Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Nordic Waterproofing Holding A/S (STO:NWG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Nordic Waterproofing Holding

What Is Nordic Waterproofing Holding's Debt?

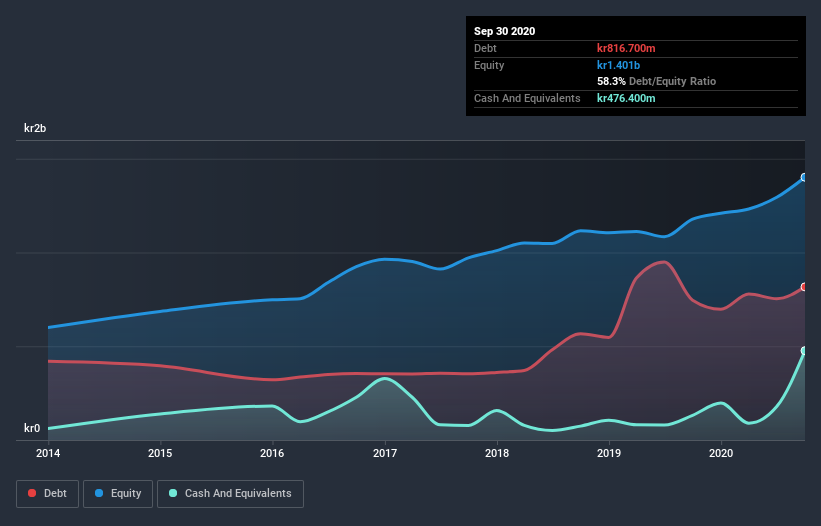

The chart below, which you can click on for greater detail, shows that Nordic Waterproofing Holding had kr751.1m in debt in September 2020; about the same as the year before. However, because it has a cash reserve of kr476.4m, its net debt is less, at about kr274.7m.

How Strong Is Nordic Waterproofing Holding's Balance Sheet?

The latest balance sheet data shows that Nordic Waterproofing Holding had liabilities of kr651.4m due within a year, and liabilities of kr953.8m falling due after that. On the other hand, it had cash of kr476.4m and kr566.3m worth of receivables due within a year. So its liabilities total kr562.5m more than the combination of its cash and short-term receivables.

Of course, Nordic Waterproofing Holding has a market capitalization of kr3.18b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Nordic Waterproofing Holding's net debt is only 0.70 times its EBITDA. And its EBIT easily covers its interest expense, being 19.6 times the size. So we're pretty relaxed about its super-conservative use of debt. On top of that, Nordic Waterproofing Holding grew its EBIT by 38% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Nordic Waterproofing Holding can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Nordic Waterproofing Holding recorded free cash flow worth a fulsome 98% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

Nordic Waterproofing Holding's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Considering this range of factors, it seems to us that Nordic Waterproofing Holding is quite prudent with its debt, and the risks seem well managed. So we're not worried about the use of a little leverage on the balance sheet. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Nordic Waterproofing Holding (of which 1 shouldn't be ignored!) you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Nordic Waterproofing Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Nordic Waterproofing Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:NWG

Nordic Waterproofing Holding

Develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure in Sweden, Norway, Denmark, Finland, rest of Europe, and internationally.

Excellent balance sheet and good value.