- Sweden

- /

- Construction

- /

- OM:NCC B

Will Recent Nordic Contract Wins Boost NCC's (OM:NCC B) Position in Construction and Infrastructure?

Reviewed by Sasha Jovanovic

- In the past week, clients have announced that NCC has secured several significant contracts in Sweden and Denmark, including the SEK 520 million refurbishment of 444 apartments in Kolding, a SEK 200 million groundwork project for a new LKAB sorting facility, a SEK 200 million parking facility for Stockholm Parkering, and a SEK 240 million upgrade to Antvorskov Barracks for the Danish Armed Forces.

- These new orders demonstrate NCC’s growing expertise across various construction sectors and geographies, reflecting its increasing role in residential, infrastructure, and public sector projects in Northern Europe.

- We'll explore how this series of substantial contract wins, particularly the major apartment redevelopment in Denmark, impacts NCC's investment outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

NCC Investment Narrative Recap

To be a shareholder in NCC, you need to believe in the company's ability to consistently secure a diverse pipeline of large-scale contracts that span residential, infrastructure, and public sector projects across Northern Europe. The recent spate of contract wins, while indicative of strong client relationships and execution capacity, does not materially shift the company’s primary short-term catalyst: the need for improved property transactions to boost financial results. The biggest risk remains a muted property transaction market hampering revenue and earnings growth.

Among the new orders, the SEK 520 million apartment redevelopment in Kolding, Denmark stands out for its scale and multi-year scope. This project signifies NCC’s reach in residential construction, but the immediate impacts on the company’s core catalyst, real estate sales replenishing earnings, are less direct, as future revenue recognition from such contracts often extends over several years.

However, it is important to remember that while new contracts provide headline appeal, the contrast between these wins and the persistent challenge of slow property sales is something investors should be aware of…

Read the full narrative on NCC (it's free!)

NCC's narrative projects SEK61.6 billion revenue and SEK1.5 billion earnings by 2028. This requires a 0.7% yearly revenue decline and no change in earnings from the current SEK1.5 billion level.

Uncover how NCC's forecasts yield a SEK200.00 fair value, a 6% downside to its current price.

Exploring Other Perspectives

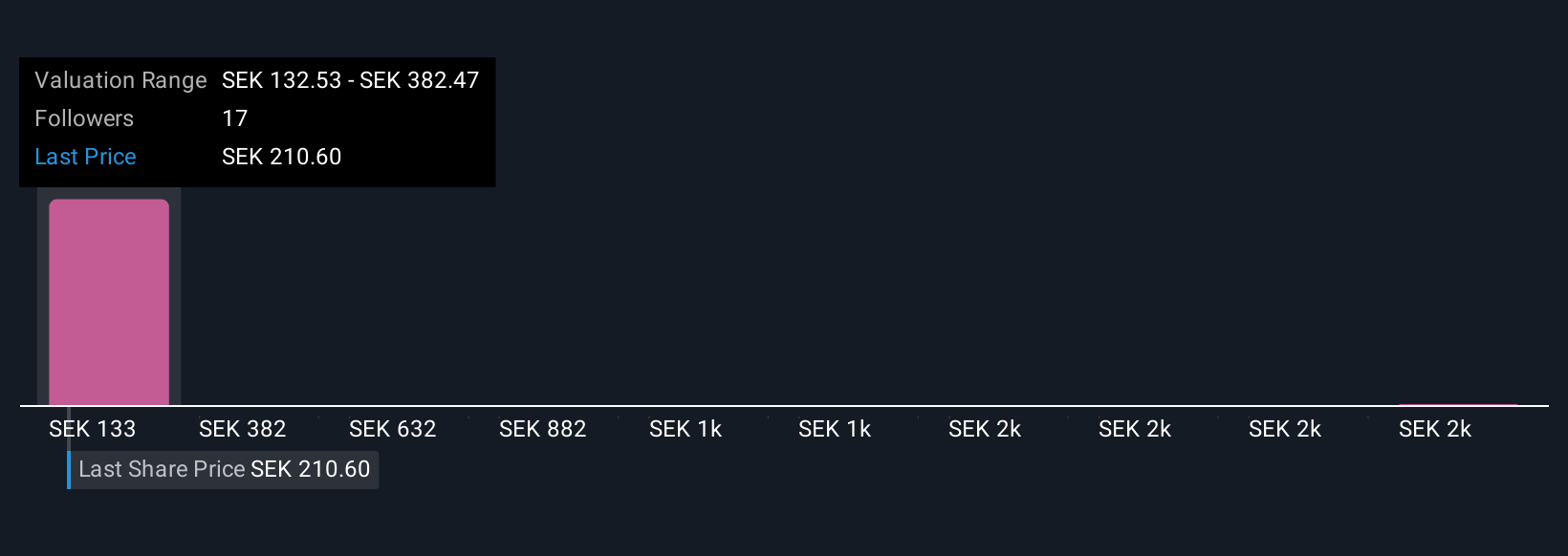

Fair value estimates for NCC from five members of the Simply Wall St Community range widely, from SEK132.53 to SEK2,631.96. Many see significant potential, but the muted property transaction market continues as a focus and may shape future results, consider exploring more investor viewpoints here.

Explore 5 other fair value estimates on NCC - why the stock might be worth 38% less than the current price!

Build Your Own NCC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NCC research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NCC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NCC's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCC B

NCC

Operates as a construction company in Sweden, Norway, Denmark, and Finland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives