- Sweden

- /

- Construction

- /

- OM:PEAB B

Peab (OM:PEAB B) Valuation Update Following Major Swedish Contract Wins and Helsinki Redevelopment

Reviewed by Kshitija Bhandaru

Peab (OM:PEAB B) has just secured extensions on five sizable road maintenance contracts in Sweden, adding about SEK 660 million to its backlog. In addition, there is a major new office redevelopment project in Helsinki worth EUR 24 million.

See our latest analysis for Peab.

Momentum has been mixed for Peab over the past year. After some lacklustre stretches, recent contract wins have offered a mild bounce, with a 1-year total shareholder return of just 0.5%. A much more impressive 63% total return over three years hints at underlying long-term strength that could be reignited by these fresh orders.

If you’re interested in uncovering more opportunities with accelerating momentum and strong ownership trends, broaden your search and discover fast growing stocks with high insider ownership

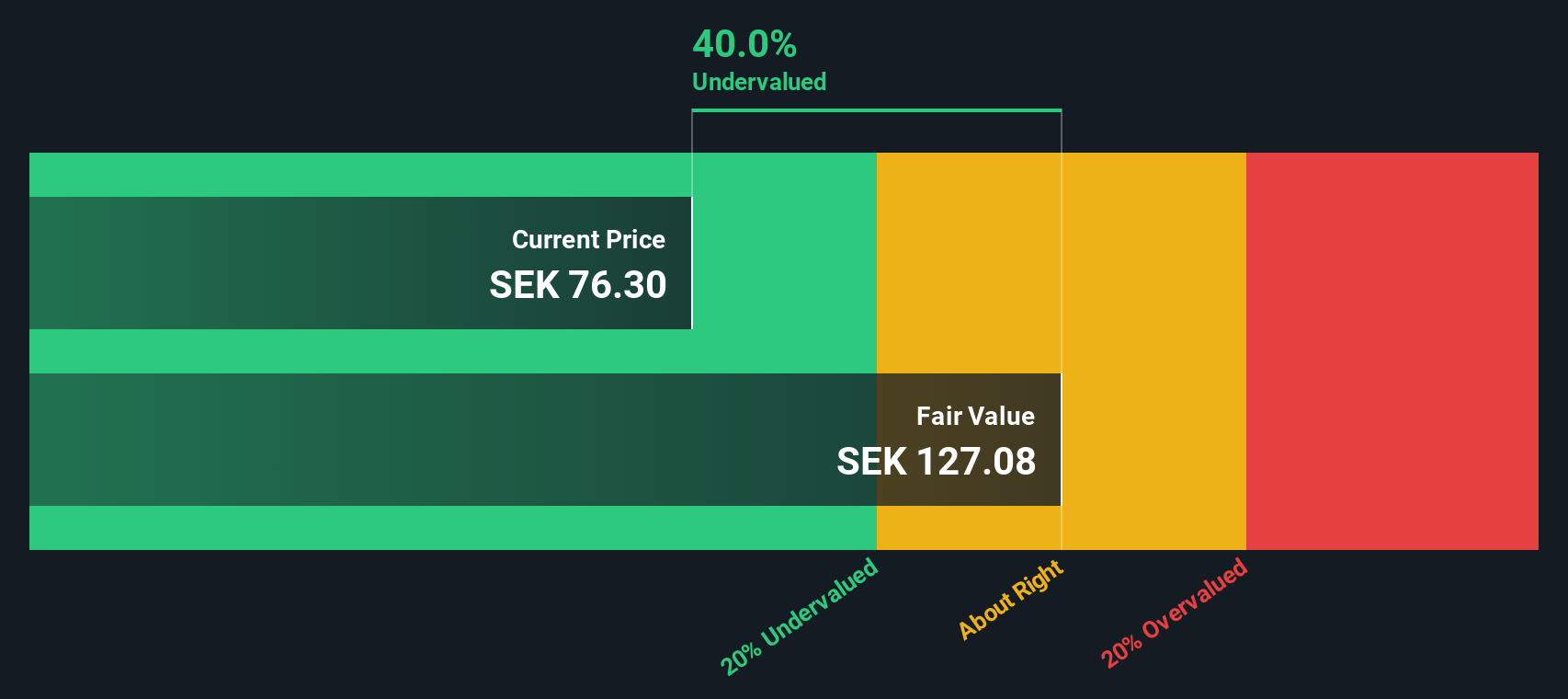

With fresh contracts in hand and strong long-term returns, is Peab’s stock offering a hidden bargain at current valuations, or has the market already factored in all the upcoming growth?

Price-to-Earnings of 14.2x: Is it justified?

Peab’s shares are currently trading at a price-to-earnings (P/E) ratio of 14.2x, which stands out as a discount against both industry peers and the company’s own historical levels. With a recent close at SEK76.4, this multiple suggests the market may be undervaluing recent earnings progress.

The price-to-earnings ratio compares a company’s current share price to its earnings per share. For construction and capital goods players like Peab, the P/E ratio is important because it reflects how much investors are willing to pay for each krona of profit, taking into account the cyclical nature of the sector.

Given Peab’s higher earnings growth outlook and a recent acceleration in profit, the current P/E looks conservative. Notably, it is well below both the peer average (21.7x) and the estimated fair P/E (25.1x). These are levels which the market often moves toward when growth momentum improves.

Compared to the broader European construction industry average of 14.9x, Peab’s multiple looks modest. When judged against its own fair P/E benchmark, the stock appears attractively priced for its forecast profile.

Explore the SWS fair ratio for Peab

Result: Price-to-Earnings of 14.2x (UNDERVALUED)

However, earnings growth may falter if construction demand slows or if project delays emerge. Both scenarios could impact Peab’s valuation outlook.

Find out about the key risks to this Peab narrative.

Another View: SWS DCF Model Paints a Different Picture

Switching from earnings multiples to the SWS DCF model produces a strikingly different valuation. The DCF calculation values Peab at SEK179.85 per share, much higher than its recent price of SEK76.4. This approach suggests the stock could be deeply undervalued if long-term cash flow assumptions are met. However, the question remains whether Peab can deliver the steady growth required to justify this premium.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Peab for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Peab Narrative

If you see things differently or want to dig into the numbers your own way, you can easily craft a personal storyline in just a few minutes. Do it your way

A great starting point for your Peab research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Going beyond Peab could unlock far greater potential for your portfolio. Find powerful trends and game-changing stocks you might otherwise miss by using these targeted searches:

- Capture opportunities in rapidly evolving medicine and patient care by tapping into these 32 healthcare AI stocks, which offers a strong edge in artificial intelligence advancements.

- Target companies offering attractive yields and financial resilience with these 18 dividend stocks with yields > 3%, ideal for building steady income and boosting long-term returns.

- Ride the wave of digital transformation by exploring these 78 cryptocurrency and blockchain stocks for forward-looking exposure to innovative cryptocurrency and blockchain businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:PEAB B

Peab

Operates as a construction and civil engineering company in Sweden, Norway, Finland, Denmark, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives