- Sweden

- /

- Trade Distributors

- /

- OM:MEAB B

Malmbergs Elektriska's (STO:MEAB B) Stock Price Has Reduced 61% In The Past Five Years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example, after five long years the Malmbergs Elektriska AB (publ) (STO:MEAB B) share price is a whole 61% lower. We certainly feel for shareholders who bought near the top. Furthermore, it's down 13% in about a quarter. That's not much fun for holders.

See our latest analysis for Malmbergs Elektriska

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

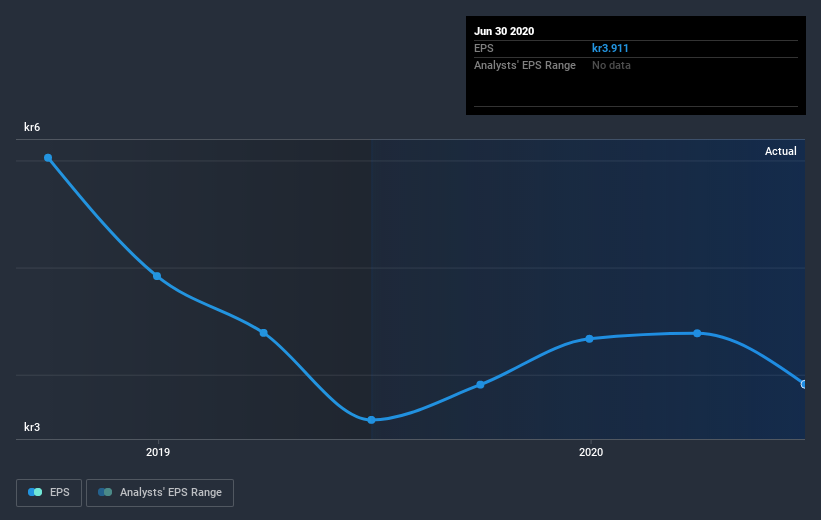

During the five years over which the share price declined, Malmbergs Elektriska's earnings per share (EPS) dropped by 16% each year. Notably, the share price has fallen at 17% per year, fairly close to the change in the EPS. This implies that the market has had a fairly steady view of the stock. So it's fair to say the share price has been responding to changes in EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Malmbergs Elektriska's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Malmbergs Elektriska's TSR, which was a 53% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

Malmbergs Elektriska provided a TSR of 11% over the last twelve months. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 9% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Malmbergs Elektriska better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Malmbergs Elektriska you should be aware of, and 1 of them is a bit concerning.

But note: Malmbergs Elektriska may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

When trading Malmbergs Elektriska or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:MEAB B

Malmbergs Elektriska

Supplies electrical equipment for installers, industrial, construction and rental companies, and retailers in Sweden and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives