- Sweden

- /

- Trade Distributors

- /

- OM:OEM B

Can OEM International's (OM:OEM B) Resilient Earnings Sustain Its Competitive Edge?

Reviewed by Sasha Jovanovic

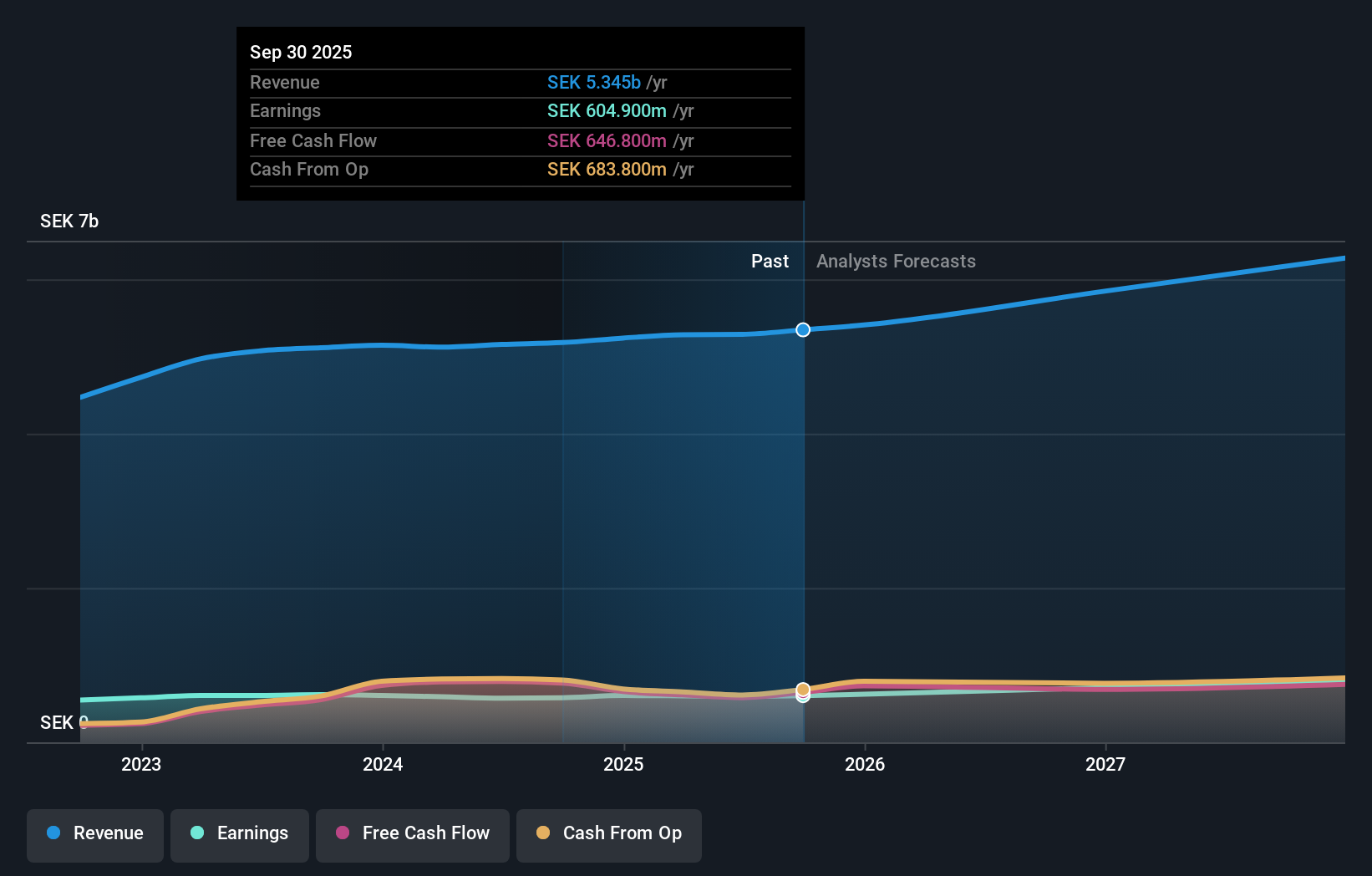

- OEM International AB (publ) recently reported its third quarter and nine-month 2025 earnings, with third quarter sales reaching SEK 1,280 million and net income of SEK 161 million, both higher than the same period last year.

- Despite a slight decrease in nine-month net income, the company showed steady operational performance through consistent sales growth and stable earnings per share figures.

- Let's explore how this steady operational performance and resilience reflected in the recent earnings report shapes OEM International's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is OEM International's Investment Narrative?

For shareholders to remain confident in OEM International, belief in the company's resilient business model and consistent ability to deliver growth, even amid minor profit fluctuations, is crucial. The recent third-quarter earnings report, showing higher sales and net income compared to last year, reinforces OEM International's operational robustness, despite a marginal dip in nine-month net income. This steady performance may help soothe previous concerns about slower profit growth and relatively high valuation multiples, as it signals that the company is still executing effectively. While the short-term catalyst of integration with EQT as a major shareholder remains in play, the latest results suggest that underlying business strength is intact. This solid footing likely means that the main risks, such as rich price-to-earnings ratios and limited board independence, still warrant attention, but the news itself is not likely to shift the biggest risk drivers meaningfully for now.

But there's a key risk around valuation that you should not overlook. OEM International's shares are on the way up, but they could be overextended by 11%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on OEM International - why the stock might be worth as much as SEK131.86!

Build Your Own OEM International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OEM International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free OEM International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OEM International's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:OEM B

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives