- Sweden

- /

- Aerospace & Defense

- /

- OM:GOMX

Take Care Before Jumping Onto GomSpace Group AB (publ) (STO:GOMX) Even Though It's 49% Cheaper

Unfortunately for some shareholders, the GomSpace Group AB (publ) (STO:GOMX) share price has dived 49% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 86% share price decline.

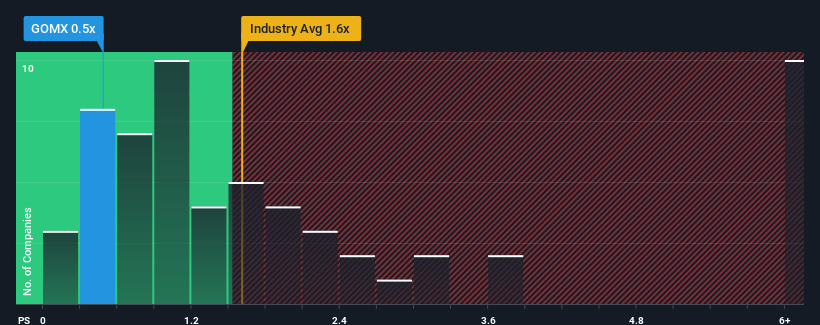

Since its price has dipped substantially, GomSpace Group may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Aerospace & Defense industry in Sweden have P/S ratios greater than 3.7x and even P/S higher than 9x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for GomSpace Group

What Does GomSpace Group's P/S Mean For Shareholders?

GomSpace Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on GomSpace Group.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like GomSpace Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.1%. Even so, admirably revenue has lifted 46% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 25% each year as estimated by the sole analyst watching the company. With the industry only predicted to deliver 15% per annum, the company is positioned for a stronger revenue result.

With this information, we find it odd that GomSpace Group is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On GomSpace Group's P/S

Shares in GomSpace Group have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

GomSpace Group's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware GomSpace Group is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of GomSpace Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GOMX

GomSpace Group

Through its subsidiaries, manufactures and sells nanosatellites and components, and turnkey solutions for satellites in Denmark, Sweden, France, rest of Europe, the United States, Asia, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives