Does Epiroc’s New Örebro Facility Advance Its Efficiency Goals and Global Strategy (OM:EPI A)?

Reviewed by Sasha Jovanovic

- In September 2025, Epiroc broke ground on a 29,000 m² advanced global distribution center in Örebro, Sweden, designed to streamline supply chains for its aftermarket mining equipment business, with the facility set to open in the second half of 2027.

- The consolidation of Epiroc's aftermarket logistics, using automation and solar power, highlights its focus on operational efficiency, safety, and reduced environmental impact while scaling up for growing global demand.

- We'll now explore how Epiroc's investment in the Örebro facility shapes its investment narrative and ongoing modernization push.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Epiroc Investment Narrative Recap

To own Epiroc stock, you’d need to believe that long-term mining equipment demand, particularly for automation, electrification, and aftermarket services, can offset current cyclical pressures in construction and potential margin risks. The Örebro hub underscores operational efficiency and sustainability, but it is not expected to materially influence near-term revenue trends or mitigate the biggest risk: prolonged weakness in the Attachments and construction sector.

Among recent developments, Epiroc’s record contract for autonomous electric mining equipment with Fortescue is especially relevant. This deal directly reinforces the company's push into automation and low-emission machinery, echoing the drivers behind the Örebro expansion, with both expected to support future recurring aftermarket revenues and margin resilience.

By contrast, investors should also be aware that growing dependence on mining cycles means that if commodity demand falters, even the most efficient supply chain...

Read the full narrative on Epiroc (it's free!)

Epiroc's narrative projects SEK72.0 billion in revenue and SEK11.2 billion in earnings by 2028. This requires a 4.2% yearly revenue growth and a SEK2.2 billion earnings increase from the current earnings of SEK9.0 billion.

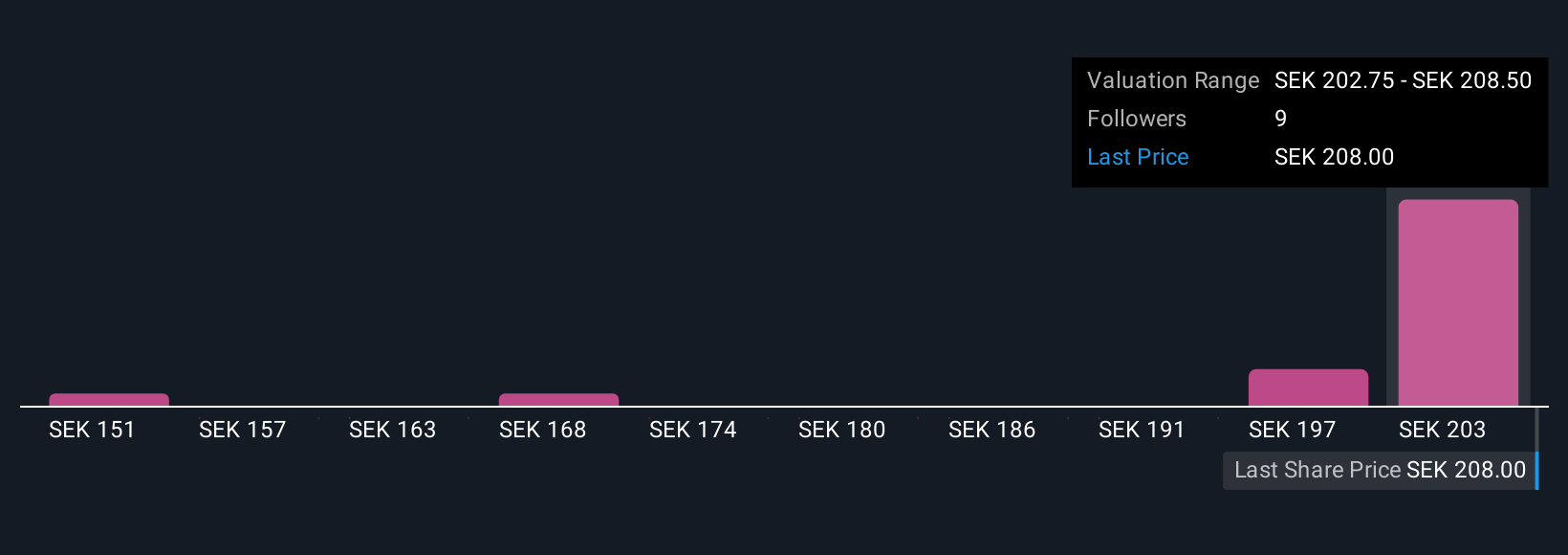

Uncover how Epiroc's forecasts yield a SEK208.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Epiroc range from SEK151 to SEK208.5, based on four individual views. While many see growth potential in automation and digital solutions, others remain cautious about the impact of weak construction markets and currency volatility, explore several viewpoints to see where you stand.

Explore 4 other fair value estimates on Epiroc - why the stock might be worth as much as SEK208.50!

Build Your Own Epiroc Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Epiroc research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Epiroc research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Epiroc's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Epiroc might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EPI A

Epiroc

Develops and produces equipment for use in surface and underground applications in North America, Europe, South America, Europe, Africa, the Middle East, Asia, Australia, and India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives