David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Peab AB (publ) (STO:PEAB B) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Peab

What Is Peab's Debt?

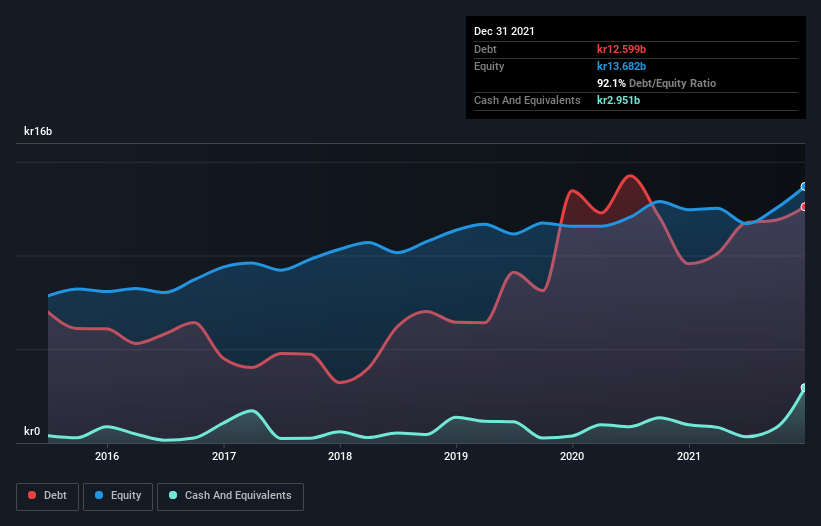

As you can see below, at the end of December 2021, Peab had kr12.6b of debt, up from kr9.56b a year ago. Click the image for more detail. However, because it has a cash reserve of kr2.95b, its net debt is less, at about kr9.65b.

How Strong Is Peab's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Peab had liabilities of kr26.0b due within 12 months and liabilities of kr7.53b due beyond that. Offsetting these obligations, it had cash of kr2.95b as well as receivables valued at kr11.3b due within 12 months. So its liabilities total kr19.3b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of kr27.5b, so it does suggest shareholders should keep an eye on Peab's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Peab's net debt to EBITDA ratio of about 1.8 suggests only moderate use of debt. And its commanding EBIT of 39.1 times its interest expense, implies the debt load is as light as a peacock feather. Peab grew its EBIT by 3.5% in the last year. Whilst that hardly knocks our socks off it is a positive when it comes to debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Peab's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Peab actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Peab's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its level of total liabilities does undermine this impression a bit. All these things considered, it appears that Peab can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Peab is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Peab, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PEAB B

Peab

Operates as a construction and civil engineering company in Sweden, Norway, Finland, Denmark, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives