Here's Why Epiroc AB (publ)'s (STO:EPI A) CEO Compensation Is The Least Of Shareholders' Concerns

Key Insights

- Epiroc will host its Annual General Meeting on 8th of May

- Salary of kr13.0m is part of CEO Helena Hedblom's total remuneration

- The overall pay is comparable to the industry average

- Epiroc's total shareholder return over the past three years was 18% while its EPS grew by 5.1% over the past three years

Performance at Epiroc AB (publ) (STO:EPI A) has been reasonably good and CEO Helena Hedblom has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 8th of May. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Epiroc

Comparing Epiroc AB (publ)'s CEO Compensation With The Industry

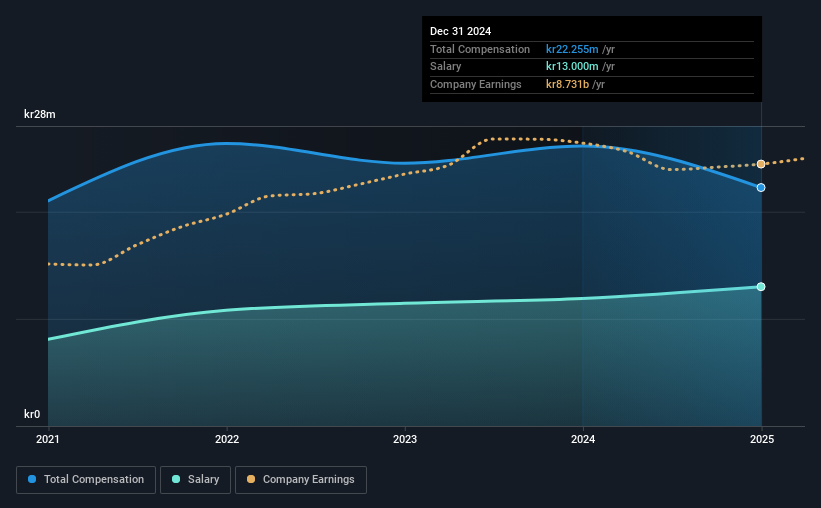

Our data indicates that Epiroc AB (publ) has a market capitalization of kr245b, and total annual CEO compensation was reported as kr22m for the year to December 2024. We note that's a decrease of 15% compared to last year. Notably, the salary which is kr13.0m, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the Swedish Machinery industry with market capitalizations over kr78b, the reported median total CEO compensation was kr30m. This suggests that Epiroc remunerates its CEO largely in line with the industry average. Moreover, Helena Hedblom also holds kr5.0m worth of Epiroc stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr13m | kr12m | 58% |

| Other | kr9.3m | kr14m | 42% |

| Total Compensation | kr22m | kr26m | 100% |

On an industry level, around 54% of total compensation represents salary and 46% is other remuneration. There isn't a significant difference between Epiroc and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Epiroc AB (publ)'s Growth

Over the past three years, Epiroc AB (publ) has seen its earnings per share (EPS) grow by 5.1% per year. It achieved revenue growth of 7.2% over the last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Epiroc AB (publ) Been A Good Investment?

With a total shareholder return of 18% over three years, Epiroc AB (publ) shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

So you may want to check if insiders are buying Epiroc shares with their own money (free access).

Important note: Epiroc is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives