Inwido (OM:INWI): Revenue Growth Forecast Outpaces Market, But Net Margin Misses Prior Year

Reviewed by Simply Wall St

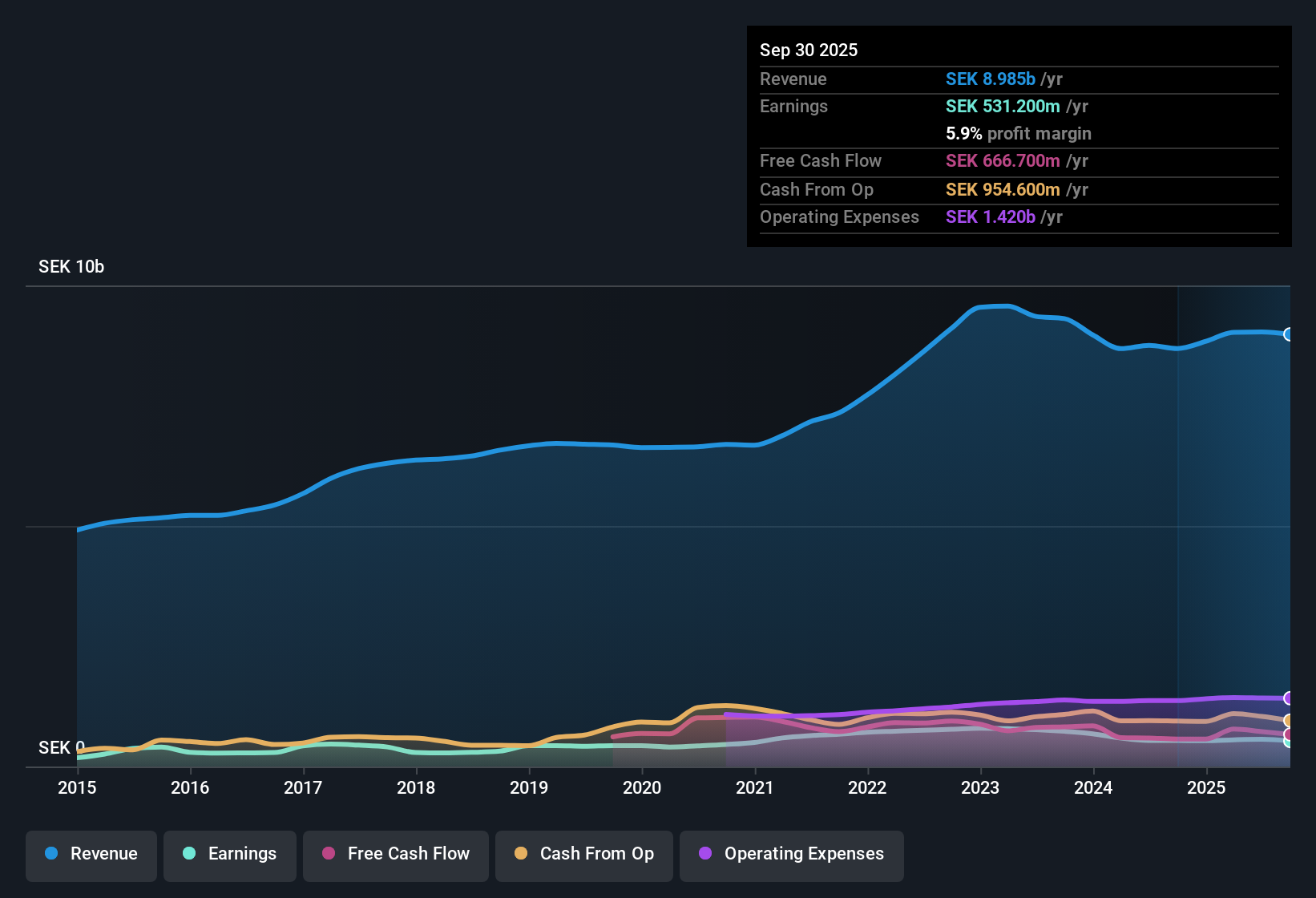

Inwido (OM:INWI) is forecasting annual revenue growth of 3.9%, outpacing the Swedish market’s expected 3.3% rate. The company’s earnings are projected to climb 15.5% per year over the forecast period, handily beating the broader market’s 12.5% growth, even as net profit margin has dipped to 5.9% from last year’s 6.2%. Over the last five years, earnings have fallen by an average of 1.9% annually and the most recent year also saw negative earnings growth, putting the focus on whether forward-looking growth can shift investor sentiment this earnings season.

See our full analysis for Inwido.Now let’s see how these headline figures stack up against the narratives that investors and analysts have been following. Some assumptions may hold, while others could be in for a surprise.

See what the community is saying about Inwido

Order Intake Up 13% Boosts Revenue Visibility

- Order intake jumped 13% this period, giving Inwido a larger sales pipeline and greater earnings visibility for upcoming quarters.

- Analysts' consensus view notes this increase in order backlog directly bolsters near-term growth prospects. However,

- challenges remain for short-term profitability due to e-commerce headwinds and delayed projects, both cited as factors that could delay converting these orders into recognized revenue,

- while the 10% organic sales growth and productivity investments signal that margins may strengthen even as some business segments struggle with competition.

- When a 13% order intake and a 19% order backlog increase come together, it can distance the business from past negative earnings trends, providing investors stronger signals about future revenue trajectories.

- See how these order figures fit into the full strategic narrative and whether analysts’ optimism is warranted in our deep-dive overview. 📊 Read the full Inwido Consensus Narrative.

Profit Margin Holds at 5.9% Despite Cost Pressures

- Net profit margin came in at 5.9%, just under last year’s 6.2%, highlighting that cost pressures have not spiraled out of control even as price competition intensifies in Western Europe.

- Consensus narrative emphasizes that ongoing investments in productivity and cost efficiencies are already delivering improved gross margins in Scandinavia and Eastern Europe.

- However, fierce pricing battles and slower e-commerce recovery could restrain further gains in overall net margins,

- and high overhead costs, maintained in expectation of future demand, may weigh on near-term profit levels if revenues lag.

Share Price Stays Below Both Analyst and DCF Fair Value

- With a recent share price of SEK148.90, Inwido trades at a notable discount to both the analyst target of SEK210.67 and a DCF fair value of SEK297.91.

- Consensus narrative points out that such a gap versus valuation benchmarks is underpinned by Inwido’s strong balance sheet and reduced net debt, which give it room for future M&A and growth.

- Though analysts caution that this discount only closes if planned profitability and revenue improvements materialize,

- and if execution risks, including cost discipline and acquisition integration, are well-managed.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Inwido on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Build your own viewpoint and put it into a compelling narrative in just a few minutes. Do it your way

A great starting point for your Inwido research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Although Inwido anticipates earnings growth, its recent history of falling profits and ongoing margin pressures raise questions about stability and consistency.

If choppy financials give you pause, use our stable growth stocks screener (2089 results) to focus on companies that deliver reliable revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors in Sweden.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives