Key Takeaways

- Strategic focus on sustainable products, operational efficiency, and disciplined acquisitions strengthens growth prospects and supports margin expansion.

- Exposure to stable aftermarket demand and strong cash flow buffers earnings volatility and minimizes short-term risk concerns.

- Heavy reliance on acquisitions, customer caution, rising costs, and slow digital adaptation threaten profitability and market share despite some revenue growth.

Catalysts

About Momentum Group- Supplies industrial components, industrial services, and related services to the industrial sector in Sweden, Norway, Denmark, Finland, and internationally.

- Growing investment in renovation and energy efficiency upgrades across Europe continues to drive robust demand in Momentum Group's core markets, which-combined with a healthy pace of bolt-on acquisitions-supports expectations for sustained organic and inorganic revenue growth.

- The company's focus on offering sustainable, energy-efficient products and value-added services positions it to benefit from increasing customer and regulatory emphasis on sustainability and green building certifications, likely driving higher-margin revenue streams and margin expansion over the coming years.

- Ongoing optimization of warehouse facilities, including the recent relocation to a modern, automated central warehouse, is expected to lower logistics costs and enhance operational efficiency, contributing positively to operating margins and long-term earnings growth.

- Strong operating cash flow and a disciplined capital allocation strategy underpin the company's ability to sustain a high rate of strategic acquisitions, broadening the product portfolio and geographic reach-critical catalysts for medium-term EPS and revenue growth.

- The company's resilience stemming from exposure to the industrial aftermarket sector-which tends to see steadier demand even during market slowdowns-provides a buffer to earnings volatility and supports stable cash flows, making it likely that market concerns are over-discounting near-term cyclical risk.

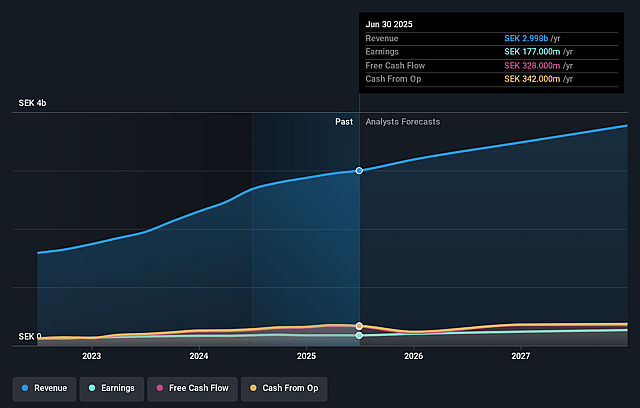

Momentum Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Momentum Group's revenue will grow by 9.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 7.4% in 3 years time.

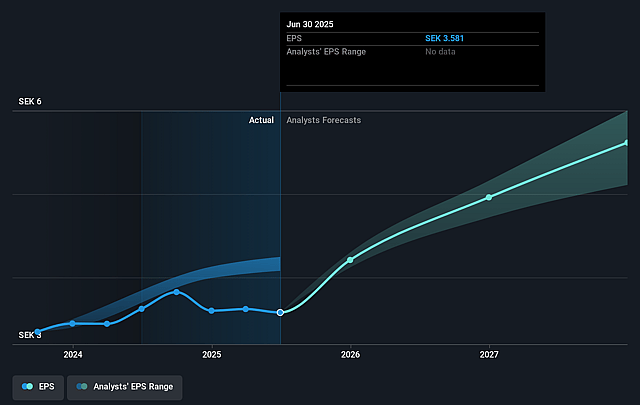

- Analysts expect earnings to reach SEK 293.9 million (and earnings per share of SEK 6.3) by about September 2028, up from SEK 177.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.8x on those 2028 earnings, down from 42.9x today. This future PE is greater than the current PE for the SE Trade Distributors industry at 29.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.04%, as per the Simply Wall St company report.

Momentum Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained customer caution and prolonged decision-making due to global economic and geopolitical uncertainties (tariffs, trade tensions, inflation, and currency volatility) could continue suppressing organic revenue growth, as seen in slightly negative organic growth and cautious customer investment behavior.

- High dependency on acquisitions for growth-evidenced by the majority of revenue and EBITA expansion coming from acquired operations-poses a risk if acquisition opportunities become scarcer, integration becomes challenging, or if acquisition premiums compress margins, potentially impacting future earnings and net margins.

- Margin pressure from increased operating costs (notably higher purchasing, logistics, and wage costs) and seasonal variations in service/project sales, alongside declining EBITA and operating margins in some business areas, may erode profitability even when revenues grow.

- Persistent low capacity utilization in workshop-heavy segments (Technical Solutions), coupled with a trend of customer restraint and service-heavy Q1 seasonality, could become entrenched, dragging on margins, revenue, and operating leverage over the longer term.

- Slowdown in digital innovation or insufficient adaptation to changing customer procurement preferences (e.g., increased demand for digital self-service platforms) risks driving customer attrition to more digitally advanced competitors or direct-to-end-user channels, negatively impacting long-term revenues and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK180.0 for Momentum Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK4.0 billion, earnings will come to SEK293.9 million, and it would be trading on a PE ratio of 35.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of SEK153.6, the analyst price target of SEK180.0 is 14.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.