As global markets navigate a mixed landscape of rising U.S. Treasury yields, fluctuating consumer confidence, and geopolitical tensions, investors are keenly observing the performance of major indices like the Nasdaq Composite and Russell 1000 Growth Index. In this environment, growth companies with significant insider ownership can offer an intriguing proposition as they often exhibit strong alignment between management and shareholder interests, potentially providing resilience amid market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

We're going to check out a few of the best picks from our screener tool.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) is a company that, along with its subsidiaries, develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control across the Nordic countries, Europe, North America, and internationally; it has a market cap of approximately SEK85.44 billion.

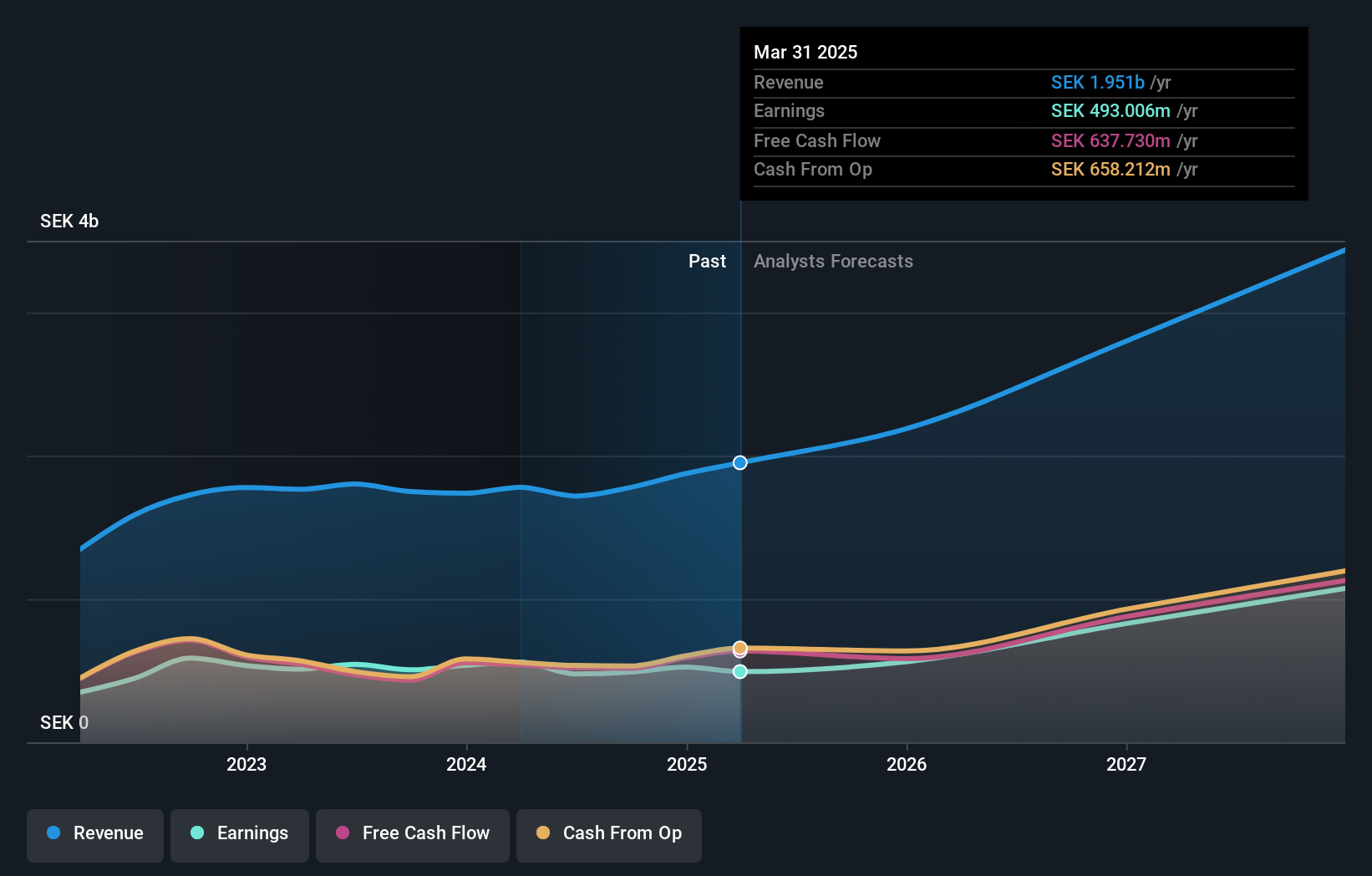

Operations: NIBE Industrier generates revenue through its segments, with SEK5.08 billion from Stoves, SEK13.24 billion from Element, and SEK33.89 billion from Climate Solutions.

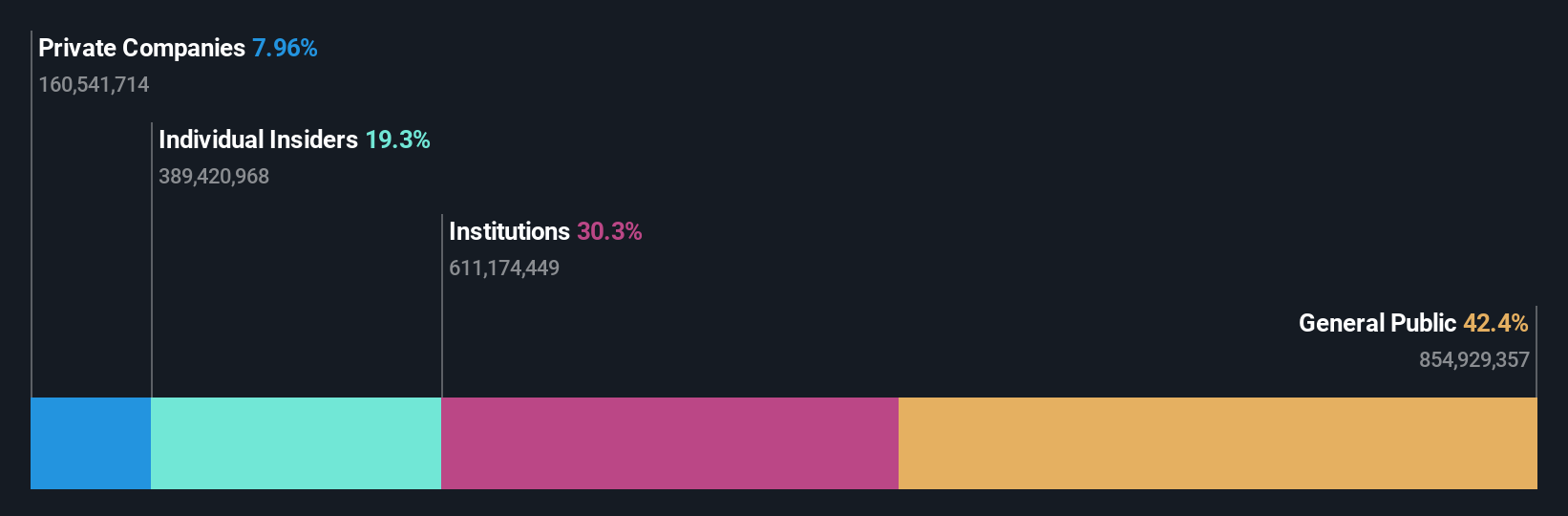

Insider Ownership: 20.2%

NIBE Industrier faces challenges with declining profit margins and a recent net loss, yet it remains attractive due to its significant earnings growth forecast of 56.53% annually, outpacing the Swedish market. Despite trading below fair value, its financial position is strained by inadequate interest coverage. Recent results show decreased sales and income compared to last year, highlighting potential volatility in performance despite promising growth prospects.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this growth report.

- The valuation report we've compiled suggests that NIBE Industrier's current price could be inflated.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and other international markets, with a market cap of approximately SEK17.84 billion.

Operations: The company generates revenue from its Communications Software segment, totaling SEK1.78 billion.

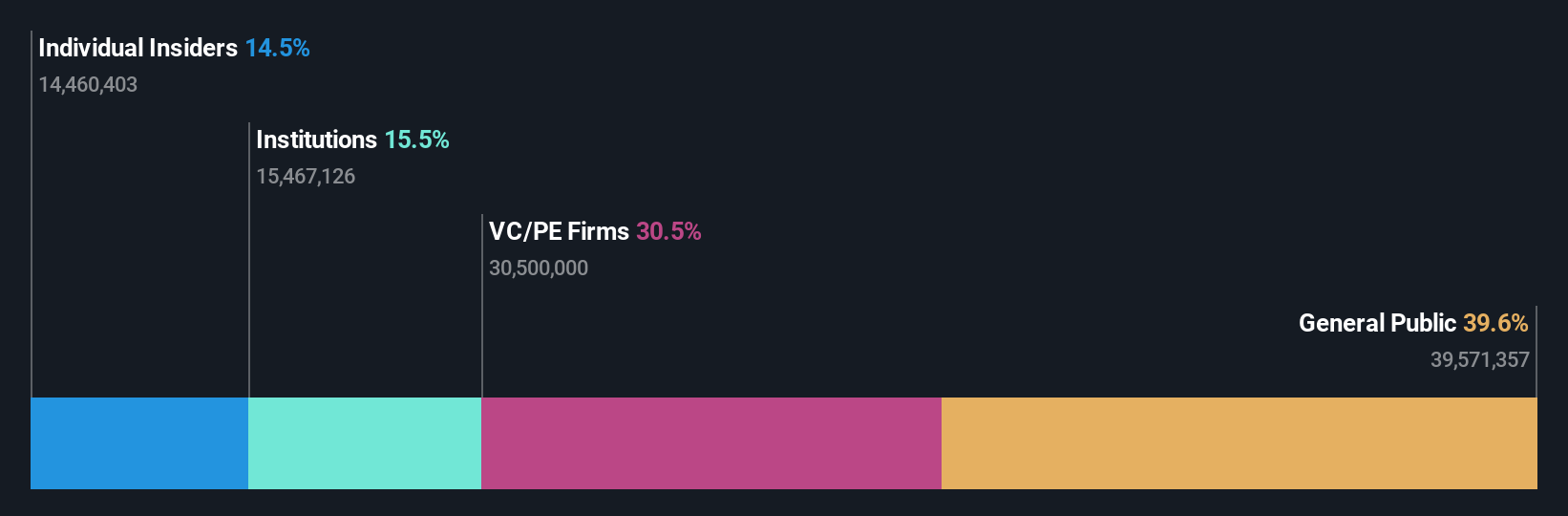

Insider Ownership: 29.7%

Truecaller is poised for growth, with earnings and revenue expected to increase significantly above the Swedish market. The company trades below its estimated fair value, suggesting potential upside. Recent insider buying indicates confidence in its prospects. Strategic partnerships with entities like Commercial International Bank enhance customer trust and communication security, while leadership changes aim to bolster innovation in key markets like India. These factors contribute to Truecaller's robust growth outlook amidst a competitive landscape.

- Click to explore a detailed breakdown of our findings in Truecaller's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Truecaller shares in the market.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stadler Rail AG, with a market cap of CHF2 billion, manufactures and sells trains across Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, the CIS countries, and internationally.

Operations: Stadler Rail's revenue is primarily derived from its Rolling Stock segment, which accounts for CHF3.10 billion, followed by Service & Components at CHF789.41 million and Signalling at CHF135.68 million.

Insider Ownership: 14.5%

Stadler Rail exhibits strong growth potential with earnings projected to rise significantly at 22.9% annually, outpacing the Swiss market. Although trading at a substantial discount to its estimated fair value, its revenue growth is slower than ideal for rapid expansion. The dividend yield of 4.5% is not well supported by free cash flow, indicating potential sustainability issues. Despite these concerns, Stadler's earnings trajectory suggests promising long-term prospects amidst the competitive rail industry landscape.

- Dive into the specifics of Stadler Rail here with our thorough growth forecast report.

- Our valuation report unveils the possibility Stadler Rail's shares may be trading at a discount.

Summing It All Up

- Click this link to deep-dive into the 1507 companies within our Fast Growing Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NIBE Industrier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NIBE B

NIBE Industrier

Develops, manufactures, markets, and sells various energy-efficient solutions for indoor climate comfort, and components and solutions for intelligent heating and control in Nordic countries, rest of Europe, North America, and internationally.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives