- Sweden

- /

- Construction

- /

- OM:NCC B

NCC (OM:NCC B): Assessing Valuation During High-Stakes West Link Contract Dispute

Reviewed by Kshitija Bhandaru

If you own shares of NCC (OM:NCC B) or are considering jumping in, this latest contract drama with the Swedish Transport Administration is the kind of development that demands attention. The West Link project in Gothenburg is no small deal, and NCC’s very public decision to contest the contract termination could influence not just future earnings, but how markets perceive the company’s ability to manage large-scale public contracts. For those watching from the sidelines, the main question is how this legal dispute and its political overtones will reshape NCC’s risk profile in the coming quarters.

NCC’s stock has been on a solid run, gaining 32% in the past year and climbing 22% over the past three months alone, suggesting growing optimism about its prospects or perhaps a shift in how investors value its construction pipeline. This is not the first high-stakes event for NCC this year, but the momentum in the share price throws the spotlight back on fundamentals and valuation. Clearly, recent performance has been strong even with some operational turbulence making headlines.

With so much focus now turning to possible legal outcomes and future earnings, is the stock setting up for additional gains, or is the market already building in the upsides of NCC’s long-term growth story?

Most Popular Narrative: 5.5% Overvalued

According to the most widely followed narrative, NCC's current share price stands slightly above what is considered its fair value, given analyst assessments and future expectations. The narrative points to a narrow premium, hinting that enthusiasm in the stock may have moved it past where the consensus of future earnings and risk factors would justify.

The company's strong financial position and balance sheet readiness for selective mergers and acquisitions (M&A) can act as a catalyst for future revenue growth and margin expansion. Positive outlook for key contracting segments such as water treatment, energy generation, and infrastructure suggests potential for sustained revenue growth.

What will really surprise investors is the strategic forecast buried under the headlines. How do conservative profit margins and ambitious growth targets transform into this valuation? Can stability and expansion coexist in such a tightly priced stock? Dig into the analyst playbook, as these assumptions might just flip your view of NCC’s true worth.

Result: Fair Value of $200 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a strengthening Swedish Krona and muted property market could quickly weaken growth assumptions for NCC. This may keep investors alert for any sign of instability.

Find out about the key risks to this NCC narrative.Another View: What Does Our DCF Model Say?

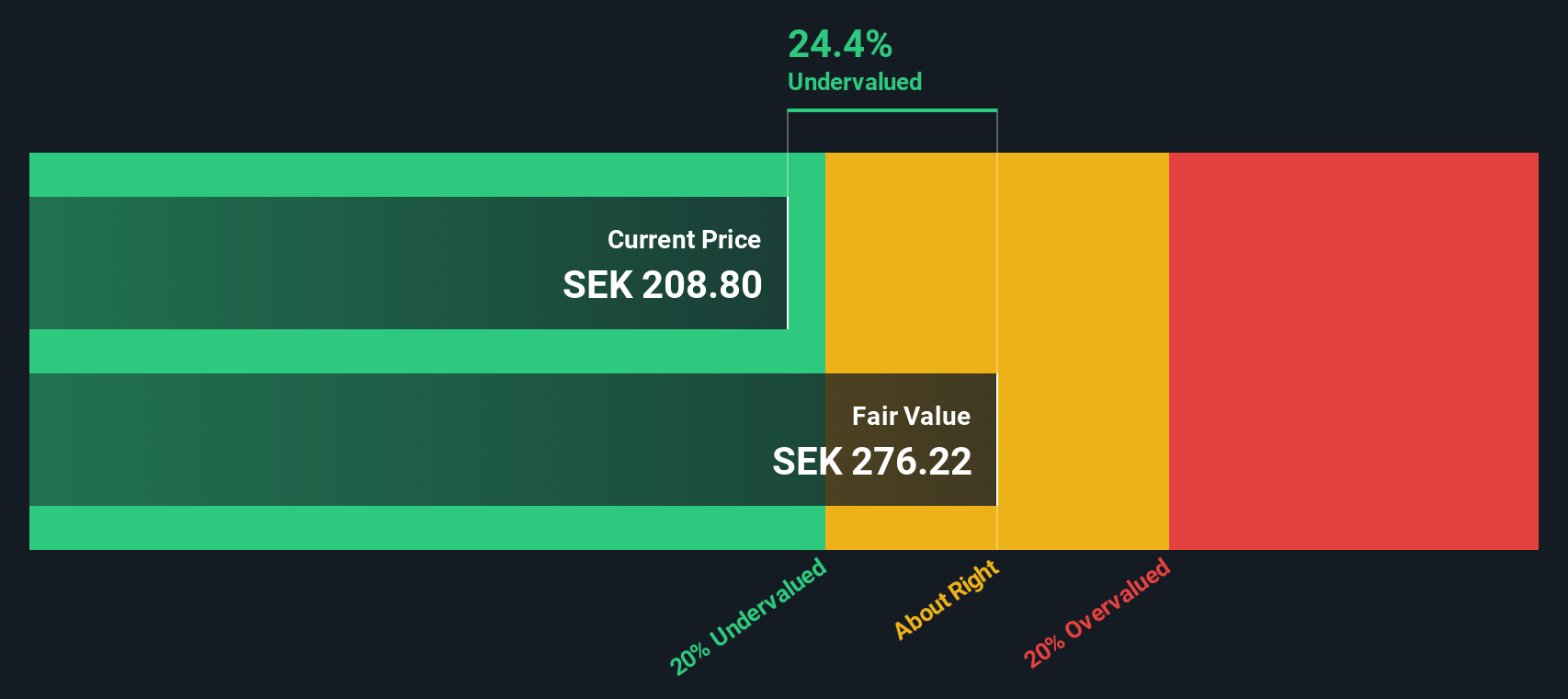

Looking through the lens of our SWS DCF model, the story flips. This approach suggests NCC could be trading at a significant discount to its intrinsic value. Should investors trust current optimism, or is there more beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding NCC to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own NCC Narrative

If you think the story runs deeper, or you trust your own research over the crowd, you can put your case together in just a few minutes. Do it your way.

A great starting point for your NCC research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit your portfolio to one sector when tomorrow’s winners are already setting up for success? Act now and give yourself the edge with these handpicked stock ideas, proven to benefit investors who move early. Don’t wait for headlines—find your next opportunity today.

- Unlock the power of reliable income streams by checking out companies offering dividend stocks with yields > 3%, which consistently provide yields over 3%.

- Position your investments for the AI revolution by seeking out innovative firms in the world of AI penny stocks and ride the wave of technological advancement.

- Spot hidden bargains with strong future potential by reviewing stocks flagged as undervalued stocks based on cash flows based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NCC B

NCC

Operates as a construction company in Sweden, Norway, Denmark, and Finland.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives