- Sweden

- /

- Industrials

- /

- OM:IDUN B

Investors Appear Satisfied With Idun Industrier AB (publ)'s (STO:IDUN B) Prospects As Shares Rocket 26%

The Idun Industrier AB (publ) (STO:IDUN B) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

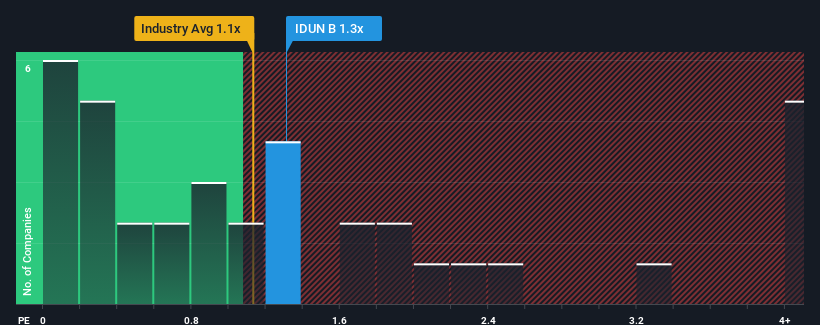

In spite of the firm bounce in price, there still wouldn't be many who think Idun Industrier's price-to-sales (or "P/S") ratio of 1.3x is worth a mention when it essentially matches the median P/S in Sweden's Industrials industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Idun Industrier

How Idun Industrier Has Been Performing

Idun Industrier certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Idun Industrier will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Idun Industrier's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The strong recent performance means it was also able to grow revenue by 193% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 3.5% during the coming year according to the one analyst following the company. With the industry predicted to deliver 4.6% growth , the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Idun Industrier's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Idun Industrier's P/S?

Its shares have lifted substantially and now Idun Industrier's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Idun Industrier maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It is also worth noting that we have found 1 warning sign for Idun Industrier that you need to take into consideration.

If you're unsure about the strength of Idun Industrier's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Idun Industrier, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IDUN B

Idun Industrier

An investment holding company, engages in the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives