Is Nordic Flanges Group (STO:NFGAB) Using Debt In A Risky Way?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Nordic Flanges Group AB (publ) (STO:NFGAB) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Nordic Flanges Group

What Is Nordic Flanges Group's Net Debt?

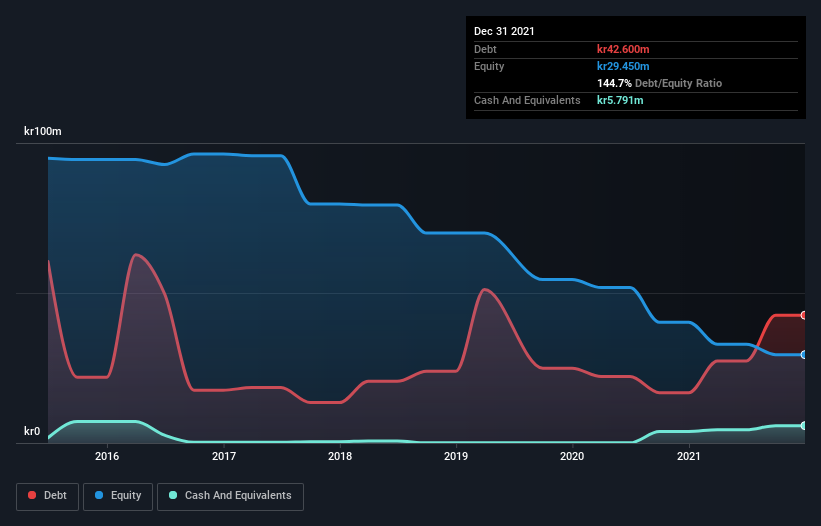

As you can see below, at the end of December 2021, Nordic Flanges Group had kr42.6m of debt, up from kr16.8m a year ago. Click the image for more detail. However, it does have kr5.79m in cash offsetting this, leading to net debt of about kr36.8m.

How Healthy Is Nordic Flanges Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nordic Flanges Group had liabilities of kr75.9m due within 12 months and liabilities of kr25.4m due beyond that. Offsetting these obligations, it had cash of kr5.79m as well as receivables valued at kr17.5m due within 12 months. So its liabilities total kr78.0m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of kr56.5m, we think shareholders really should watch Nordic Flanges Group's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Nordic Flanges Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Nordic Flanges Group's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Over the last twelve months Nordic Flanges Group produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping kr6.8m. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through kr12m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Nordic Flanges Group has 5 warning signs (and 4 which are a bit concerning) we think you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Flanges Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NFGAB

Nordic Flanges Group

Manufactures and sells industrial flanges in Sweden, the rest of the Nordic region, the United States, and internationally.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026