- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

Unearthing Hidden Opportunities With These 3 Undiscovered Gems

Reviewed by Simply Wall St

As global markets navigate a landscape marked by volatile corporate earnings, AI competition concerns, and steady interest rates from major central banks, investors are increasingly seeking opportunities beyond the well-trodden paths of large-cap stocks. In this environment, small-cap stocks can present unique opportunities for growth due to their potential for innovation and agility in adapting to changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

EVS Broadcast Equipment (ENXTBR:EVS)

Simply Wall St Value Rating: ★★★★★★

Overview: EVS Broadcast Equipment SA specializes in live video technology for broadcast and media productions globally, with a market cap of €424.76 million.

Operations: The company generates revenue primarily from solutions based on tapeless workflows with a modular architecture, amounting to €183.85 million. The market cap stands at €424.76 million.

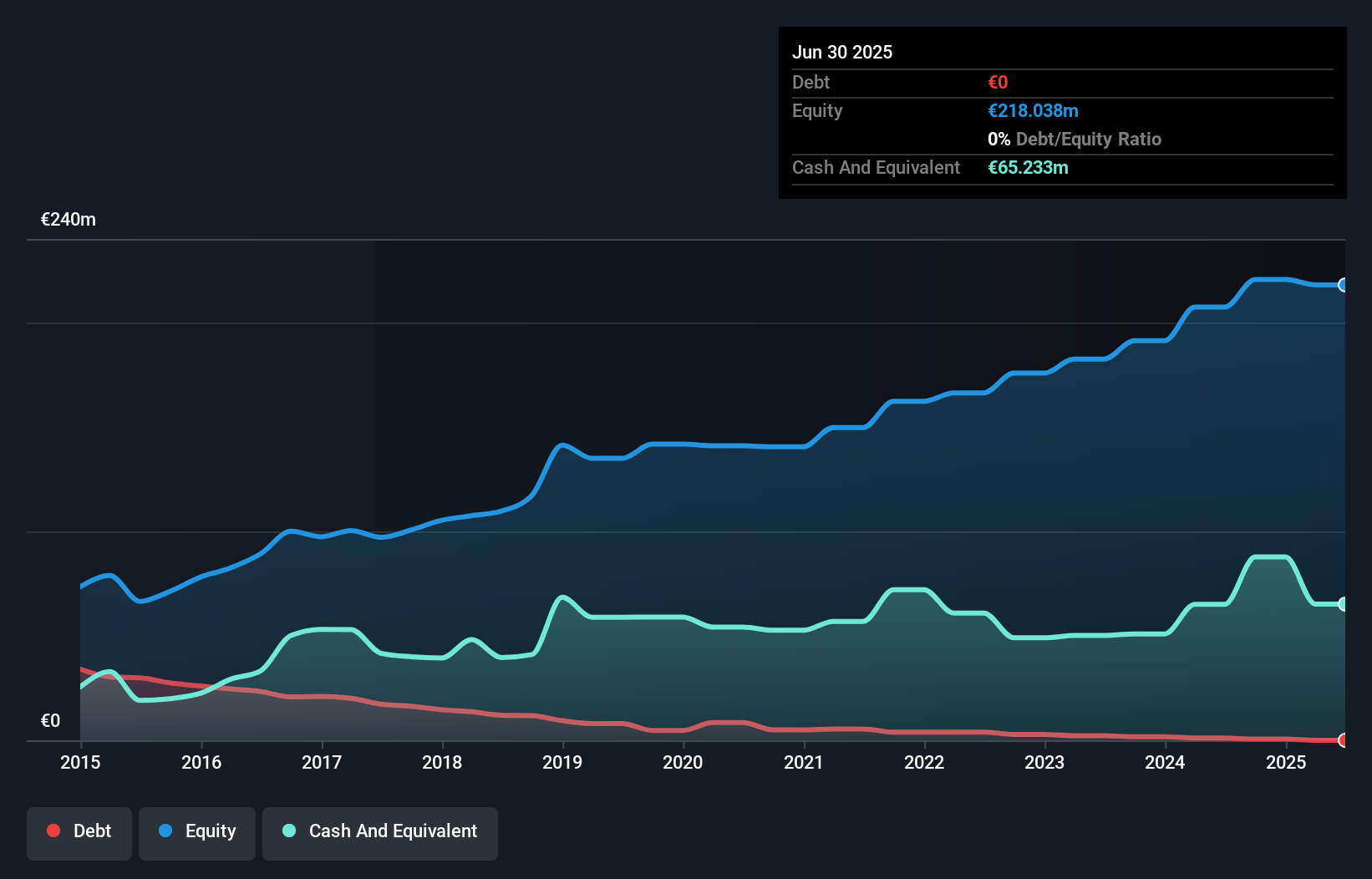

EVS Broadcast Equipment, a nimble player in the broadcast technology space, stands out with its debt to equity ratio dropping from 5.9 to 0.5 over five years, indicating prudent financial management. Its cash reserves surpass total debt, ensuring stability and flexibility for future endeavors. Trading at 28% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. With earnings growth of 1.3% that outpaces the industry average of -6.4%, EVS shows resilience amidst sector challenges. Recent announcements include a €10 million share buyback program and an anticipated dividend payout of €1.10 per share for 2024, highlighting shareholder-friendly initiatives.

- Click to explore a detailed breakdown of our findings in EVS Broadcast Equipment's health report.

Assess EVS Broadcast Equipment's past performance with our detailed historical performance reports.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Momentum Group AB (publ) provides industrial components and services to the industrial sector, with a market capitalization of approximately SEK8.70 billion.

Operations: Momentum Group AB (publ) generates revenue primarily through the supply of industrial components and services, with a notable segment adjustment of SEK2.81 billion.

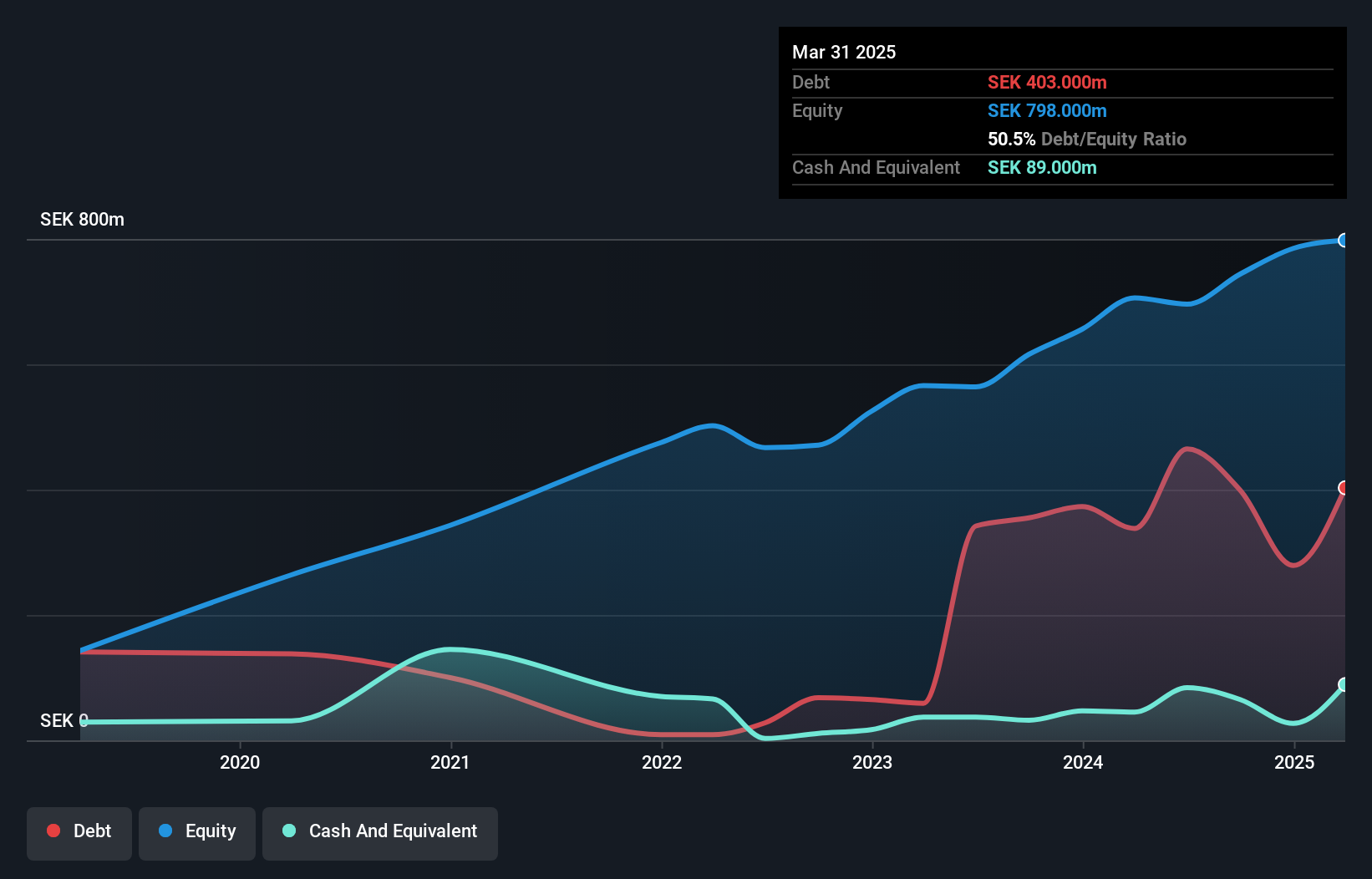

Momentum Group, a modestly-sized player in the industry, has shown a promising reduction in its debt to equity ratio from 82.1% to 53.6% over five years, indicating improved financial health. Its interest payments are comfortably covered by EBIT at 8.9 times, suggesting strong operational performance. The company trades at a value that is 17.2% below estimated fair value, hinting at potential undervaluation in the market. Earnings have grown by an impressive 14.5% last year, outpacing the industry average of -6.2%. With high-quality earnings and positive free cash flow reported consistently, Momentum seems poised for continued growth and stability in its sector.

- Navigate through the intricacies of Momentum Group with our comprehensive health report here.

Gain insights into Momentum Group's past trends and performance with our Past report.

Inaba Denki SangyoLtd (TSE:9934)

Simply Wall St Value Rating: ★★★★★★

Overview: Inaba Denki Sangyo Co., Ltd. operates in Japan, supplying electrical equipment and materials, industrial automation, and proprietary products, with a market cap of ¥211.75 billion.

Operations: The company generates revenue through the sale of electrical equipment, materials, industrial automation solutions, and proprietary products. It focuses on optimizing its cost structure to improve profitability. The net profit margin has shown a consistent trend over recent periods, indicating effective cost management strategies.

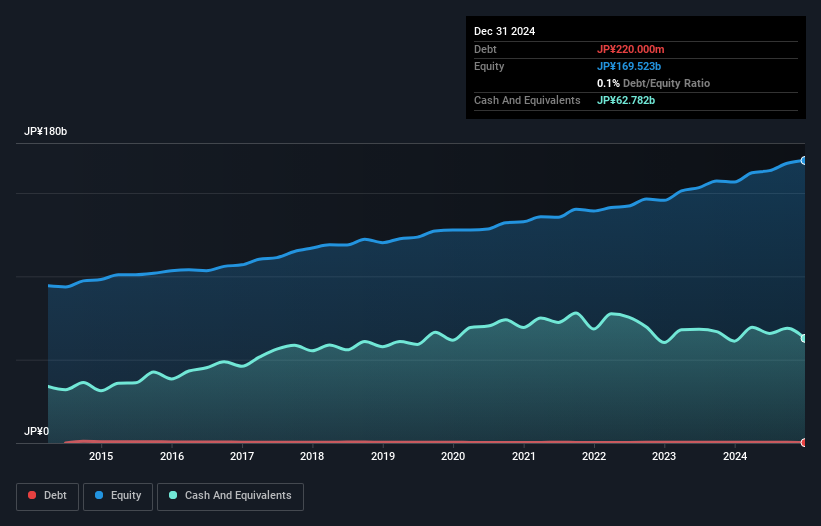

Inaba Denki Sangyo, a relatively small player in its sector, shows potential with earnings growth of 10.7% over the past year, outpacing the Trade Distributors industry's 0.4%. The company is trading at a notable discount of 34.5% below its estimated fair value, suggesting room for appreciation. Financially robust with more cash than total debt and a reduced debt-to-equity ratio from 0.4 to 0.1 over five years, Inaba Denki also announced a share repurchase program worth ¥2,700 million to buy back 740,000 shares by May 2025 to enhance shareholder value further.

- Click here and access our complete health analysis report to understand the dynamics of Inaba Denki SangyoLtd.

Evaluate Inaba Denki SangyoLtd's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 4663 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Momentum Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives