Three Undiscovered Gems In Sweden Backed By Strong Fundamentals

Reviewed by Simply Wall St

As European inflation nears the central bank's target, the pan-European STOXX Europe 600 Index has reached a record high, driven by expectations of potential interest rate cuts. In this favorable economic climate, identifying stocks with strong fundamentals becomes crucial for investors seeking stable opportunities. In this article, we explore three undiscovered gems in Sweden that are backed by robust financial health and promising prospects.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

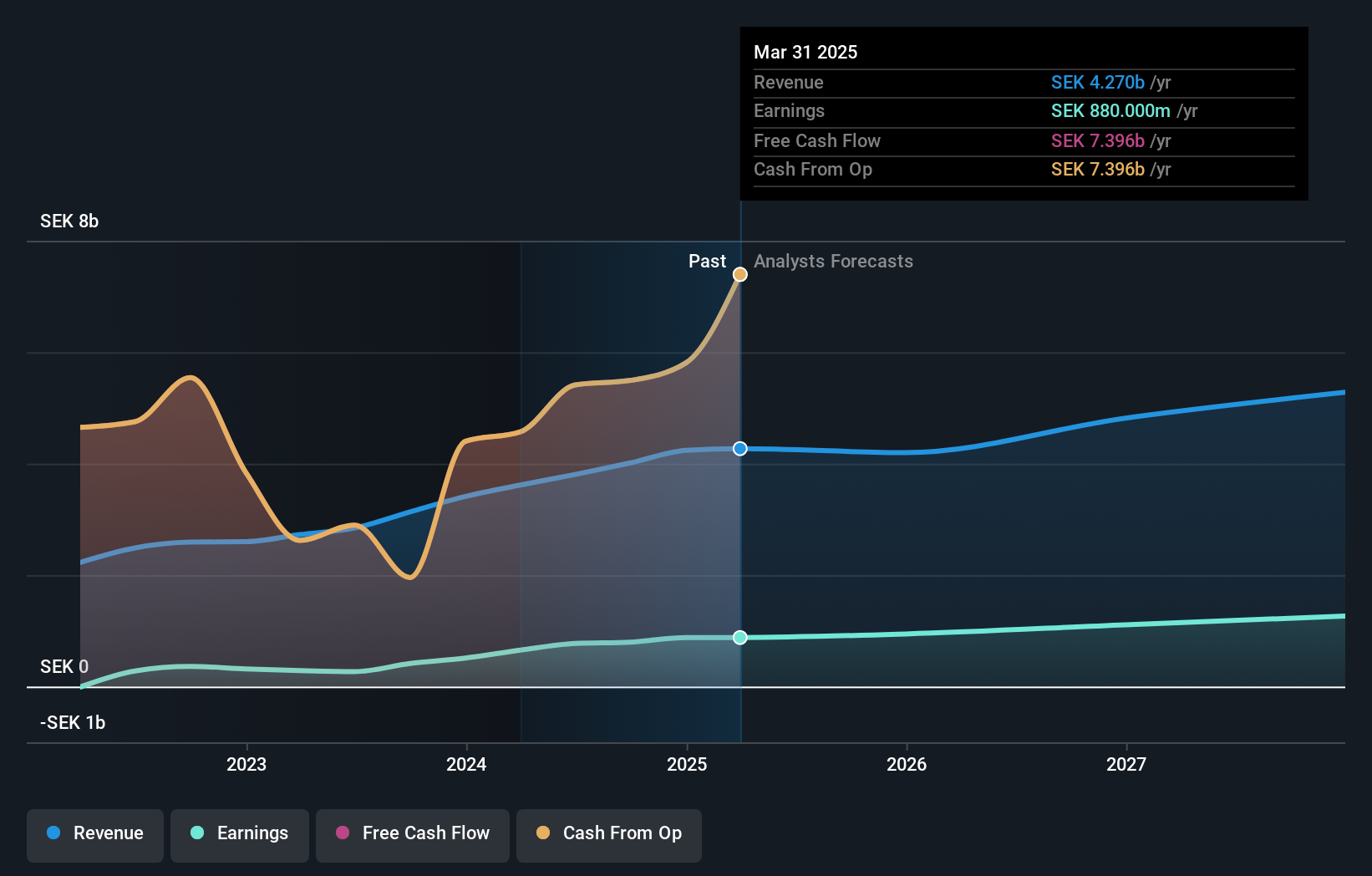

Overview: Hoist Finance AB (publ) is a credit market company that focuses on loan acquisition and management operations across Europe, with a market cap of SEK6.91 billion.

Operations: The company's revenue streams consist of SEK2.86 billion from unsecured loans and SEK821 million from secured loans, with an additional SEK255 million categorized under group items. Net profit margin trends indicate significant fluctuations over recent periods.

Hoist Finance has shown impressive earnings growth of 210.8% over the past year, outpacing the Consumer Finance industry’s -2.1%. Their net debt to equity ratio stands at 96.8%, which is considered high but has improved from 136.1% five years ago. Recently, Hoist launched a savings offering in Ireland and Austria under the HoistSpar brand, expanding its reach to over 120,000 retail deposit customers across multiple countries. Additionally, they commenced a share repurchase program worth SEK 100 million starting July 29, 2024.

- Unlock comprehensive insights into our analysis of Hoist Finance stock in this health report.

Review our historical performance report to gain insights into Hoist Finance's's past performance.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★☆

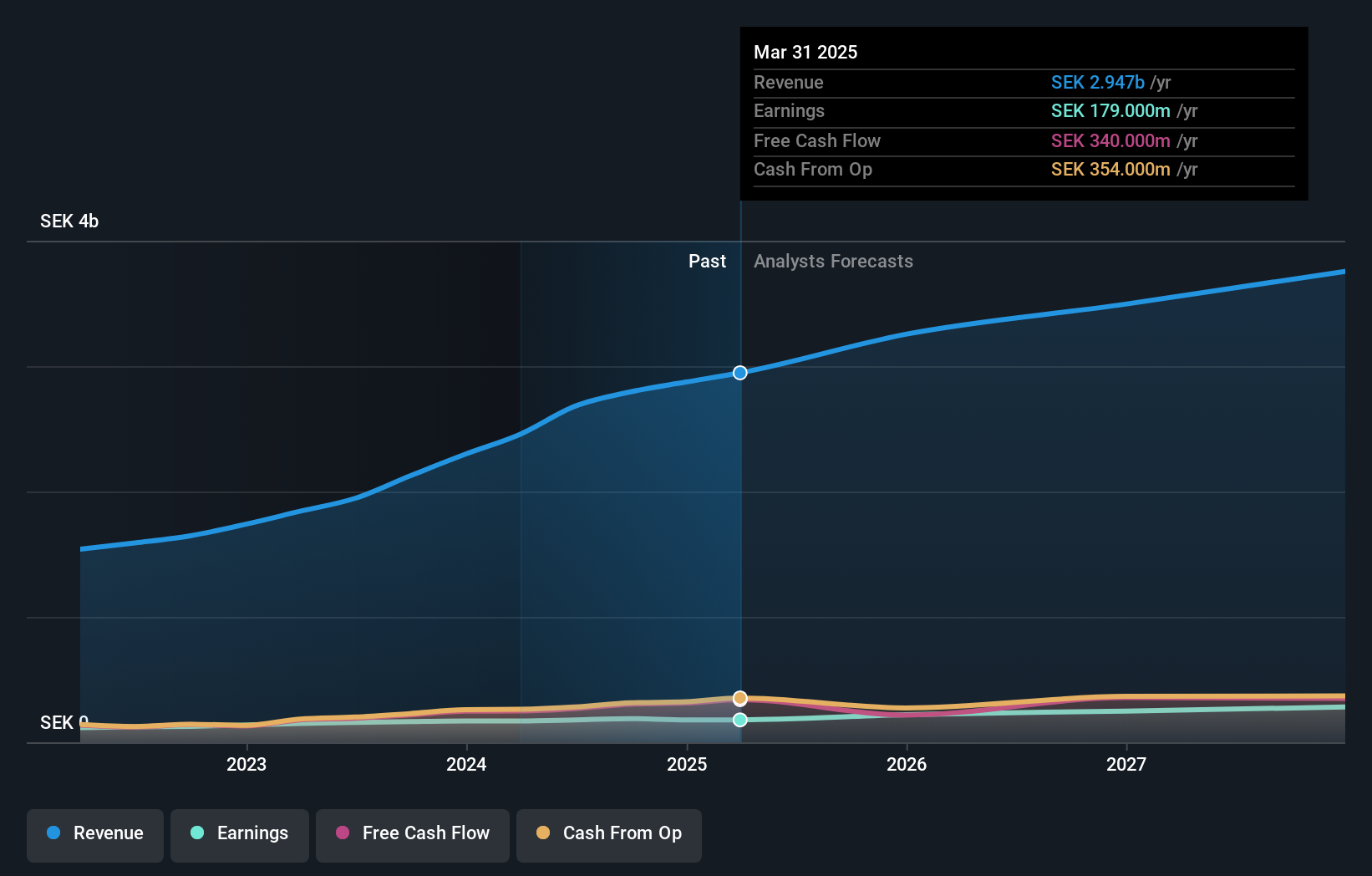

Overview: Momentum Group AB (publ) supplies industrial components, industrial services, and related services to the industrial sector and has a market cap of SEK8.42 billion.

Operations: Momentum Group AB (publ) generates revenue primarily from its industrial components and services segments, with a total revenue of SEK2.68 billion after adjustments. The company has a market cap of SEK8.42 billion.

Momentum Group's earnings surged 13.3% last year, outpacing the Trade Distributors industry’s 1.3%. The company recently reported Q2 sales of SEK 773 million, up from SEK 549 million a year ago, with net income rising to SEK 53 million from SEK 44 million. Trading at a notable discount of 28.3% below its estimated fair value, Momentum also boasts high-quality earnings and has reduced its debt to equity ratio from 88.9% to 66.8% over five years.

- Delve into the full analysis health report here for a deeper understanding of Momentum Group.

Gain insights into Momentum Group's past trends and performance with our Past report.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

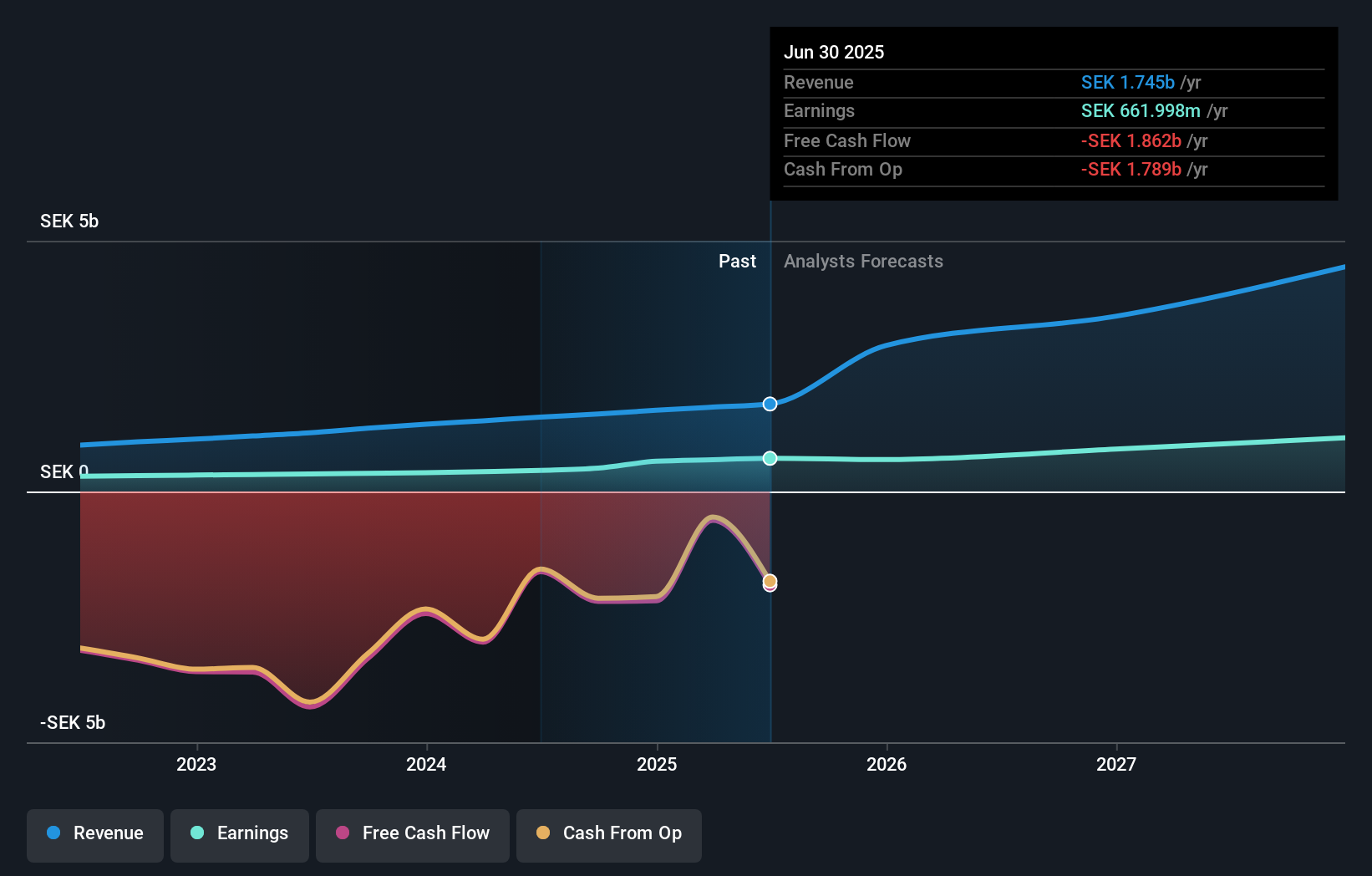

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK5.68 billion.

Operations: TF Bank AB (publ) generates revenue primarily from Credit Cards (SEK511.24 million), Consumer Lending (SEK607.24 million), and E-commerce Solutions excluding credit cards (SEK363.28 million).

TF Bank, with total assets of SEK24.1B and equity of SEK2.4B, recently restructured to establish Rediem Capital AB for handling non-performing exposures. The bank's earnings growth (21.3%) outpaced the industry average (10.4%). Trading at 54.7% below its fair value estimate, TF Bank has a low allowance for bad loans (62%) but a high level of bad loans (10.6%). Customer deposits make up 95% of its liabilities, indicating low-risk funding sources.

- Click here and access our complete health analysis report to understand the dynamics of TF Bank.

Examine TF Bank's past performance report to understand how it has performed in the past.

Key Takeaways

- Navigate through the entire inventory of 55 Swedish Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives