Is Now The Time To Put FM Mattsson Mora Group (STO:FMM B) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in FM Mattsson Mora Group (STO:FMM B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for FM Mattsson Mora Group

How Fast Is FM Mattsson Mora Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that FM Mattsson Mora Group has grown EPS by 40% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

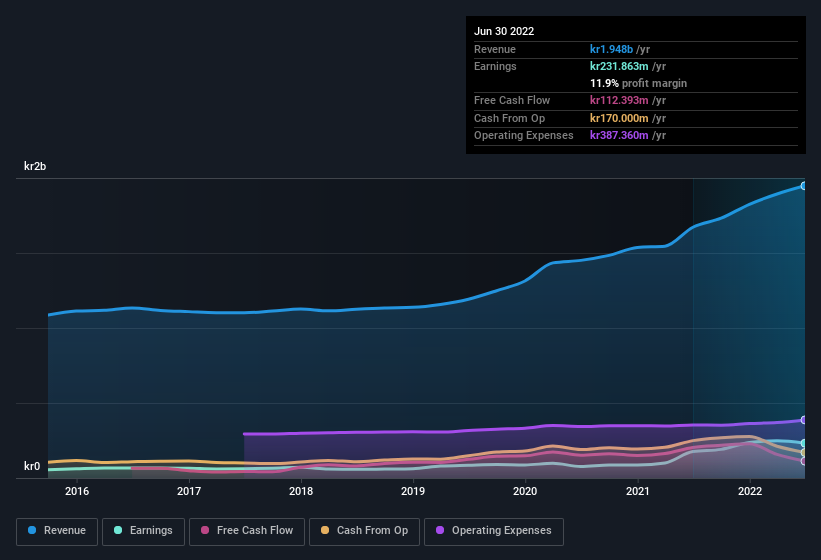

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. FM Mattsson Mora Group maintained stable EBIT margins over the last year, all while growing revenue 17% to kr1.9b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

FM Mattsson Mora Group isn't a huge company, given its market capitalisation of kr2.3b. That makes it extra important to check on its balance sheet strength.

Are FM Mattsson Mora Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did FM Mattsson Mora Group insiders refrain from selling stock during the year, but they also spent kr743k buying it. This is a good look for the company as it paints an optimistic picture for the future. Zooming in, we can see that the biggest insider purchase was by Independent Director Hakan Broman for kr478k worth of shares, at about kr79.67 per share.

Along with the insider buying, another encouraging sign for FM Mattsson Mora Group is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at kr649m, they have plenty of motivation to push the business to succeed. At 28% of the company, the co-investment by insiders fosters confidence that management will make long-term focussed decisions.

Should You Add FM Mattsson Mora Group To Your Watchlist?

FM Mattsson Mora Group's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest FM Mattsson Mora Group belongs near the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with FM Mattsson Mora Group , and understanding it should be part of your investment process.

The good news is that FM Mattsson Mora Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FMM B

FM Mattsson

Develops, manufactures, and sells water taps and related products for bathrooms and kitchens in Sweden, Norway, Denmark, Finland, Benelux, the United Kingdom, Germany, Italy, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives