If EPS Growth Is Important To You, NIBE Industrier (STO:NIBE B) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like NIBE Industrier (STO:NIBE B), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide NIBE Industrier with the means to add long-term value to shareholders.

Our analysis indicates that NIBE B is potentially overvalued!

How Quickly Is NIBE Industrier Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, NIBE Industrier has grown EPS by 19% per year, compound, in the last three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

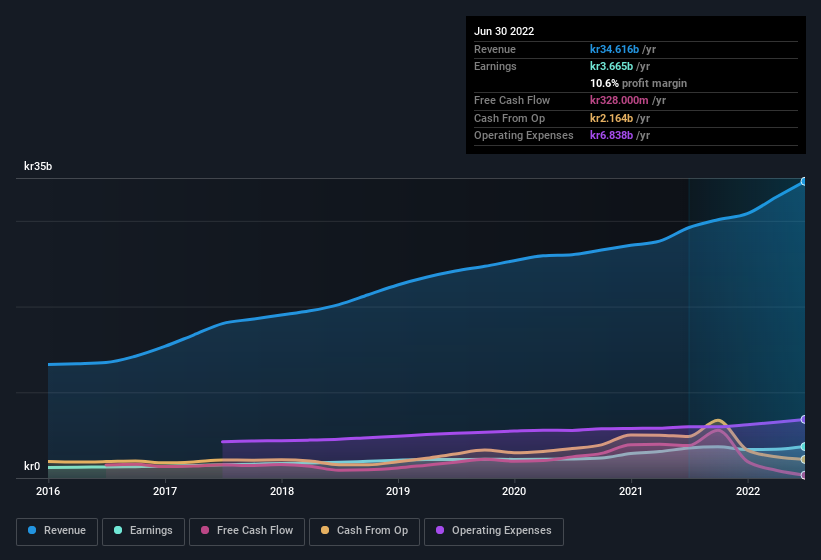

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for NIBE Industrier remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to kr35b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for NIBE Industrier's future profits.

Are NIBE Industrier Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news is that NIBE Industrier insiders spent a whopping kr17m on stock in just one year, without so much as a single sale. Knowing this, NIBE Industrier will have have all eyes on them in anticipation for the what could happen in the near future. We also note that it was the Chief Financial Officer, Hans Backman, who made the biggest single acquisition, paying kr5.0m for shares at about kr77.63 each.

On top of the insider buying, it's good to see that NIBE Industrier insiders have a valuable investment in the business. We note that their impressive stake in the company is worth kr27b. That equates to 14% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Gerteric Lindquist, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like NIBE Industrier, with market caps over kr91b, is about kr26m.

NIBE Industrier's CEO took home a total compensation package of kr8.3m in the year prior to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add NIBE Industrier To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into NIBE Industrier's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of NIBE Industrier.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of NIBE Industrier, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade NIBE Industrier, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential with questionable track record.