- Sweden

- /

- Electrical

- /

- OM:FAG

Here's Why It's Unlikely That Fagerhult Group AB's (STO:FAG) CEO Will See A Pay Rise This Year

Key Insights

- Fagerhult Group will host its Annual General Meeting on 28th of April

- Salary of kr6.10m is part of CEO Bodil Gallon's total remuneration

- The total compensation is similar to the average for the industry

- Fagerhult Group's three-year loss to shareholders was 3.7% while its EPS was down 8.7% over the past three years

Shareholders will probably not be too impressed with the underwhelming results at Fagerhult Group AB (STO:FAG) recently. At the upcoming AGM on 28th of April, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Fagerhult Group

How Does Total Compensation For Bodil Gallon Compare With Other Companies In The Industry?

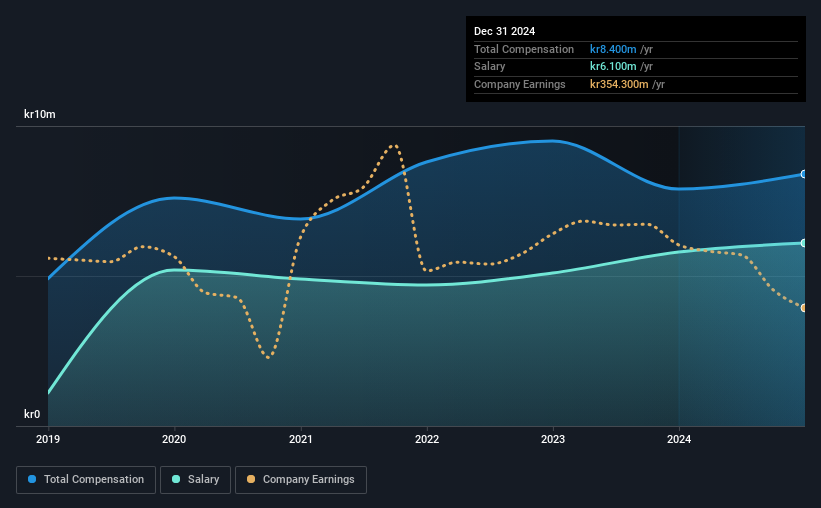

At the time of writing, our data shows that Fagerhult Group AB has a market capitalization of kr7.2b, and reported total annual CEO compensation of kr8.4m for the year to December 2024. That's a modest increase of 6.3% on the prior year. We note that the salary portion, which stands at kr6.10m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Swedish Electrical industry with market capitalizations between kr3.8b and kr15b, we discovered that the median CEO total compensation of that group was kr8.3m. So it looks like Fagerhult Group compensates Bodil Gallon in line with the median for the industry. Furthermore, Bodil Gallon directly owns kr2.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr6.1m | kr5.8m | 73% |

| Other | kr2.3m | kr2.1m | 27% |

| Total Compensation | kr8.4m | kr7.9m | 100% |

Talking in terms of the industry, salary represented approximately 75% of total compensation out of all the companies we analyzed, while other remuneration made up 25% of the pie. Our data reveals that Fagerhult Group allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Fagerhult Group AB's Growth

Over the last three years, Fagerhult Group AB has shrunk its earnings per share by 8.7% per year. In the last year, its revenue is down 3.0%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Fagerhult Group AB Been A Good Investment?

Given the total shareholder loss of 3.7% over three years, many shareholders in Fagerhult Group AB are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Fagerhult Group that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FAG

Fagerhult Group

Designs, manufactures, and markets professional lighting solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives