- Sweden

- /

- Industrials

- /

- OM:LATO B

A Fresh Look at Latour’s (OM:LATO B) Valuation as Shares Lose Steam

Reviewed by Kshitija Bhandaru

Investment AB Latour (OM:LATO B) has caught some attention lately, likely as investors take a closer look at its latest performance numbers and share price movement. While nothing specific has moved the needle, there are trends worth watching.

See our latest analysis for Investment AB Latour.

Latour’s share price has pulled back recently, trading at SEK232.6 and posting a 1-year price return of -17%. Long-term investors are still ahead with a three-year total shareholder return of 34%. The sideways momentum suggests cautious sentiment about growth prospects, even as the company continues to navigate a shifting economic backdrop.

If you want to see which other companies are showing momentum and strong insider support, broaden your scope with our fast growing stocks with high insider ownership.

With shares trading well below analyst targets despite steady revenue growth, investors face a key question: is Latour currently undervalued, or is the market already factoring in any potential rebound in growth?

Price-to-Earnings of 30.9x: Is it justified?

Latour’s shares currently trade at a price-to-earnings (P/E) ratio of 30.9x, putting the stock at a higher valuation compared to both industry peers and the wider sector.

The price-to-earnings ratio reflects what investors are willing to pay today for each unit of a company’s earnings. For a diversified industrials group like Latour, this multiple often signals investor expectations for steady profit growth or premium business quality.

But does Latour’s current multiple hold up under scrutiny? The company has actually experienced negative earnings growth over the past twelve months, and its average annual earnings growth over the last five years sits at a modest 2.8%. Meanwhile, industry peers have a lower P/E of 22.6x, indicating the market is assigning Latour a significant premium over typical sector performance. Without stronger growth prospects, this valuation may be tough to defend relative to both the peer group average (30.1x) and broader sector trends.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.9x (OVERVALUED)

However, persistent earnings weakness or unexpected setbacks in revenue growth could quickly reverse any renewed optimism in Latour’s valuation story.

Find out about the key risks to this Investment AB Latour narrative.

Another View: What Does Our DCF Model Say?

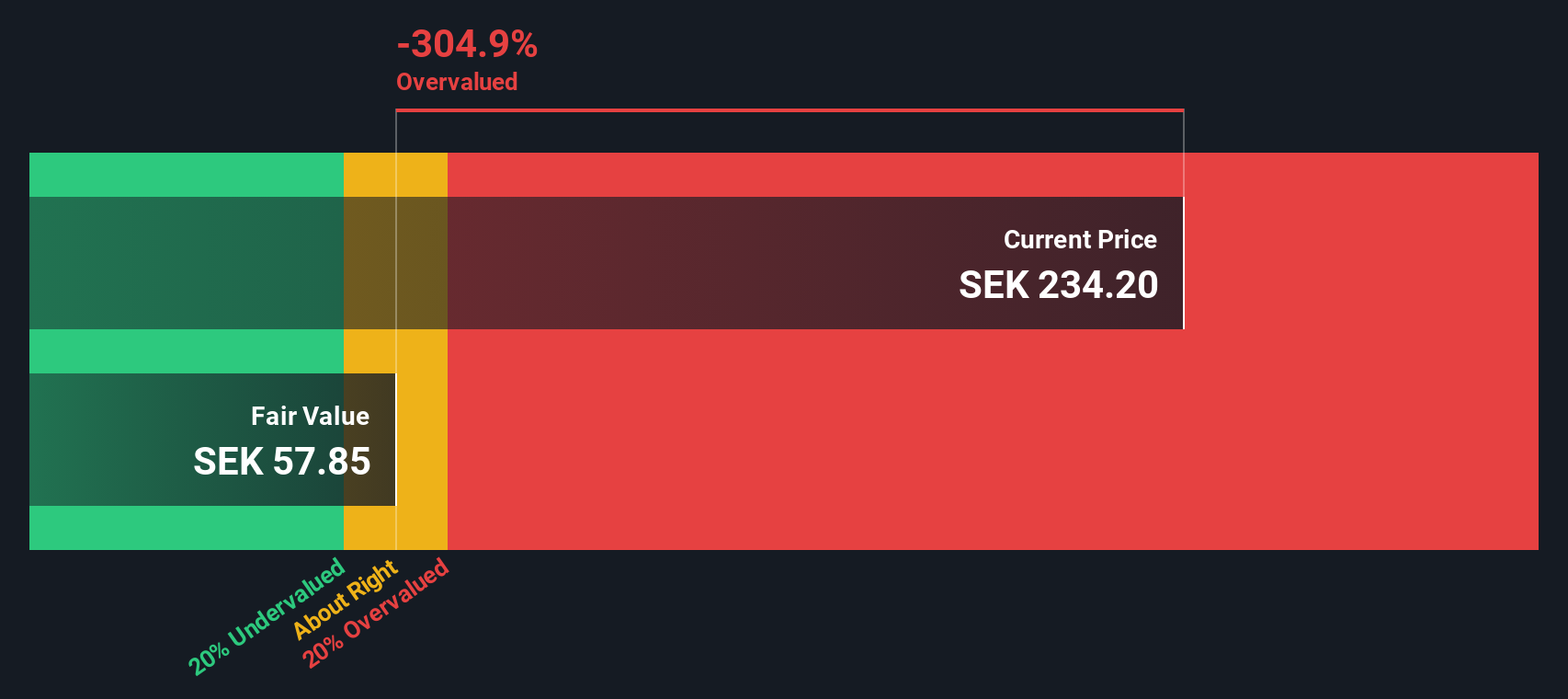

Shifting focus from earnings ratios, the SWS DCF model offers a different perspective by estimating Latour’s value based on future cash flows. Interestingly, the DCF suggests the stock is trading well above its fair value estimate, raising new concerns about downside risk. Could this signal more room to fall, or might the market see something the models do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Investment AB Latour for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Investment AB Latour Narrative

If you believe there is more beneath the headlines or want your own perspective, you can put together your analysis in just a few minutes, Do it your way.

A great starting point for your Investment AB Latour research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that opportunity does not wait. The right stock today could mean gains tomorrow. Use the Simply Wall Street Screener to seize your advantage with standout ideas from across the market.

- Uncover high-growth potential by reviewing these 24 AI penny stocks that are harnessing artificial intelligence to outpace industry trends and reshape entire sectors.

- Lock in reliable income opportunities with these 20 dividend stocks with yields > 3% offering attractive yields above 3% for those seeking consistent returns in their portfolios.

- Tap into tomorrow’s technology leaders with these 26 quantum computing stocks, where companies are advancing breakthroughs in quantum computing and revolutionizing how problems are solved.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LATO B

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives