- Sweden

- /

- Hospitality

- /

- OM:NREST

October 2025 European Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

Amid recent declines in major European stock indexes, including the STOXX Europe 600 and notable losses in Germany's DAX and France's CAC 40, investors are navigating a landscape marked by political turmoil and trade tensions. In such an environment, identifying stocks priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Siltronic (XTRA:WAF) | €55.90 | €111.17 | 49.7% |

| SBO (WBAG:SBO) | €26.85 | €53.66 | 50% |

| Nexam Chemical Holding (OM:NEXAM) | SEK3.78 | SEK7.49 | 49.5% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.87 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.75 | €11.32 | 49.2% |

| DigiTouch (BIT:DGT) | €1.92 | €3.79 | 49.3% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.34 | €6.65 | 49.8% |

| Allegro.eu (WSE:ALE) | PLN33.52 | PLN66.16 | 49.3% |

| Aker BioMarine (OB:AKBM) | NOK85.80 | NOK170.24 | 49.6% |

| Absolent Air Care Group (OM:ABSO) | SEK253.00 | SEK502.83 | 49.7% |

Here's a peek at a few of the choices from the screener.

Acast (OM:ACAST)

Overview: Acast AB (publ) is a podcasting company with operations in Europe, North America, and internationally, and has a market cap of SEK3.63 billion.

Operations: Acast generates its revenue from podcasting operations across Europe, North America, and other international markets.

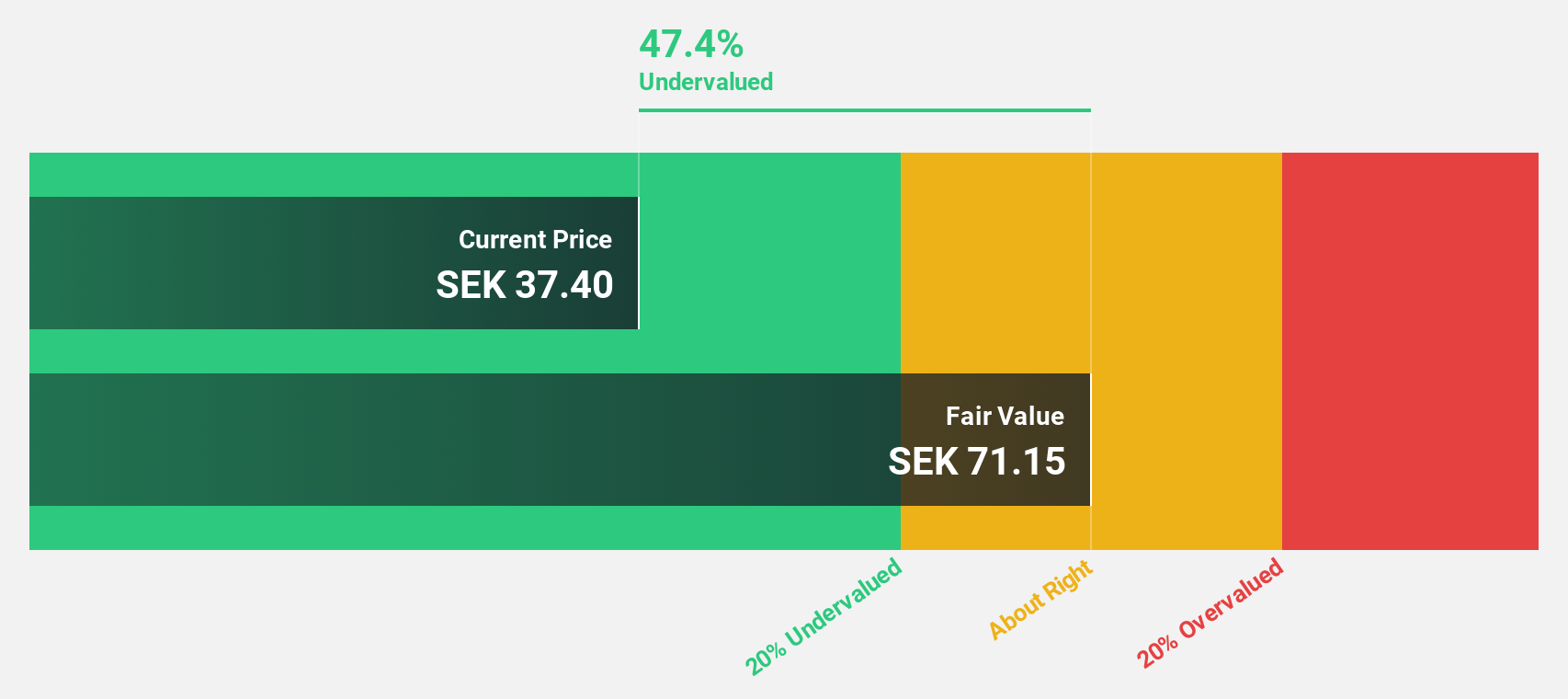

Estimated Discount To Fair Value: 43.9%

Acast is trading at a significant discount to its estimated fair value of SEK 35.46, with current prices around SEK 19.9, suggesting it may be undervalued based on cash flows. Despite reporting increased losses recently, Acast's revenue growth is forecasted at 12.5% annually, outpacing the Swedish market average. The recent partnership with Magnite could enhance monetization opportunities and support its path to profitability within three years, despite low projected return on equity of 7.8%.

- Upon reviewing our latest growth report, Acast's projected financial performance appears quite optimistic.

- Dive into the specifics of Acast here with our thorough financial health report.

Fagerhult Group (OM:FAG)

Overview: Fagerhult Group AB, with a market cap of SEK7.17 billion, designs, manufactures, and markets professional lighting solutions globally through its subsidiaries.

Operations: The company's revenue is derived from several segments, including Premium (SEK2.69 billion), Collection (SEK3.59 billion), Professional (SEK929.70 million), Infrastructure (SEK778.70 million), and Smart Solutions (SEK12.50 million).

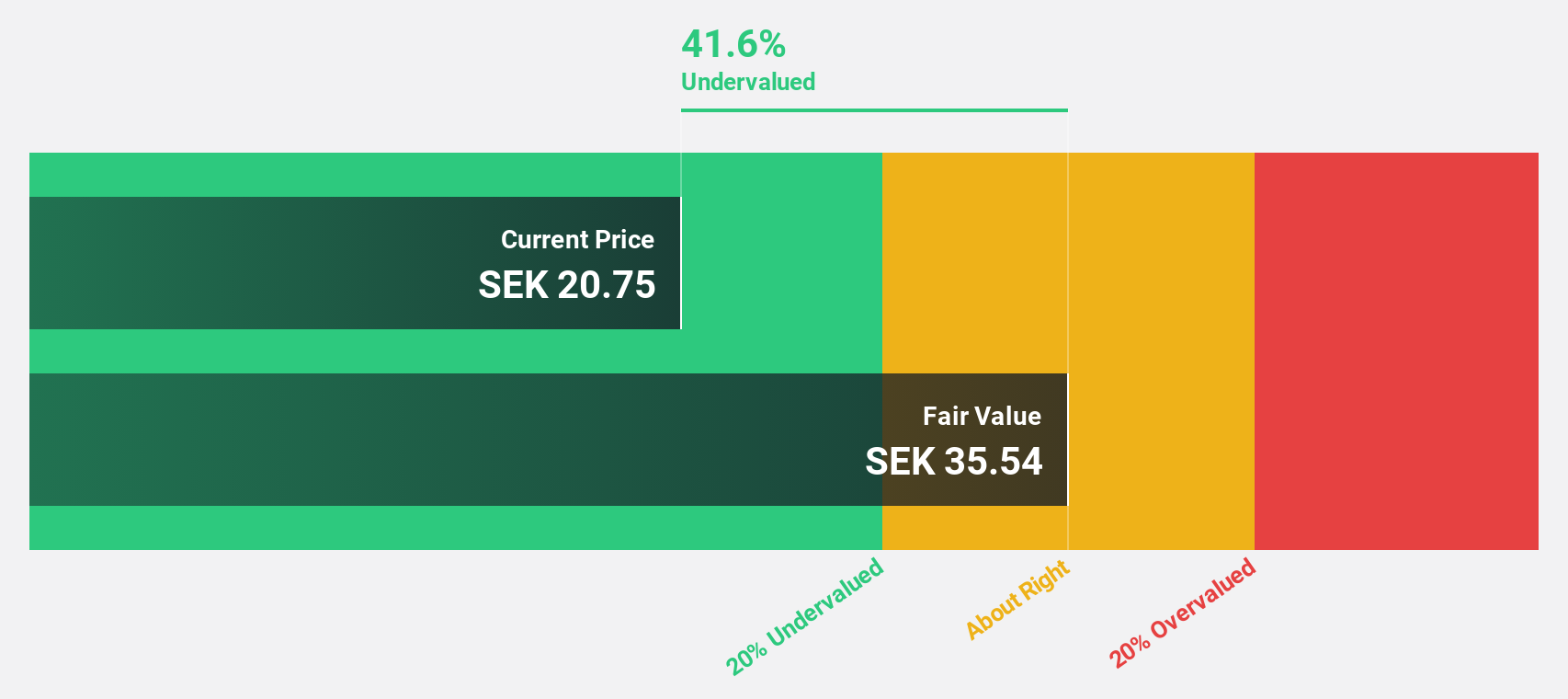

Estimated Discount To Fair Value: 41.5%

Fagerhult Group is trading at a significant discount to its estimated fair value of SEK 69.47, with current prices around SEK 40.65, highlighting potential undervaluation based on cash flows. Despite recent declines in sales and net income, earnings are forecast to grow significantly over the next three years at 34.8% annually, outpacing the Swedish market's growth rate. However, low return on equity forecasts and profit margins indicate challenges in achieving sustainable profitability despite projected growth.

- Our earnings growth report unveils the potential for significant increases in Fagerhult Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Fagerhult Group.

Nordrest Holding (OM:NREST)

Overview: Nordrest Holding AB (publ) is a foodservice company operating in Sweden and internationally, with a market capitalization of SEK2.61 billion.

Operations: The company's revenue from its restaurant segment is SEK2.15 billion.

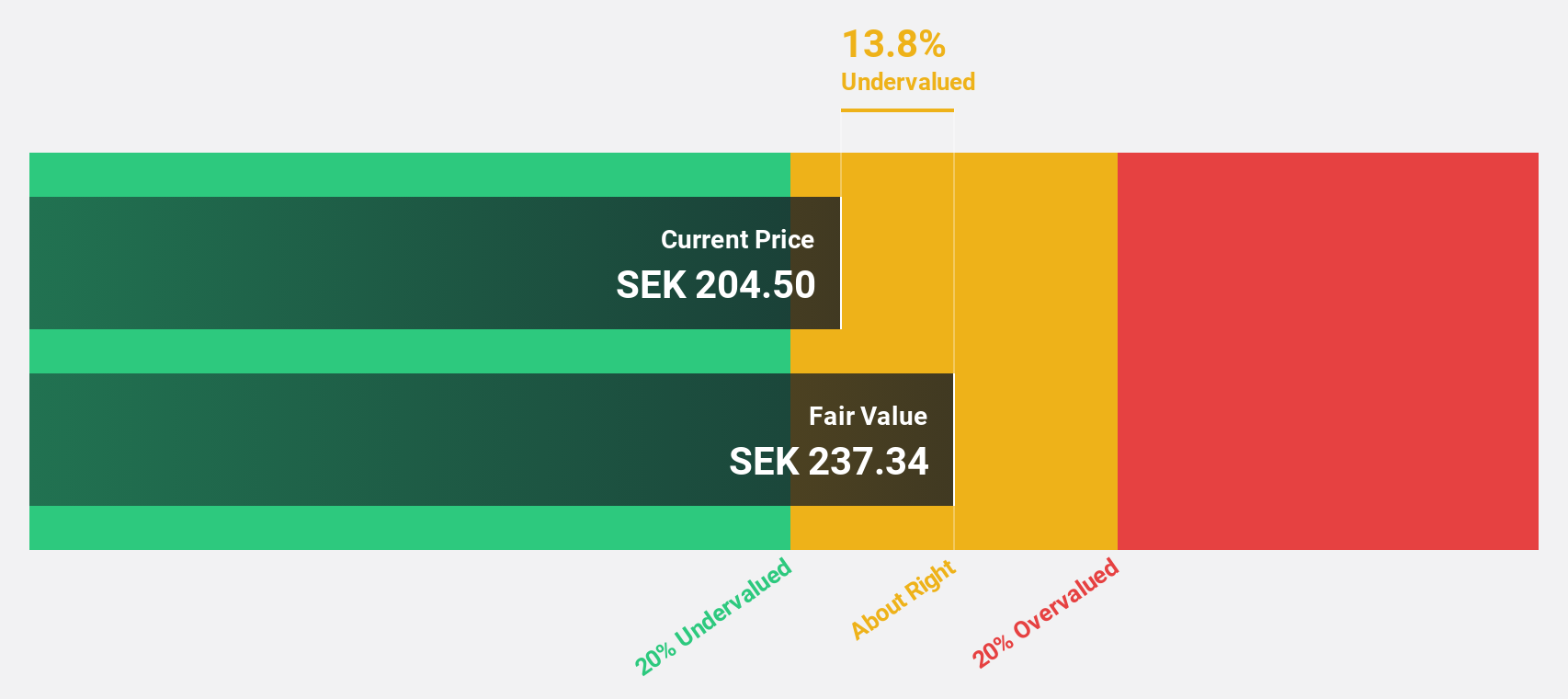

Estimated Discount To Fair Value: 13.7%

Nordrest Holding is trading at SEK 205, below its fair value estimate of SEK 237.56, suggesting potential undervaluation based on cash flows. The company has shown robust earnings growth of 22.5% over the past year, with future earnings forecasted to grow at 17.5% annually, outpacing the Swedish market's 16.5%. Recent reports show strong financial performance with increased sales and net income for both the quarter and half-year periods compared to last year.

- Our expertly prepared growth report on Nordrest Holding implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Nordrest Holding.

Next Steps

- Explore the 214 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordrest Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NREST

Nordrest Holding

Operates as a foodservice company in Sweden and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives