- Germany

- /

- Infrastructure

- /

- XTRA:HHFA

Unveiling Three Undiscovered Gems in Europe with Strong Financial Foundations

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently ended higher, snapping a two-week losing streak, hopes for increased government spending have buoyed investor sentiment despite ongoing trade tensions. In this environment of cautious optimism and mixed economic signals, identifying stocks with strong financial foundations becomes crucial for navigating potential market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.50% | 27.28% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★★

Overview: Momentum Group AB (publ) supplies industrial components and services to the industrial sector, with a market capitalization of approximately SEK7.96 billion.

Operations: Momentum Group generates revenue primarily from its Industry and Infrastructure segments, contributing SEK1.73 billion and SEK1.16 billion, respectively. The company has a net profit margin of 5.6%, reflecting its profitability relative to total revenue after accounting for expenses and taxes.

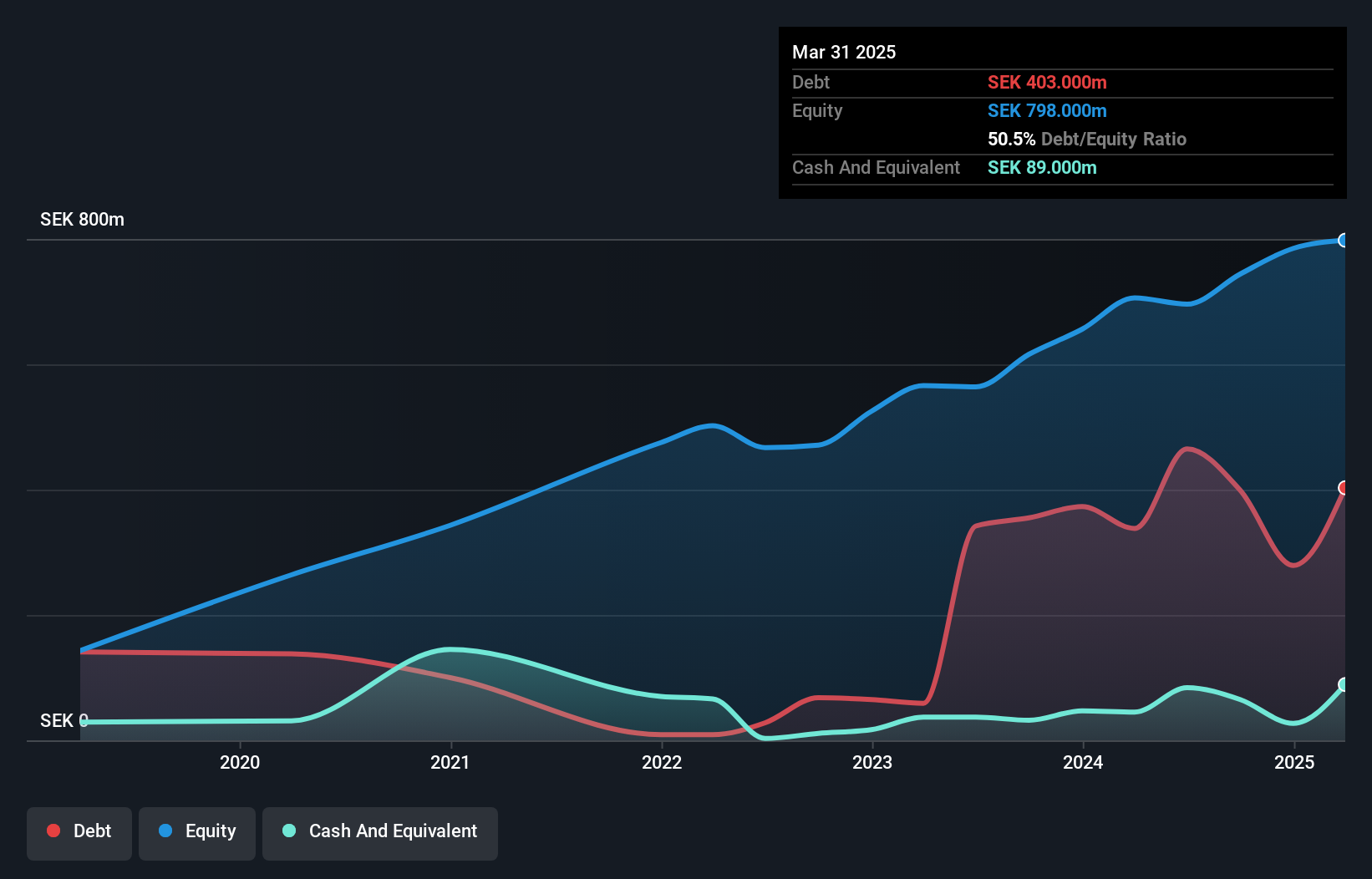

Momentum Group, a small player in the European market, has shown robust financial health with its debt to equity ratio dropping from 77% to 35.5% over five years. Its interest payments are comfortably covered by EBIT at 8.4 times, indicating solid earnings quality. The company reported SEK 2.88 billion in revenue for the full year ending December 2024, up from SEK 2.3 billion previously, though net income saw a slight increase to SEK 178 million from SEK 170 million last year. With forecasted earnings growth of nearly 14% annually and satisfactory net debt levels at 32%, Momentum seems poised for continued stability and potential growth within its industry context.

- Click here to discover the nuances of Momentum Group with our detailed analytical health report.

Understand Momentum Group's track record by examining our Past report.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF 1.07 billion, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland.

Operations: Jungfraubahn Holding AG generates revenue primarily from its Jungfraujoch - TOP of Europe segment, contributing CHF 190.99 million, and Experience Mountains segment at CHF 51.27 million. The Winter Sports segment adds CHF 40.47 million to the revenue stream.

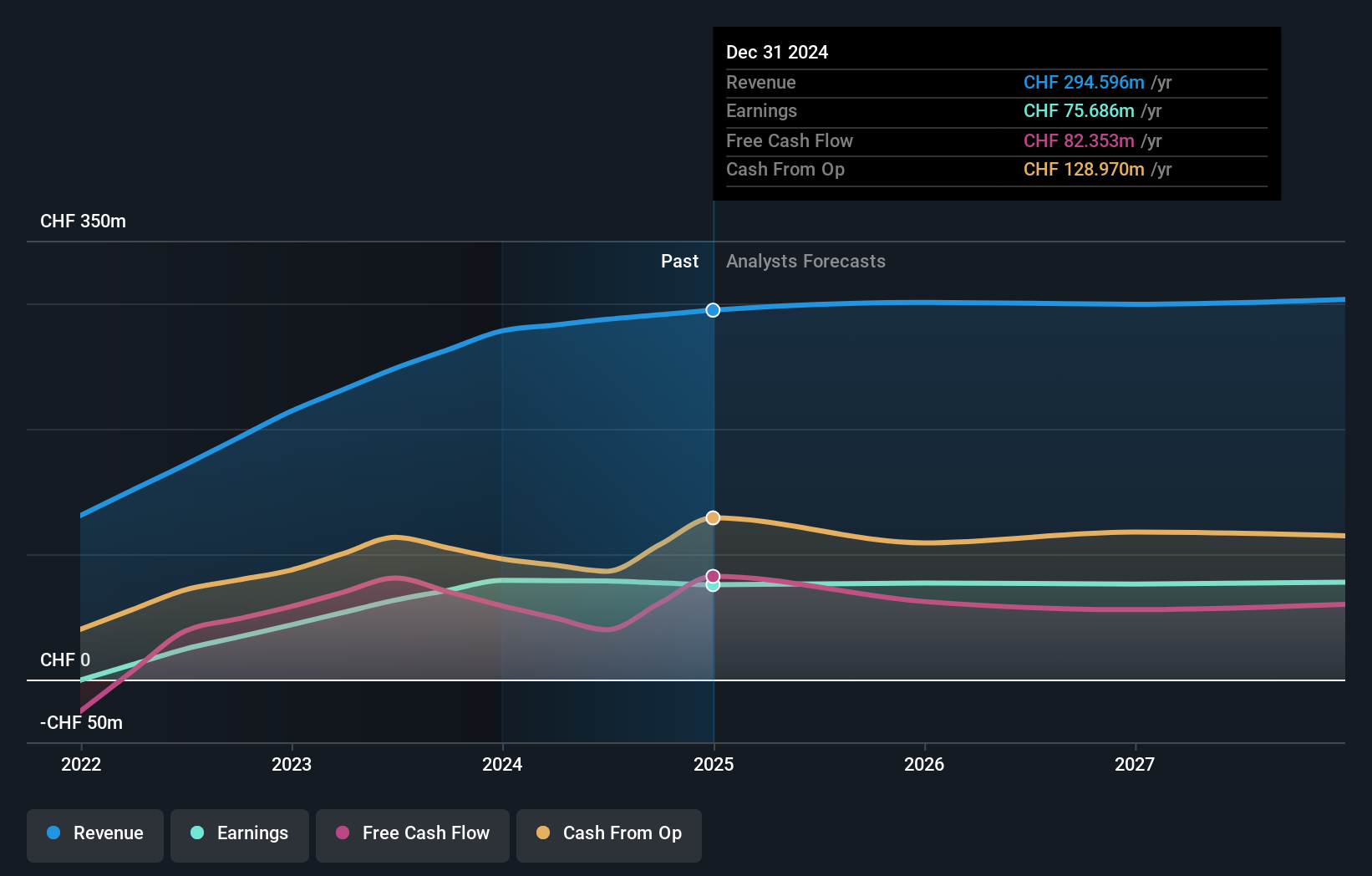

Jungfraubahn Holding, a notable player in the transportation sector, has shown impressive earnings growth of 24% over the past year, outpacing its industry peers. Its net debt to equity ratio stands at a satisfactory 13.6%, indicating prudent financial management. The company is trading at 34.3% below its estimated fair value, offering potential upside for investors seeking undervalued opportunities. With high-quality past earnings and no concerns over interest coverage or cash runway due to profitability, JFN seems well-positioned for steady progress with forecasted annual earnings growth of 2.75%.

- Dive into the specifics of Jungfraubahn Holding here with our thorough health report.

Evaluate Jungfraubahn Holding's historical performance by accessing our past performance report.

Hamburger Hafen und Logistik (XTRA:HHFA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hamburger Hafen und Logistik Aktiengesellschaft is a port and transport logistics company operating in Germany, the rest of the European Union, and internationally, with a market cap of €1.31 billion.

Operations: Hamburger Hafen und Logistik generates revenue primarily from its port and transport logistics operations across Germany, the European Union, and internationally. The company has a market capitalization of approximately €1.31 billion.

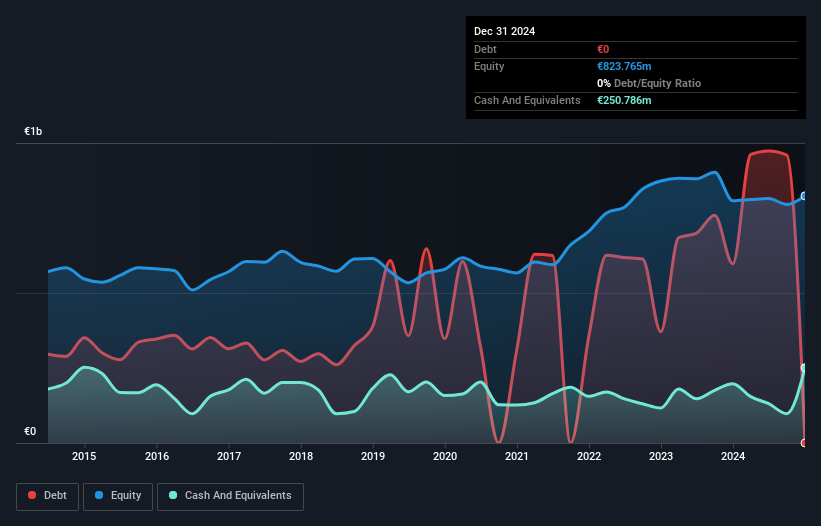

Hamburger Hafen und Logistik (HHLA) has demonstrated robust growth, with earnings rising by 62.9% over the past year, significantly outpacing the infrastructure industry's -1.3%. The company is debt-free, a notable improvement from five years ago when its debt-to-equity ratio stood at 60%. Recent financial results show sales climbing to €1.61 billion from €1.45 billion last year, while net income increased to €32.52 million from €19.96 million. Despite these gains, free cash flow remains negative due to high capital expenditures of approximately €253 million in 2024 and recent acquisitions totaling around €26 million impacting liquidity dynamics this year.

Summing It All Up

- Explore the 351 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hamburger Hafen und Logistik might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HHFA

Hamburger Hafen und Logistik

Operates as a port and transport logistics company in Germany, rest of European Union, and internationally.

Proven track record with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion