- Sweden

- /

- Aerospace & Defense

- /

- OM:MILDEF

Swedish Exchange Growth Companies With High Insider Ownership For June 2024

Reviewed by Simply Wall St

As European markets grapple with political uncertainty and fluctuating economic signals, investors are keenly watching for opportunities that offer stability and potential growth. In this context, Swedish growth companies with high insider ownership can be particularly appealing, as significant insider stakes often suggest confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 21.6% |

| BioArctic (OM:BIOA B) | 35.1% | 50.9% |

| Sileon (OM:SILEON) | 33.3% | 109.3% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| InCoax Networks (OM:INCOAX) | 17.9% | 104.9% |

| Calliditas Therapeutics (OM:CALTX) | 11.6% | 52.9% |

| edyoutec (NGM:EDYOU) | 14.6% | 63.1% |

| Egetis Therapeutics (OM:EGTX) | 17.6% | 98.2% |

| Yubico (OM:YUBICO) | 37.5% | 43.4% |

| SaveLend Group (OM:YIELD) | 24.9% | 103.4% |

We'll examine a selection from our screener results.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★☆☆

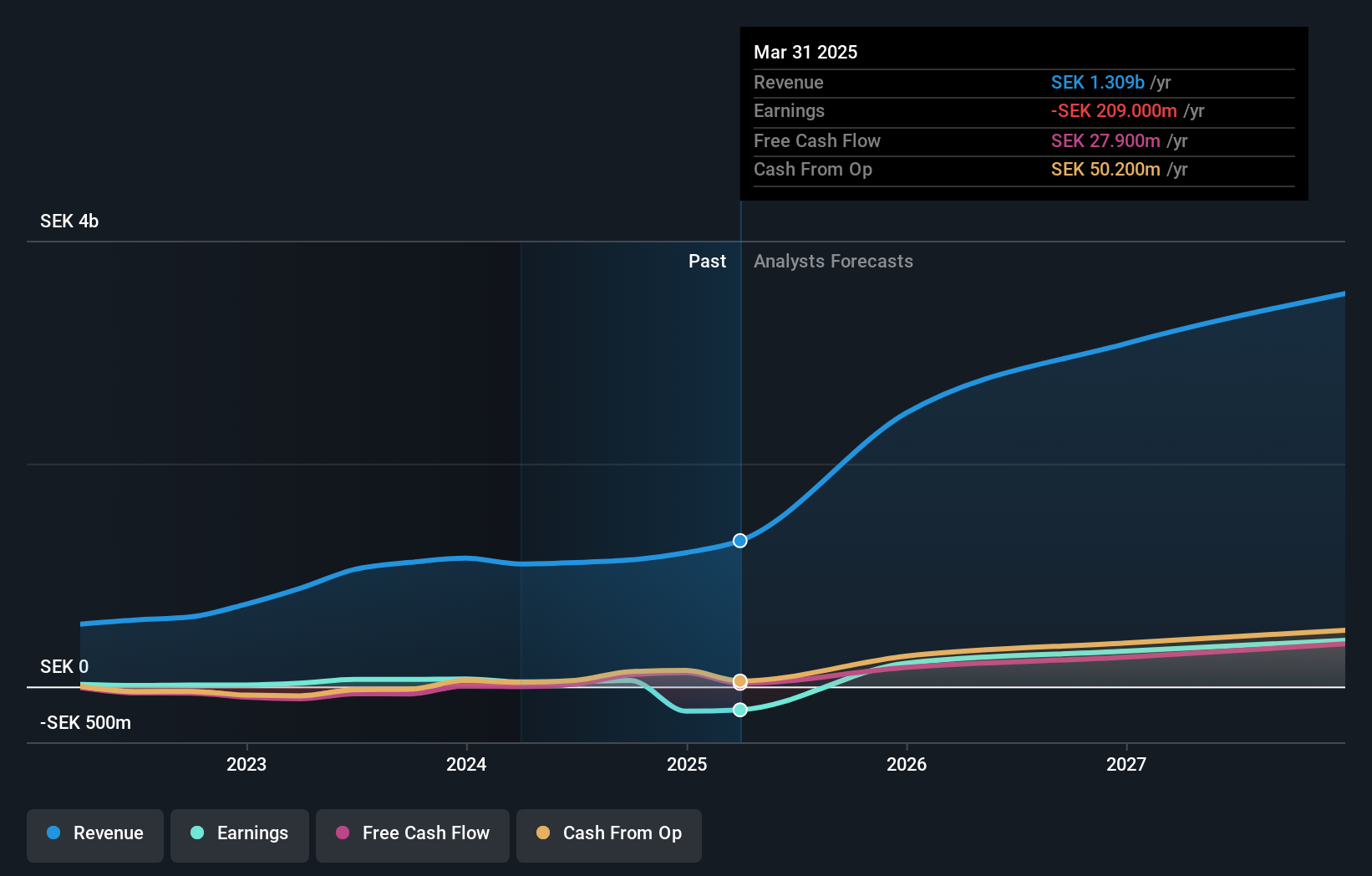

Overview: MilDef Group AB specializes in developing, manufacturing, and selling rugged IT solutions and special electronics mainly for the security and defense sectors, with a market capitalization of approximately SEK 2.72 billion.

Operations: The company generates SEK 1.10 billion from its computer hardware segment.

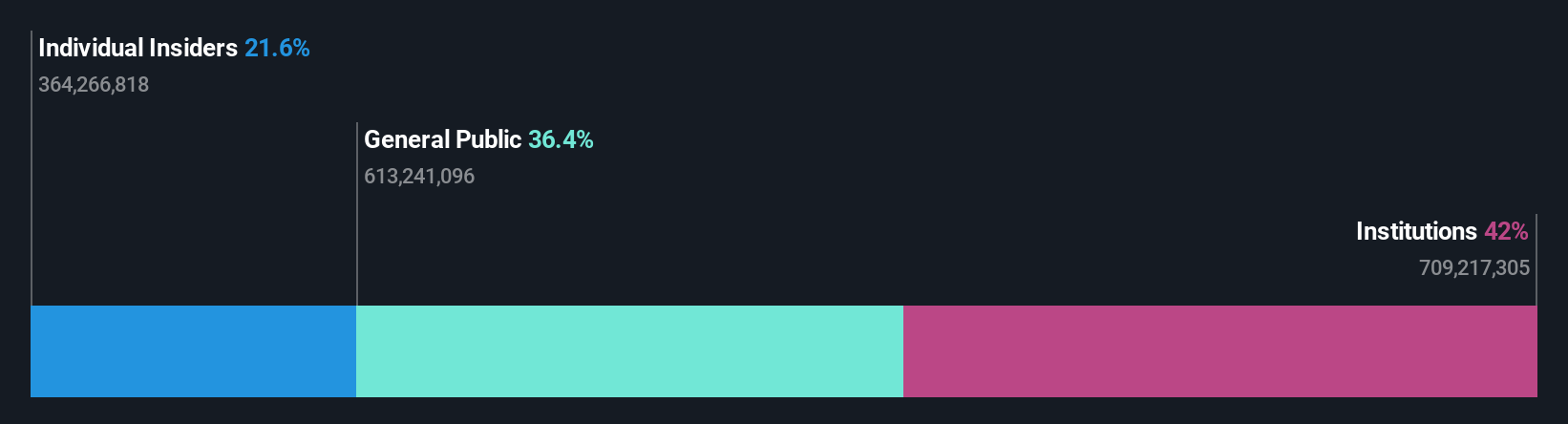

Insider Ownership: 23%

MilDef Group AB, a Swedish company with significant insider ownership, is poised for notable growth. Despite a recent quarterly loss with sales dropping to SEK 231.9 million from SEK 283.2 million year-over-year and a net loss of SEK 11.4 million, the forecast for MilDef's earnings shows an impressive annual increase of 44.7%, outpacing the Swedish market's average. Additionally, strategic contracts in Estonia and with BAE Systems Bofors signal potential future revenue streams, enhancing its growth profile amidst operational challenges.

- Delve into the full analysis future growth report here for a deeper understanding of MilDef Group.

- The analysis detailed in our MilDef Group valuation report hints at an inflated share price compared to its estimated value.

Storskogen Group (OM:STOR B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Storskogen Group AB (publ) is a conglomerate that acquires and nurtures small and medium-sized enterprises across the services, trade, and industrial sectors, with a market capitalization of SEK 13.86 billion.

Operations: The company generates revenue through three primary segments: services (SEK 11.05 billion), trade (SEK 9.77 billion), and industry (SEK 14.38 billion).

Insider Ownership: 17.4%

Storskogen Group AB, despite a recent dividend increase to SEK 0.09 per share, experienced a significant decline in Q1 earnings with sales dropping from SEK 9.21 billion to SEK 8.36 billion and net income falling to SEK 116 million from SEK 460 million year-over-year. However, the company shows promise with expected substantial earnings growth over the next three years and increased insider buying over the past three months, indicating confidence among key stakeholders. Yet, challenges persist as interest payments strain financials and profit margins have decreased significantly compared to the previous year.

- Navigate through the intricacies of Storskogen Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Storskogen Group's shares may be trading at a discount.

Where To Now?

- Delve into our full catalog of 83 Fast Growing Swedish Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MILDEF

MilDef Group

Develops, manufactures, and sells rugged IT solutions in Sweden, Norway, Finland, Denmark, the United Kingdom, Germany, Switzerland, the United States, Australia, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives