedbergs Group, a small player in the European market, is showing promise with its robust earnings growth of 34.6% last year, outpacing the building industry's -2.9%. With a debt to equity ratio reduced from 97.3% to 45.5% over five years and net debt to equity at a satisfactory 39.2%, financial health appears solid. The company trades at an attractive value, estimated at 51.9% below fair value, suggesting potential for investors seeking undervalued opportunities. Recent results highlight this momentum; Q2 sales reached SEK 570 million and net income climbed to SEK 51 million from SEK 40 million year-on-year, reflecting strategic improvements and operational efficiency gains.

- Click here to discover the nuances of Svedbergs Group with our detailed analytical health report.

Review our historical performance report to gain insights into Svedbergs Group's's past performance.

Key Takeaways

- Dive into all 330 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector in Sweden, Norway, Denmark, Finland, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives